Rogers 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

80

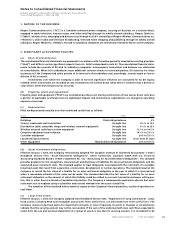

Notes to Consolidated Financial Statements

(b) Rogers Wireless Communications Inc.:

On March 20, 2002, the Company exchanged, with five institutional investors, 4,305,830 Class B Non-Voting shares of the

Company for 4,925,000 Wireless Class B Restricted Voting shares. This transaction increased the Company’s ownership in

Wireless from 52.4% to 55.8%. This transaction had the impact of increasing goodwill by $92.2 million, reducing the carry-

ing value of non-controlling interest by $12.6 million and increasing the carrying value of share capital and contributed

surplus by $104.8 million.

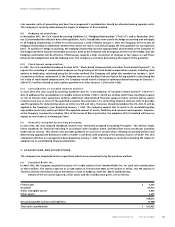

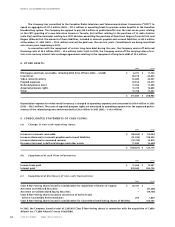

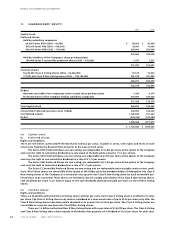

4. PROPERTY, PLANT AND EQUIPMENT:

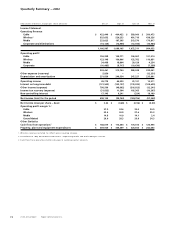

Details of PP&E are as follows:

2003 2002

Net book Net book

Cost value Cost value

Land and buildings $ 313,695 $ 263,262 $ 298,273 $ 257,673

Towers, head-ends and transmitters 593,757 282,612 536,060 278,632

Distribution cable and subscriber drops 3,438,248 1,855,201 3,136,545 1,785,510

Wireless network equipment 2,629,608 1,369,704 2,419,035 1,363,028

Wireless network radio base station equipment 1,375,739 465,172 1,347,891 489,992

Computer equipment and software 1,193,064 397,867 1,108,670 460,549

Customer equipment 613,741 212,026 613,997 256,144

Leasehold improvements 168,296 67,224 161,159 66,571

Other equipment 416,722 126,236 317,245 93,899

$10,742,870 $ 5,039,304 $ 9,938,875 $ 5,051,998

Depreciation expense for 2003 amounted to $973.6 million (2002 – $928.8 million).

PP&E not yet in service and, therefore, not depreciated at December 31, 2003 amounted to $223.1 million (2002 –

$361.8 million).

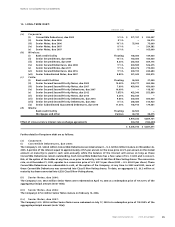

5. GOODWILL AND INTANGIBLE ASSETS:

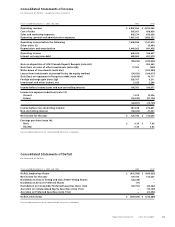

(a) Goodwill:

2003 2002

Goodwill $ 2,264,840 $ 2,265,264

Less accumulated amortization 373,204 373,204

$ 1,891,636 $ 1,892,060

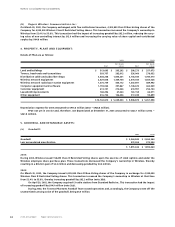

2003:

During 2003, Wireless issued 158,495 Class B Restricted Voting shares upon the exercise of stock options and under the

Wireless employee share purchase plan. These transactions decreased the Company’s ownership in Wireless, thereby

resulting in a dilution gain of $2.0 million and decreasing goodwill by $0.4 million.

2002:

On March 20, 2002, the Company issued 4,305,830 Class B Non-Voting shares of the Company in exchange for 4,925,000

Wireless Class B Restricted Voting shares. This transaction increased the Company’s ownership in Wireless at that time

from 52.4% to 55.8%, thereby increasing goodwill by $92.2 million (note 3(b)).

On April 29, 2002, the Company acquired 13 radio stations from Standard Radio Inc. This transaction had the impact

of increasing goodwill by $94.9 million (note 3(a)).

During 2002, the Toronto Phantoms Football Team ceased operations and, accordingly, the Company wrote off the

unamortized carrying value of the goodwill, being $6.5 million.