Rogers 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

68

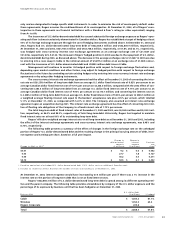

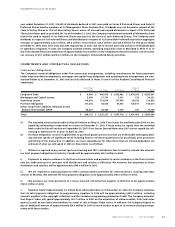

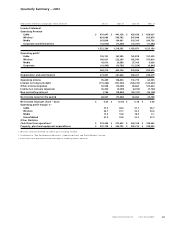

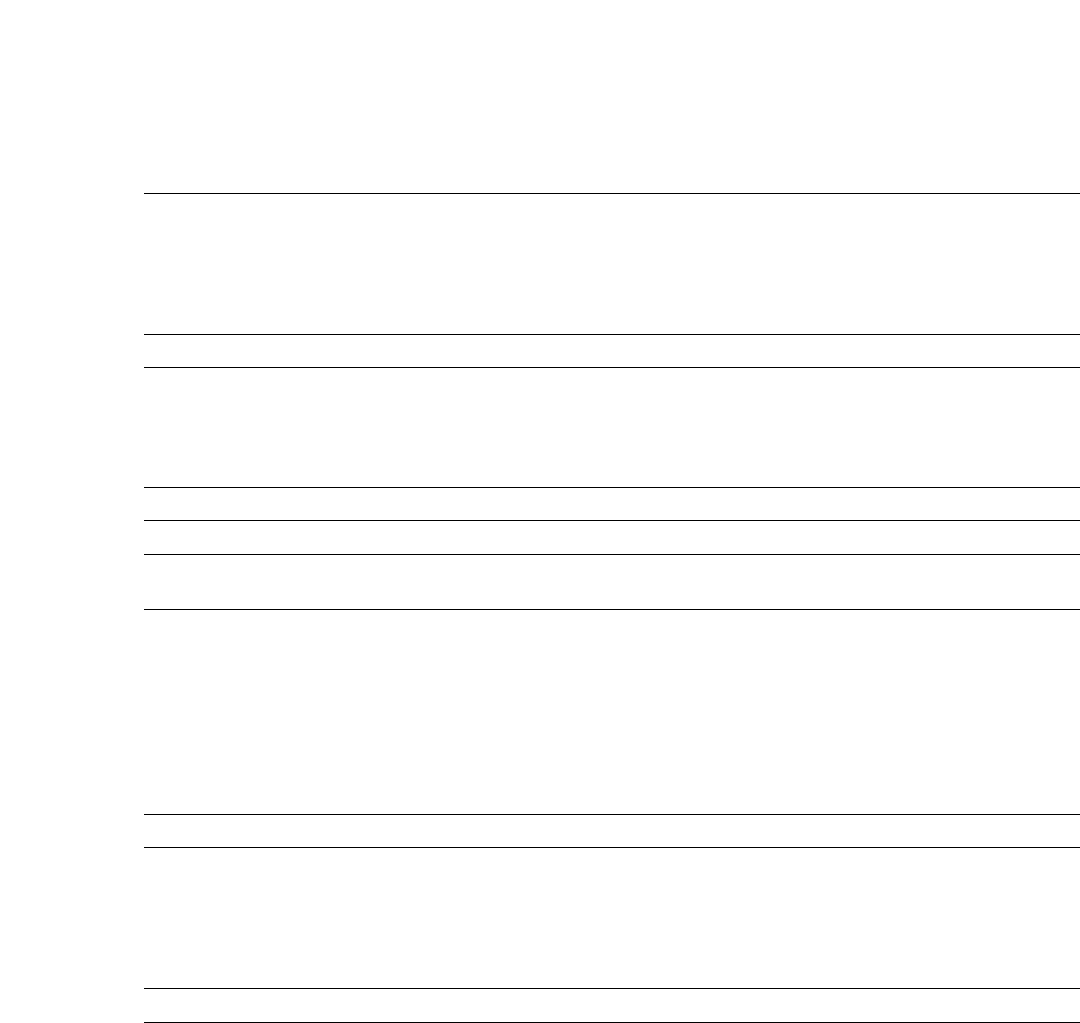

(thousands of dollars, except per share amounts)

Years ended December 31 2003 2002 2001 2000 1999

Income and Cash Flow

Operating Revenue

Cable $ 1,769,220 $ 1,596,401 $ 1,433,029 $ 1,291,161 $ 1,148,519

Wireless 2,282,203 1,965,927 1,753,145 1,639,104 1,418,579

Media 854,992 810,805 721,710 681,023 607,604

Corporate and eliminations (59,052) (50,088) 4,772 – –

4,847,363 4,323,045 3,912,656 3,611,288 3,174,702

Operating Profit1

Cable 663,474 563,480 516,805 457,777 411,205

Wireless 727,572 527,687 411,945 410,924 422,328

Media 106,724 87,635 68,306 77,390 77,252

Corporate and eliminations (48,874) (37,188) (44,535) (28,366) (16,957)

1,448,896 1,141,614 952,521 917,725 893,828

Net Income (loss)3$ 129,193 $ 312,032 $ (464,361) $ 127,520 $ 977,916

Cash flow from operations2$ 984,749 $ 642,433 $ 470,471 $ 770,781 $ 495,200

Property, plant and equipment, net $ 963,742 $ 1,261,983 $ 1,420,747 $ 1,212,734 $ 832,423

Average Class A and Class B shares

outstanding (000’s) 225,918 213,570 208,644 203,761 189,805

Per Share Earnings (loss) – basic $ 0.35 $ 1.05 $ (2.56) $ 0.37 $ 5.01

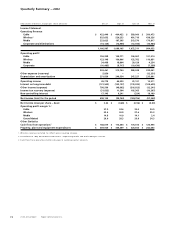

Balance Sheet

Assets

Property, plant and equipment, net $ 5,039,304 $ 5,051,998 $ 4,717,731 $ 4,047,329 $ 3,539,160

Goodwill and other intangible assets 2,291,855 2,315,734 2,134,925 1,601,433 1,379,582

Investments 229,221 223,937 1,047,888 972,648 554,241

Other assets 905,115 932,834 909,835 1,127,190 683,627

$ 8,465,495 $ 8,524,503 $ 8,810,379 $ 7,748,600 $ 6,156,610

Liabilities and Shareholders’ Equity (Deficiency)

Long-term debt $ 5,305,016 $ 5,687,471 $ 4,990,357 $ 3,957,662 $ 3,594,966

Accounts payable and other liabilities 1,199,757 1,272,745 1,192,165 1,232,463 1,016,754

Future income taxes – 27,716 137,189 145,560 138,803

Non-controlling interest 193,342 132,536 186,377 88,683 132,459

Shareholders’ equity (deficiency) 1,767,380 1,404,035 2,304,291 2,324,232 1,273,628

$ 8,465,495 $ 8,524,503 $ 8,810,379 $ 7,748,600 $ 6,156,610

1 As defined in “Key Performance Indicators – Operating Profit and Profit Margin” section.

2 Cash flow from operations before changes in working capital amounts.

3 Restated for the change in accounting of foreign exchange translation.

Five Year Financial Summary