Rogers 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 59

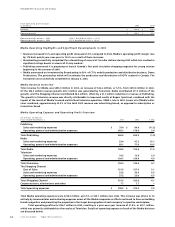

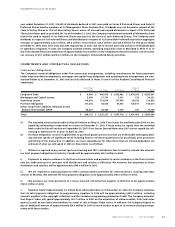

Including the $853.9 million of cash generated from operations after changes in working capital, the aggregate net funds

raised in 2003 totaled $1,650.6 million.

The net funds used during 2003 totalled approximately $1,687.7 million consisting of:

• additions to property plant and equipment of $963.7 million;

• aggregate redemptions of long-term debt of $626.0 million repurchases and redemptions by RCI and Cable of certain

Canadian and U.S. dollar-denominated public debt;

• payment of dividends of $11.6 million on Class B Non-Voting Shares, Class A Voting Shares and Series E Preferred Shares;

• net other investments of $27.9 million of which $29.4 million relates to cash contributions to the Blue Jays net of

$3.6 million cash distributions received from other investments;

• distributions on Convertible Preferred Securities of $33.0 million;

• premiums on the early repayment of long-term debt aggregating $19.3 million; and

• financing costs incurred of $6.2 million.

As a result of the above, cash of $37.2 million was used during 2003. Taking into account the $26.9 million cash balance at

the beginning of the year, the ending 2003 cash deficiency was $10.3 million.

Financing

Rogers’ long-term financial instruments are described in the Notes to the Consolidated Financial Statements.

During 2003, the following financings were completed: in May, 2003, RCI completed a $250 million equity issue with

the issuance of 12,722,647 Class B Non-Voting Shares for proceeds, net of fees and expenses, of $239.0 million; and in

June, 2003, Cable issued U.S.$350.0 million (Canadian equivalent $470.4 million) 6.25% Senior Secured Second Priority

Notes due 2013.

During 2003, the following debt redemptions were made, which aggregated $626.0 million with repurchase premi-

ums of $19.3 million in total: in April, 2003, RCI redeemed US$54.6 million aggregate principal amount of its 91/8% Senior

Notes due 2006 at a redemption price of 101.521% of the aggregate principal amount; in June, 2003, Cable redeemed

US$74.8 million aggregate principal amount of its 10% Senior Secured Second Priority Debentures due 2007 at a redemp-

tion price of 105.0% of the aggregate principal amount; in July, 2003, RCI redeemed US$205.4 million aggregate principal

amount of its 87/8% Senior Notes due 2007 at a redemption price of 102.958% of the aggregate principal amount; and in

August, 2003, RCI redeemed $165.0 million aggregate principal amount of its 83/4% Senior Notes due 2007 at a redemption

price of 102.917% of the aggregate principal amount.

In February 2004, Cable redeemed $300.0 million aggregate principal amount of its 9.65% senior secured second

priority debentures due 2014 at a redemption price of 104.825% of the aggregate principal amount on February 23, 2004.

In January, 2004, Cable established a dividend/distribution policy to distribute $6.0 million per month to RCI on a

regular basis, starting in January, 2004.

Rogers structures its borrowings generally on a stand-alone basis. Therefore, borrowings by each of its three prin-

cipal operating groups are generally secured only by the assets of the respective entities within each operating group,

and such instruments generally do not provide for guarantees or cross-collateralization or cross-defaults between

groups. Currently, no such guarantees or cross-collateralizations or cross-defaults between the groups exist.

At December 31, 2003, Rogers’ long-term committed bank credit facilities provided for aggregate credit of $2.28 bil-

lion, of which $237.5 million was drawn down. Generally, access to these credit facilities is subject to compliance within

certain debt to operating profit ratios, and at December 31, 2003, based upon the most restrictive covenants under the

bank credit facilities and public debt instruments, Rogers could have borrowed additional long-term debt under existing

credit facilities of approximately $1.90 billion including $400.0 million available for the repayment of debt maturing in

Cable in 2005.

Of all the Rogers debt instruments, the provisions of the bank loan agreements generally impose the most restric-

tive limitations on the operations and activities of the companies governed by these agreements. The most significant of

these restrictions are debt incurrence and maintenance tests (based upon certain ratios of debt to operating profit),

restrictions upon additional investments, sales of assets and distributions to shareholders. Rogers and its subsidiaries are

currently in compliance with all of the covenants under their respective debt instruments and Rogers expects all

covenants to remain in compliance. (See Note 10 to the Consolidated Financial Statements for details of the specific debt

instruments.) On December 31, 2003, a total of $270.1 million could have been distributed to Rogers Corporate from Media

via the repayment of unsecured subordinated intercompany notes.

Rogers’ required repayments on all long-term debt in the next five years totals $2.5 billion, excluding an aggregate

$36.2 million effect of cross-currency interest rate exchange agreements. In 2004, required repayments total $11.5 million.

In 2005, required repayments total $651.1 million including $376.8 million for the repayment of Cable’s 10% Senior Secured

Second Priority Notes due 2005 and $271.2 million for the repayment of Rogers’ 53/4% Convertible Debentures due 2005. In

2006, required repayments total $323.1 million, mainly comprised of $75.0 million for the repayment of Rogers’ 101/2%

Senior Notes due 2006, $160.0 million for the repayment of Wireless’ 101/2% Senior Secured Notes due 2006, $22.2 million

for the repayment of a mortgage due 2006, and the $63.5 million outstanding under the Media bank credit facility at

December 31, 2003. In 2007, required repayments total $936.2 million mainly comprised of $450.0 million for the repayment

Management’s Discussion and Analysis