Rogers 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 99

Notes to Consolidated Financial Statements

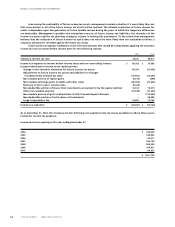

The Company makes contributions to the plans to secure the benefits of plan members and invests in permitted

investments using the target ranges established by the Pension Committee of the Company. The Pension Committee

reviews actuarial assumptions on an annual basis. The assumptions established including the expected long-term rate of

return are based on existing performance and trends and expected results.

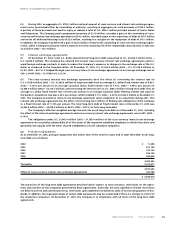

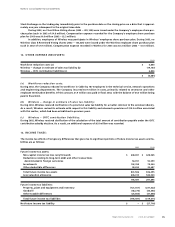

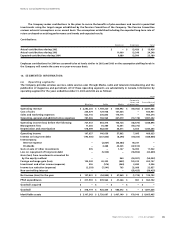

Contributions:

Employer Employee Total

Actual contributions during 2002 $ – $ 13,426 $ 13,426

Actual contributions during 2003 11,000 13,248 24,248

Expected contributions during 2004 9,680 13,500 23,180

Employee contributions for 2004 are assumed to be at levels similar to 2002 and 2003 on the assumption staffing levels in

the Company will remain the same on a year-over-year basis.

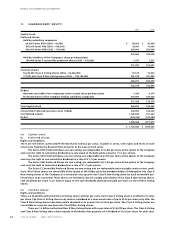

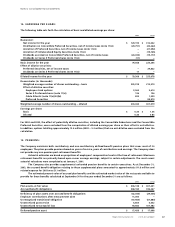

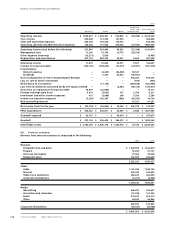

16. SEGMENTED INFORMATION:

(a) Operating segments:

The Company provides wireless services, cable services and, through Media, radio and television broadcasting and the

publication of magazines and periodicals. All of these operating segments are substantially in Canada. Information by

operating segment for the years ended December 31, 2003 and 2002 are as follows:

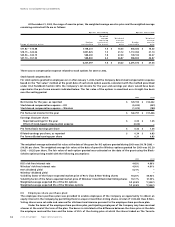

2003

Corporate

items and Consolidated

Wireless Cable Media eliminations total

Operating revenue $ 2,282,203 $ 1,769,220 $ 854,992 $ (59,052) $ 4,847,363

Cost of sales 244,479 129,938 131,534 – 505,951

Sales and marketing expenses 522,716 206,843 175,715 – 905,274

Operating, general and administrative expenses 787,436 768,965 441,019 (10,178) 1,987,242

Operating income (loss) before the following 727,572 663,474 106,724 (48,874) 1,448,896

Management fees 11,336 35,385 12,551 (59,272) –

Depreciation and amortization 518,599 482,050 36,311 3,303 1,040,263

Operating income 197,637 146,039 57,862 7,095 408,633

Interest on long-term debt (193,506) (237,803) (8,296) (49,260) (488,865)

Intercompany:

Interest expense – (2,867) (46,380) 49,247 –

Dividends – 4,488 43,325 (47,813) –

Gain on sale of other investments 305 – 1,107 16,490 17,902

Loss on repayment of long-term debt – (5,945) – (18,894) (24,839)

Gain (loss) from investments accounted for

by the equity method – – 964 (54,997) (54,033)

Foreign exchange gain (loss) 135,242 49,302 (852) 120,015 303,707

Investment and other income (expense) 556 (516) (464) 2,680 2,256

Income tax reduction (expense) (2,393) (7,541) 703 32,088 22,857

Non-controlling interest – – – (58,425) (58,425)

Net income (loss) for the year $ 137,841 $ (54,843) $ 47,969 $ (1,774) $ 129,193

PP&E expenditures $ 411,933 $ 509,562 $ 41,266 $ 981 $ 963,742

Goodwill acquired $ – $ – $ – $ – $ –

Goodwill $ 378,719 $ 926,445 $ 586,472 $ – $ 1,891,636

Identifiable assets $ 3,107,343 $ 3,720,087 $ 1,467,149 $ 170,916 $ 8,465,495