Rogers 2003 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

84

Notes to Consolidated Financial Statements

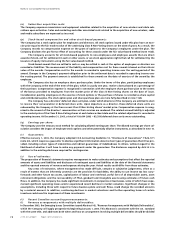

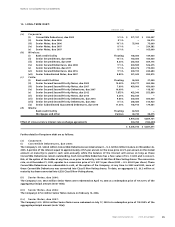

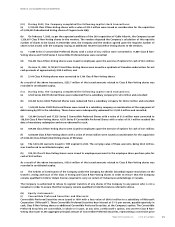

The Company has committed to the Canadian Radio-television and Telecommunications Commission (“CRTC”) to

spend an aggregate of $77.4 million (2002 – $77.4 million) in operating funds to provide certain benefits to the Canadian

broadcasting system. The Company has agreed to pay $50.0 million in public benefits over the next seven years relating

to the CRTC granting of a new television licence in Toronto, $6.0 million relating to the purchase of 13 radio stations

(note 3(a)) and the remainder relating to a CRTC decision permitting the purchase of Sportsnet, Rogers (Toronto) Ltd. and

Rogers (Alberta) Ltd. The amount of these liabilities, included in accounts payable and accrued liabilities, is $63.5 million

at December 31, 2003 (2002 – $74.0 million) and will be paid over the next six years. Commitments are being amortized

over seven years, beginning in 2002.

In connection with the repayment of certain long-term debt during the year, the Company wrote off deferred

financing costs of $5.5 million (2002 – $3.0 million) (note 10(e)). In 2002, the Company wrote off the carrying value of cer-

tain cross-currency interest rate exchange agreements relating to the repayment of long-term debt of $2.3 million.

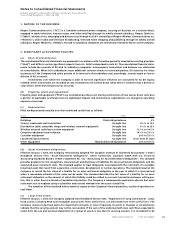

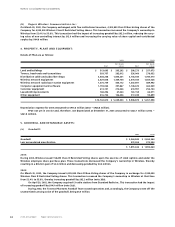

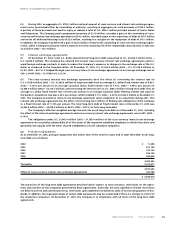

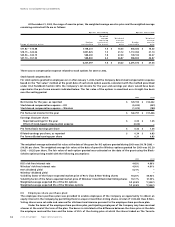

8. OTHER ASSETS:

2003 2002

Mortgages and loans receivable, including $894 from officers (2002 – $1,848) $ 6,077 $ 11,133

Inventories 69,318 66,433

Video rental inventory 31,685 33,557

Prepaid expenses 57,812 52,372

Deferred pension asset 17,456 17,098

Acquired program rights 17,729 16,883

Other 11,728 11,507

$ 211,805 $ 208,983

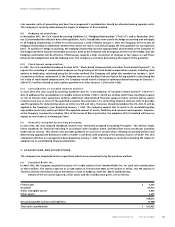

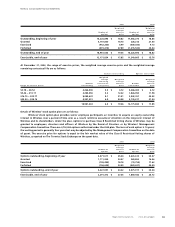

Depreciation expense for video rental inventory is charged to operating expenses and amounted to $60.4 million in 2003

(2002 – $56.5 million). The costs of acquired program rights are amortized to operating expense over the expected perfor-

mances of the related programs and amounted to $20.9 million in 2003 (2002 – $16.9 million).

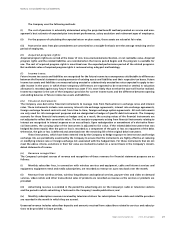

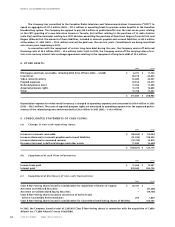

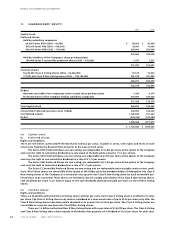

9. CONSOLIDATED STATEMENTS OF CASH FLOWS:

(a) Change in non-cash operating items:

2003 2002

Increase in accounts receivable $ (38,694) $ (14,447)

Increase (decrease) in accounts payable and accrued liabilities (91,230) 128,336

Increase (decrease) in unearned revenue (12,743) 16,872

Decrease (increase) in deferred charges and other assets 11,846 (4,645)

$ (130,821) $ 126,116

(b) Supplemental cash flow information:

2003 2002

Income taxes paid $ 11,606 $ 15,397

Interest paid 474,044 450,126

(c) Supplemental disclosure of non-cash transactions:

2003 2002

Class B Non-Voting shares issued in consideration for acquisition of shares of Cogeco $ 35,181 $ –

Accretion on Preferred Securities – (37,246)

Accretion on Collateralized Equity Securities – (19,745)

Class B Non-Voting shares issued on conversion of Series B and

Series E Convertible Preferred shares 203 1,800

Class B Non-Voting shares issued in consideration for Class B Restricted Voting shares of Wireless – 104,766

In 2003, the Company issued a total of 2,065,402 Class B Non-Voting shares in connection with the acquisition of Cable

Atlantic Inc. (“Cable Atlantic”) (note 11(a)(iii)(b)).