Rogers 2003 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 83

Notes to Consolidated Financial Statements

with Cogeco. This transaction and number of shares exchanged was based on the closing market value of Cogeco shares

on the date of the transaction of $11.727 per share (note 11(a)(iii)(a)) and had the effect of increasing the Company’s

investment in Cogeco by $35.3 million, including costs of the transaction. The Company’s total investment in Cogeco rep-

resents an approximate 18.19% equity ownership.

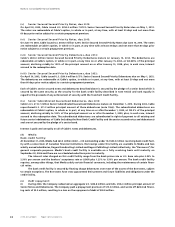

(c) Gain on disposition of AT&T Canada Deposit Receipts:

The deposit receipt holders of AT&T Canada Inc. (“AT&T Canada”), including the Company, had a contractual right to real-

ize a minimum deposit receipt price of $37.50 per deposit receipt, increasing at 16% per annum from June 30, 2000 (the

“accreted floor price”) until June 30, 2003, or such earlier time as a minority shareholder of AT&T Canada exercised its

obligation to acquire all of the shares and Deposit Receipts of AT&T Canada. On June 25, 2002, AT&T Corp. announced its

intention to purchase, for cash, the Deposit Receipts of AT&T Canada. This transaction was completed on October 8, 2002 and

the Company recognized a pre-tax gain of approximately $904.3 million. The Company received cash proceeds of approxi-

mately $1,280.4 million and these proceeds were used to redeem the Preferred Securities and settle the Collateralized Equity

Securities, as described below.

The issuance of the Preferred Securities and Collateralized Equity Securities in previous years resulted in the mon-

etization of a substantial portion of the Company’s investment in AT&T Canada, with the Company receiving cash of

approximately $1,186.0 million. The redemption amount with respect to these securities, being $1,317.0 million, was paid

on October 8, 2002, being the same day that the Company received the proceeds from the Deposit Receipts.

The Company, in accordance with the terms of the agreements of these securities, had the right to provide notifi-

cation by specified dates if its intent was to satisfy the redemption of these securities by way of shares. As the Company

determined that it would repay these securities in cash, no notification was provided and the accretion on the value of

these securities after the notice date, being $5.2 million, was expensed in the consolidated statement of income. Amounts

related to the accretion prior to the notice date and the costs incurred by the Company of originally issuing these securi-

ties are recorded in the consolidated statements of deficit (note 11(c)).

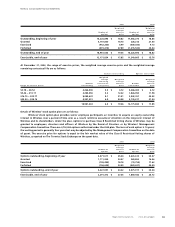

(d) Gains (losses) on sales of other investments:

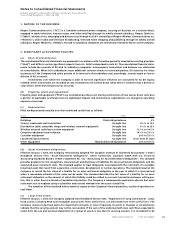

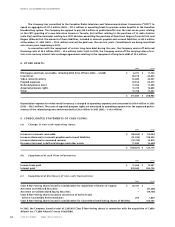

In 2003 and 2002, the Company sold certain investments resulting in the following gains (losses) being recorded:

2003 2002

Publicly traded companies $ 17,902 $ 2,062

Investment accounted for by the equity method – (2,627)

$ 17,902 $ (565)

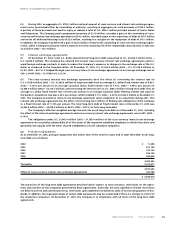

(e) Write-down of investments:

During 2002, the Company recorded the following write-down of investments:

2002

Cogeco Cable Inc. and Cogeco Inc. $ 238,921

Other investments in public and private companies 62,063

$ 300,984

In 2000, the Company acquired 4,253,800 Subordinate Voting Common shares of Cogeco for $187.2 million and 2,724,800

Subordinate Voting Common shares of Cogeco Inc. for $120.8 million.

During 2002, the Company determined that the decline in the market value of shares held in Cogeco and Cogeco

Inc. represented an impairment that was other than temporary and the shares were written down to their closing quoted

market value at December 31, 2002.

7. DEFERRED CHARGES:

2003 2002

Financing costs $ 64,741 $ 77,915

Pre-operating costs 8,854 20,004

CRTC commitments 56,992 69,238

Other 11,893 17,683

$ 142,480 $ 184,840

Amortization of deferred charges for 2003 amounted to $42.4 million (2002 – $47.2 million). Accumulated amortization as

at December 31, 2003 amounted to $138.3 million (2002 – $105.7 million).