Rogers 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 85

Notes to Consolidated Financial Statements

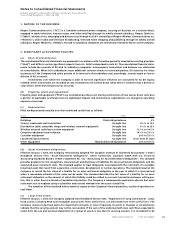

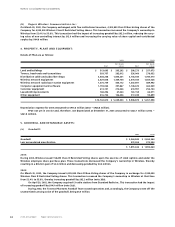

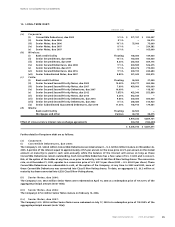

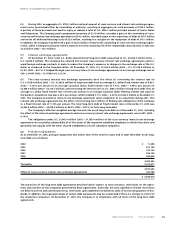

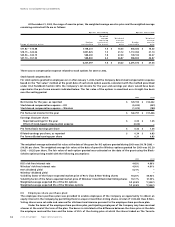

10. LONG-TERM DEBT:

Interest rate 2003 2002

(a) Corporate:

(i) Convertible Debentures, due 2005 53/4% $ 271,197 $ 320,007

(ii) Senior Notes, due 2006 91/8% – 86,314

(iii) Senior Notes, due 2006 101/2% 75,000 75,000

(iv) Senior Notes, due 2007 87/8% – 324,382

(v) Senior Notes, due 2007 83/4% – 165,000

(b) Wireless:

(i) Bank credit facility Floating 138,000 149,000

(ii) Senior Secured Notes, due 2006 101/2% 160,000 160,000

(iii) Senior Secured Notes, due 2007 8.30% 253,453 309,775

(iv) Senior Secured Debentures, due 2008 93/8% 430,589 526,275

(v) Senior Secured Notes, due 2011 95/8% 633,276 774,004

(vi) Senior Secured Debentures, due 2016 93/4% 200,193 244,680

(vii) Senior Subordinated Notes, due 2007 8.80% 231,443 282,875

(c) Cable:

(i) Bank credit facilities Floating 36,000 37,000

(ii) Senior Secured Second Priority Notes, due 2005 10.00% 376,777 460,506

(iii) Senior Secured Second Priority Notes, due 2007 7.60% 450,000 450,000

(iv) Senior Secured Second Priority Debentures, due 2007 10.00% – 118,167

(v) Senior Secured Second Priority Notes, due 2012 7.875% 452,340 552,860

(vi) Senior Secured Second Priority Notes, due 2013 6.25% 452,340 –

(vii) Senior Secured Second Priority Debentures, due 2014 9.65% 300,000 300,000

(viii) Senior Secured Second Priority Debentures, due 2032 83/4% 258,480 315,920

(ix) Senior Subordinated Guaranteed Debentures, due 2015 11.00% 146,914 179,561

(d) Media:

Bank credit facility Floating 63,500 –

Mortgages and other Various 40,730 38,375

4,970,232 5,869,701

Effect of cross-currency interest rate exchange agreements 334,784 (182,230)

$ 5,305,016 $ 5,687,471

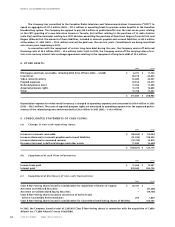

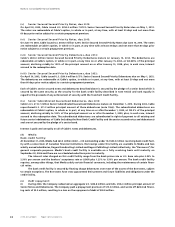

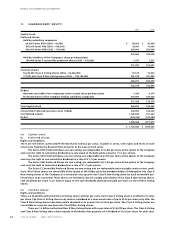

Further details of long-term debt are as follows:

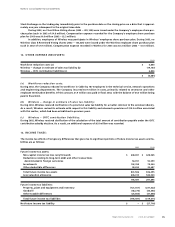

(a) Corporate:

(i) Convertible Debentures, due 2005:

The Company’s U.S. $224.8 million Convertible Debentures (accreted amount – U.S. $209.8 million) mature on November 26,

2005. A portion of the interest equal to approximately 2.95% per annum on the issue price (or 2% per annum on the stated

amount at maturity) is paid in cash semi-annually while the balance of the interest will accrue so long as these

Convertible Debentures remain outstanding. Each Convertible Debenture has a face value of U.S. $1,000 and is convert-

ible, at the option of the holder at any time, on or prior to maturity, into 34.368 Class B Non-Voting shares. The conversion

rate, as at December 31, 2003, equates to a conversion price of U.S. $27.16 per share (2002 – U.S. $26.22 per share). These

Convertible Debentures are redeemable in cash, at the option of the Company, at any time. In 2003 and 2002, none of

these Convertible Debentures was converted into Class B Non-Voting shares. To date, an aggregate U.S. $0.2 million at

maturity has been converted into 6,528 Class B Non-Voting shares.

(ii) Senior Notes, due 2006:

The Company’s U.S. $54.6 million Senior Notes were redeemed on April 14, 2003 at a redemption price of 101.521% of the

aggregate principal amount (note 10(e)).

(iii) Senior Notes, due 2006:

The Company’s $75.0 million Senior Notes mature on February 14, 2006.

(iv) Senior Notes, due 2007:

The Company’s U.S. $205.4 million Senior Notes were redeemed on July 17, 2003 at a redemption price of 102.958% of the

aggregate principal amount (note 10(e)).