Rogers 2003 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

106

Notes to Consolidated Financial Statements

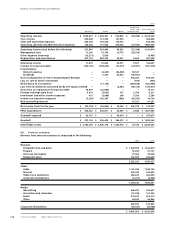

$189.9 million), accrued interest payable totalled $83.2 million (2002 – $115.2 million), accrued liabilities related to payroll

totalled $123.8 million (2002 – $53.8 million), and CRTC commitments totalled $71.9 million (2002 – $74.0 million).

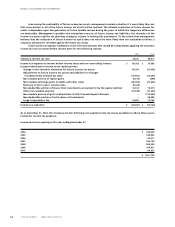

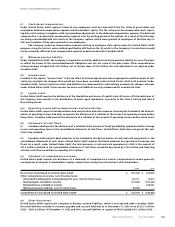

(q) Stock-based compensation disclosures:

For options granted to employees, had the Company determined compensation costs based on the fair values at grant dates

of the stock options granted by RCI and Wireless consistent with the method prescribed under SFAS 123, the Company’s net

income (loss) and earnings (loss) per share would have been reported as the pro forma amounts indicated below:

2003 2002

Net income (loss) in accordance with United States GAAP, as reported $ (57,150) $ 349,878

Stock-based compensation expense – RCI (28,123) (31,125)

Stock-based compensation expense – Wireless (6,790) (8,289)

Pro forma net income (loss) $ (92,063) $ 310,464

Basic earnings (loss) per share $ (0.25) $ 1.64

Effect of stock-based compensation (0.16) (0.19)

Pro forma basic earnings (loss) per share $ (0.41) $ 1.45

Diluted earnings (loss) per share $ (0.25) $ 1.23

Pro forma diluted earnings (loss) per share (0.41) 1.10

See note 11 for further details of stock-based compensation.

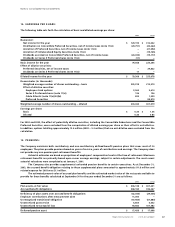

(r) Recent United States accounting pronouncements:

In 2003, the FASB issued and amended Interpretation No. 46, “Consolidation of Variable Interest Entities” (“FIN 46”).

Its consolidation provisions are applicable for all newly created variable interest entities created after January 31, 2003,

and are applicable to existing VIEs as of the beginning of the Company’s year beginning January 1, 2004. With respect to

entities that do not qualify to be assessed for consolidation based on voting interests, FIN 46 generally requires a com-

pany that has a variable interest that will absorb a majority of VIEs expected losses if they occur, receive a majority of the

entity’s expected residual returns if they occur, or both to consolidate that VIE. The Company expects this to result in its

consolidating Blue Jays Holdco (note 6(a)), which will affect the reported amount of assets, liabilities, and revenues and

expenses. However, as the Company is presently recording 100% of the losses of Blue Jays Holdco, the adoption of this

standard will have no impact on net income or earnings per share.

In 2002, the Emerging Issues Task Force (“EITF”) reached a consensus regarding EITF Issue 00-21, “Accounting for

Revenue Arrangements with Multiple Deliverables”. The consensus addresses not only when and how an arrangement

involving multiple deliverables should be divided into separate units of accounting but also how the arrangement’s con-

sideration should be allocated among separate units. The pronouncement is effective for the Company commencing with

its 2004 fiscal year. The Company is currently determining the impact of prospectively adopting EITF 00-21.

In 2003, the FASB issued SFAS 150, “Accounting for Certain Financial Instruments with Characteristics of Both

Liabilities and Equity”. This statement requires that under specified circumstances, these instruments be reclassified from

equity to liabilities on the balance sheet. This statement is effective for financial instruments entered into or modified

after May 31, 2003, and otherwise is effective for the Company’s year beginning January 1, 2004. The Company did not

enter into any financial instruments within the scope of this statement after May 31, 2003, and is presently assessing the

impact of this statement on the Company’s consolidated financial statements.

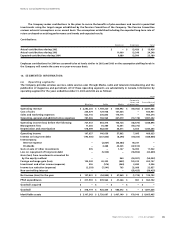

23. SUBSEQUENT EVENTS:

(a) In January 2004, Cable submitted a notice of redemption to redeem $300.0 million aggregate principal amount of

its 9.65% Senior Secured Second Priority Debentures, due 2014 at a redemption price of 104.825% of the aggregate princi-

pal amount on February 23, 2004.

(b) In January 2004, Cable announced a multi-year agreement with Yahoo! Inc. (“Yahoo”) to provide co-branded

Internet services to current and future customers of Cable’s high speed residential Internet access services. In return for

payment by the Company of a monthly fee, Yahoo will assume operation of Cable’s e-mail service and provide a suite of

customized Yahoo content, products and services to Cable’s broadband Internet access customers. These content, prod-

ucts and services include the following: a customizable browsing environment; personalized homepage; enhanced e-mail

services such as spam control, parental controls, premium pop-up blocking and storage; enhanced instant messaging

capabilities; and multi-media services. Depending on the level of Internet access service, subscribers will receive some or

all of these features as part of a monthly subscription payment. The agreement also contemplates that Cable and Yahoo

may collaborate to offer premium products and services to Cable’s subscribers for an additional fee.