Rogers 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 79

Notes to Consolidated Financial Statements

into separate units of accounting and how the arrangement’s consideration should be allocated among separate units.

The Company is currently determining the impact of adoption of this standard.

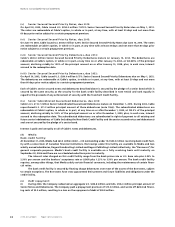

(ii) Hedging relationships:

In November 2001, the CICA issued Accounting Guideline 13, “Hedging Relationships” (“AcG-13”), and in November 2002,

the CICA amended the effective date of the guideline. AcG-13 establishes new criteria for hedge accounting and will apply

to all hedging relationships in effect on or after January 1, 2004. Effective January 1, 2004, the Company will re-assess all

hedging relationships to determine whether the criteria are met or not and will apply the new guidance on a prospective

basis. To qualify for hedge accounting, the hedging relationship must be appropriately documented at the inception of

the hedge and there must be reasonable assurance, both at the inception and throughout the term of the hedge, that the

hedging relationship will be effective. Effectiveness requires a high correlation of changes in fair values or cash flows

between the hedged item and the hedging item. The Company is currently determining the impact of the guideline.

(iii) Stock-based compensation:

In 2003, the CICA amended Handbook Section 3870, “Stock-based Compensation and other Stock-based Payments”, to

require the recording of compensation expense on the granting of all stock-based compensation awards, including stock

options to employees, calculated using the fair-value method. The Company will adopt this standard on January 1, 2004,

retroactively without restatement. If the Company were to use the Black-Scholes Option Pricing model for calculating the

fair value of stock-based compensation, the Company would record a charge to opening retained earnings on January 1,

2004 of $7.0 million related to stock options granted on or after January 1, 2002 (note 11(d)).

(iv) Consolidation of variable interest entities:

In June 2003, the CICA issued Accounting Guideline AcG-15, “Consolidation of Variable Interest Entities” (“AcG-15”).

AcG-15 addresses the consolidation of variable interest entities (“VIEs”), which are entities which have insufficient equity

at risk to finance their operations without additional subordinated financial support and/or entities whose equity

investors lack one or more of the specified essential characteristics of a controlling financial interest. AcG-15 provides

specific guidance for determining when an entity is a VIE and who, if anyone, should consolidate the VIE. AcG-15 will be

applied in the Company’s year beginning January 1, 2005. The Company expects this to result in its consolidating Blue

Jays Holdco (note 6 (a)), which will affect the reported amount of assets, liabilities, and revenues and expenses. However,

as the Company is presently recording 100% of the losses of Blue Jays Holdco, the adoption of this standard will have no

impact on net income or earnings per share.

(v) Generally accepted accounting principles:

In June 2003, the CICA released Handbook Section 1100, “Generally Accepted Accounting Principles”. This Section estab-

lishes standards for financial reporting in accordance with Canadian GAAP, and describes what constitutes Canadian

GAAP and its sources. This section also provides guidance on sources to consult when selecting accounting policies and

determining appropriate disclosures when a matter is not dealt with explicitly in the primary sources of GAAP. The new

standard is effective on a prospective basis beginning January 1, 2004. The Company is currently evaluating the impact of

adoption on its consolidated financial statements.

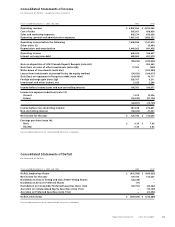

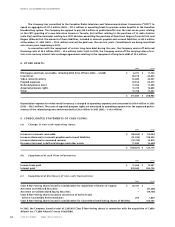

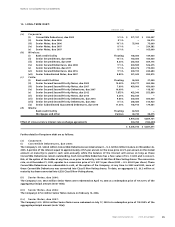

3. ACQUISITIONS AND DIVESTITURES:

The Company has completed certain acquisitions which were accounted for by the purchase method.

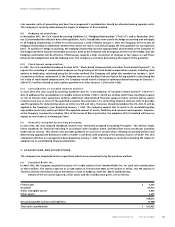

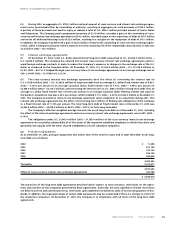

(a) Standard Radio Inc.:

In April 2002, the Company acquired the assets of 13 radio stations from Standard Radio Inc. for total cash consideration

of $103.4 million. The stations operate as an AM station in Toronto (the FAN), an FM station in Orillia, two FM stations in

Timmins and two FM stations and an AM station in each of Sudbury, Sault Ste. Marie and North Bay.

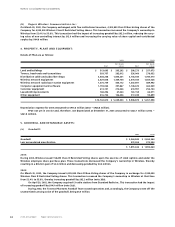

Details of the net assets acquired, at fair value, and the consideration given, are as follows:

Fixed assets $ 5,000

Goodwill 94,914

Other intangible assets 3,840

Other assets 4,659

108,413

Accounts payable and accrued liabilities (4,988)

Total cash consideration $ 103,425