Rogers 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

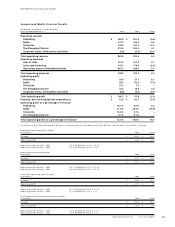

2003 Annual ReportRogers Communications Inc. 43

WIRELESS STRATEGY OVERVIEW

Wireless seeks to achieve profitable growth within the Canadian wireless communications industry. Wireless’ strategy is

designed to maximize its operating profit, as previously defined, and return on investment. The key elements of Rogers

Wireless’ strategy are as follows:

• focusing on data services that are attractive to youth and small and medium size businesses to optimize its customer mix;

• delivering on customer expectations by improving handset reliability, network quality and customer service while

reducing subscriber deactivations, or churn;

• increasing revenue from existing customers by utilizing analytical tools to target customers likely to purchase optional

services such as voicemail, calling line ID, text messaging and wireless Internet;

• enhancing its sales distribution channels to increase its focus on youth and business customers;

• maintaining a technologically advanced, high quality and pervasive network by improving the quality of its GSM/GPRS

network and increasing capacity; and

• leveraging its relationships with the Rogers group of companies to provide bundled product and service offerings at

attractive prices, in addition to cross-selling, joint sales distribution and cost reduction initiatives through infrastruc-

ture sharing.

WIRELESS SEASONALITY

Wireless’ operating results are subject to seasonal fluctuations that materially impact quarter-to-quarter operating

results. Accordingly, one quarter’s operating results are not necessarily indicative of what a subsequent quarter’s operat-

ing results will be. In particular, this seasonality generally results in relatively lower fourth quarter operating profits due

primarily to increased marketing and promotional expenditures and relatively higher levels of subscriber additions,

resulting in higher subscriber acquisition and activation-related expenses. Seasonal fluctuation also typically occurs in the

third quarter of each year because higher usage and roaming result in higher network revenue and operating profit.

RECENT WIRELESS INDUSTRY TRENDS

Focus on Customer Retention

The wireless communications industry’s current market penetration in Canada is approximately 42% of the population,

compared to approximately 54% in the U.S. and approximately 87% in the United Kingdom, and Wireless expects the

Canadian wireless industry to grow by 3 to 4 percentage points each year. While this will produce growth, the growth is

slowing compared to historical levels. Such slowing growth has been, and will continue, driving the increased focus on

customer satisfaction, the sale to customers of new data and voice service features and, primarily, customer retention.

Due to legislation in the U.S. and other countries regarding local number portability and the speculation that this approach

will be adopted by Canadian regulators, customer satisfaction and retention will become even more critical in the future.

Demand for Sophisticated Data Applications and Migration to Next Generation Wireless Technology

The ongoing development of wireless data transmission technologies has led manufacturers to create wireless devices

with increasingly advanced capabilities, including access to e-mail and other corporate information technology platforms,

news, sports, financial information and services, shopping services, and other functions. Increased demand for sophisti-

cated wireless services, especially data communications services, has led wireless providers to migrate towards the next

generation of digital voice and data networks. These networks are intended to provide wireless communications with

wireline quality sound, far higher data transmission speeds and streaming video capability. These networks are expected

to support a variety of data applications, including high-speed Internet access, multimedia services and seamless access

to corporate information systems, such as e-mail and purchasing systems. As discussed above, Wireless began trials of

EDGE technology in the Vancouver market late in 2003 and intends to begin deploying EDGE across the remainder of its

national GSM/GPRS network during 2004.

Development of Additional Technologies

The development of additional technologies and their use by consumers may accelerate the widespread adoption of 3G

digital voice and data networks. One such example is Wi-Fi, which allows suitably equipped devices, such as laptop com-

puters and personal digital assistants, to connect to a wireless access point. The wireless connection is only effective

within a range of approximately 100 meters and at theoretical speeds of up to 54 megabits per second. To address these

limitations, Wi-Fi access points must be placed selectively in high-traffic locations where potential customers frequent and

have sufficient time to use the service. Technology companies are currently developing additional technologies designed

to improve Wi-Fi and otherwise utilize the higher data transmission speeds found in a third generation (“3G”) network.

Future enhancements to the range of Wi-Fi service, and the networking of Wi-Fi access points may provide additional

Management’s Discussion and Analysis