Rogers 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 19

Cable, together with RCI, announced an initiative on February 12, 2004, to deploy an advanced broadband Internet

Protocol (IP) multimedia network to support primary line voice-over-cable telephony and other new services across cable

service areas. This investment plan, the completion of which assumes a regulatory environment supportive of competi-

tion from voice-over-cable telephony, includes the capital costs required to deploy a scalable primary line quality digital

voice-over-cable telephony service utilizing PacketCable and DOCSIS standards, including the costs associated with

switching, transport, IP network redundancy, multi-hour network and customer premises powering, network status mon-

itoring, customer premises equipment, information technologies and systems integration. Cable also expects the PP&E

expenditures required to deploy this platform will be approximately $200 million over two years. Cable also expects the

majority of the PP&E expenditures will occur in the first 12 to 18 months of the deployment, with 2004 expenditures

expected to be between $140 million and $170 million. Once this initial platform is deployed, the additional variable PP&E

expenditures associated with adding each voice-over-cable telephony service subscriber, which includes uninterruptible

backup powering at the home, is expected to be in the range of $300 to $340 per subscriber.

Cable is currently refining its business strategies with respect to voice-over-cable telephony services. As a result,

the PP&E expenditures, costs and timeline described above are initial estimates. In addition, Cable, together with RCI, is

considering offering the telephony services described above through another wholly owned RCI subsidiary, Rogers

Telecom Inc. (Rogers Telecom). RCI is currently in the process of recruiting an industry executive to lead Rogers Telecom.

Although Cable’s business strategies and organizational structure with respect to telephony services continue to be

refined, it plans to incur most or all of the PP&E expenditures described above to upgrade its network to an advanced

broadband multimedia platform capable of supporting voice-over-cable telephony and other new services. In the event

that Rogers Telecom offers voice-over-cable telephony services, Cable would enter into an agreement with Rogers

Telecom which could relate to, among other things, access to and the use of Cable’s network.

For a more detailed discussion of the business strategies of the Cable, Wireless and Media divisions, please refer to

the respective sections below.

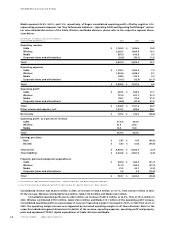

KEY PERFORMANCE INDICATORS

The Company measures the success of its strategies using a number of key performance indicators, which are outlined

below. With the exception of revenue, the following key performance indicators are not measurements in accordance

with Canadian or U.S. GAAP and should not be considered as an alternative to net income or any other measure of perfor-

mance under Canadian or U.S. GAAP.

Revenue

Revenue is a measurement defined by Canadian and U.S. GAAP. Revenue is net of items such as trade or volume discounts

and certain excise and sales taxes. It is the base on which operating profit cash flow, a key performance indicator defined

below, is determined. It measures the potential to deliver operating profit cash flow as well as indicating the level of

growth in a competitive marketplace.

The Company derives its revenues principally from a combination of:

• recurring monthly subscription-based fees for services from Cable and Wireless;

• incremental usage-based fees from subscribers of Cable and Wireless;

• revenues from retail operations at Cable and Wireless; and

• revenues at its Media division, which derives its revenues from a combination of magazine subscriptions and advertis-

ing revenues in television, radio and publishing, subscriptions for television stations received from cable and satellite

providers and retail sales derived from its televised home shopping network.

Subscriber Counts

The Company determines the number of subscribers to its services and publications based on active subscribers. A wire-

less subscriber is, generally, represented by each identifiable telephone number. A cable subscriber is represented by a

dwelling unit. In the case of multiple units in one dwelling, such as an apartment building, each tenant with cable service,

whether invoiced individually or having services included in his or her rent, is counted as one subscriber. Commercial or

institutional units, such as hospitals or hotels, are each considered to be one subscriber. When subscribers are deactivated,

either voluntarily or involuntarily for non-payment, these customers are considered to be deactivations in the month that

service is discontinued.

Subscriber Churn

Subscriber churn is calculated on a monthly basis. For any particular month, subscriber churn for Cable or Wireless repre-

sents the number of subscribers deactivating in the month divided by the aggregate number of subscribers at the

beginning of the month. When used or reported for a period greater than one month, subscriber churn represents the

monthly average of the subscriber churn for the period.

Management’s Discussion and Analysis