Rogers 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 67

year ended December 31, 2001, $14,000 of dividends declared in 2001 were paid on Series B Preferred Shares and Series E

Preferred Shares held by members of its Management Share Purchase Plan. Dividends may not be paid in respect of the

Class A Voting Shares or Class B Non-Voting Shares unless all accrued and unpaid dividends in respect of its Preferred

Shares have been paid or provided for. As at December 31, 2002, the Company had declared and paid all dividends sched-

uled to be paid in respect of its Preferred Shares pursuant to the terms of such Preferred Shares. The Company paid

dividends in respect of its Preferred Shares and distributions in respect of its Convertible Preferred securities in aggregate

amounts of approximately $20.3 million, $18.6 million, $18.6 million, $20.3 million and $29.8 million for the years ended

December 31, 1999, 2000, 2001, 2002 and 2003 respectively, in each case net of income taxes and exclusive of dividends paid

to subsidiary companies. In 2002, the Company accreted interest, excluding acquisition costs as described in Note 11 (c) to

the Consolidated Financial Statements of approximately $15.4 million on the Company Preferred Securities, net of income

tax recovery of $9.7 million and $16.5 million on the Company’s Collateralized Equity Securities.

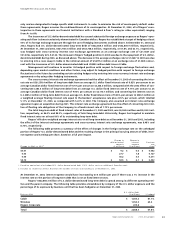

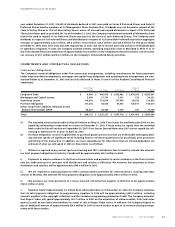

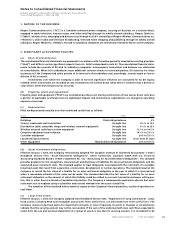

COMMITMENTS AND CONTRACTUAL OBLIGATIONS

Contractual Obligations

The Company’s material obligations under firm contractual arrangements, including commitments for future payments

under long-term debt arrangements, mortgage and capital lease obligations and operating lease arrangements are sum-

marized below as at December 31, 2003 and are fully disclosed in Notes 10 and 19 of the Audited Consolidated Financial

Statements.

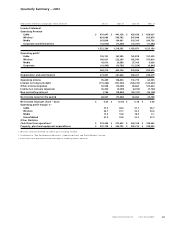

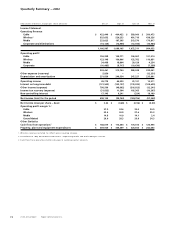

Less Than After 5

1 Year 1–3 Years 4–5 Years Years Total

Long-term Debt $ 6,400 $ 946,473 $ 1,503,485 $ 2,479,543 $ 4,935,901

Mortgages and Capital Leases 5,098 27,791 1,313 129 34,331

Operating Leases 114,824 191,874 127,499 85,633 519,830

Purchase Obligation 101,243 44,504 47,056 125,811 318,614

Other Long-Term Liabilities reflected on the

Balance Sheet Under GAAP 38,607 28,585 7,765 347 75,304

Total $ 266,172 $ 1,239,227 $ 1,687,118 $ 2,691,463 $ 5,883,980

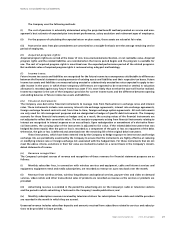

(1) The amended wireless bank credit facility will mature on May 31, 2006 if our Senior Secured Notes due 2006 are not

repaid (by refinancing or otherwise) on or prior to December 31, 2005. If these notes are repaid, then the amended

bank credit facility will mature on September 30, 2007 if our Senior Secured Notes due 2007 are not repaid (by refi-

nancing or otherwise) on or prior to April 30, 2007.

(2) Purchase obligations consist of agreements to purchase goods and services that are enforceable and legally bind-

ing and that specify all significant terms including fixed or minimum quantities to be purchased, price provisions

and timing of the transaction. In addition, we incur expenditures for other items that are volume-dependent. An

estimate of what we will spend in 2004 on these items is as follows:

i. Wireless is required to pay annual spectrum licensing and CRTC contribution fees to Industry Canada. We estimate

our total payment obligations to Industry Canada will be approximately $60.0 million in 2004.

ii. Payments to acquire customers in the form of commissions and payments to retain customers in the form of resid-

uals are made pursuant to contracts with distributors and retailers at Wireless. We estimate that payments to these

distributors and retailers will be approximately $340.0 million in 2004.

iii. We are required to make payments to other communications providers for interconnection, roaming and other

services at Wireless. We estimate the total payment obligation to be approximately $145.0 million in 2004.

iv. We estimate our total payments to a major network infrastructure supplier at Wireless to be approximately

$165.0 million in 2004.

v. Based on Cable’s approximately 2.3 million basic cable subscribers as of December 31, 2003, the Company estimates

that its total payment obligation to programming suppliers in 2004 will be approximately $399.9 million, including

amounts payable to the copyright collectives and the Canadian programming production funds. The Company estimates

that Rogers Video will spend approximately $62.7 million in 2004 on the acquisition of videocassettes, DVDs and video

games (as well as non-rental merchandise) for rental or sale in Rogers Video stores. In addition, the Company expects to

pay an additional amount of approximately $24.9 million in 2004 to movie studios as part of its revenue-sharing arrange-

ments with those studios.

Management’s Discussion and Analysis