Rogers 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 81

Notes to Consolidated Financial Statements

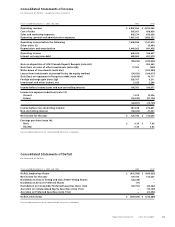

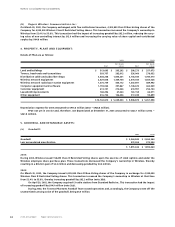

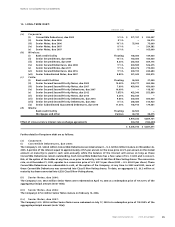

(b) Intangible assets:

2003 2002

Net book Net book

Cost value Cost value

Spectrum licences $ 396,824 $ 396,824 $ 396,824 $ 396,824

Brand licence 37,800 – 37,800 22,470

Subscribers 5,200 520 5,200 1,040

Other 3,840 2,875 3,840 3,340

$ 443,664 $ 400,219 $ 443,664 $ 423,674

Amortization of subscribers, brand licence and other in 2003 amounted to $23.5 million (2002 – $3.5 million).

In a spectrum auction conducted by Industry Canada in February 2001, the Company purchased 23 personal com-

munications services licences of 10 megahertz (“MHz”) or 20 MHz each, in the 1.9 gigahertz (“GHz”) band in various regions

across Canada at a cost of $396.8 million, including costs of acquisition. This amount has been recorded as spectrum

licences. The Company has determined that these licences have indefinite lives for accounting purposes.

The AT&T brand licence was acquired in 1996 at an aggregate cost of $37.8 million, which provided Wireless with,

among other things, the right to use the AT&T brand name. The cost of the brand licence was deferred and amortized on

a straight-line basis to expense over the 15-year term of the brand licence agreement. In December 2003, Wireless

announced that it would terminate its brand licence agreement in early 2004 and change its brand name to exclude the

AT&T brand. Consequently, the Company determined the useful life of the brand licence ended on December 31, 2003 and

accordingly, fully amortized the remaining net book value of $20.0 million.

Subscribers are being amortized on a straight-line basis over 10 years.

Other includes the brand name and employment contracts acquired as part of the acquisition of the 13 radio sta-

tions from Standard Radio Inc. (note 3(a)). These intangible assets are being amortized on a straight-line basis over

periods ranging between five and seven years.

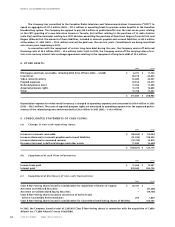

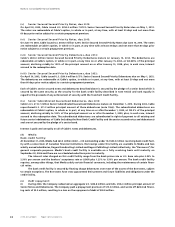

6. INVESTMENTS:

2003 2002

Quoted Quoted

market Book market Book

Number Description value value value value

Investments accounted for

by the equity method:

Blue Jays Holdco $ 95,720 $ 122,844

Other 5,055 7,079

100,775 129,923

Investments accounted for by the

cost method, net of write-downs

Publicly traded companies:

Cogeco Cable Inc. 7,253,800 Subordinate

(2002 – Voting

4,253,800) Common 121,501 75,758 40,454 40,454

Cogeco Inc. 2,724,800 Subordinate

Voting

Common 43,488 28,610 28,610 28,610

Other publicly traded companies 25,482 7,508 27,934 10,323

190,471 111,876 96,998 79,387

Private companies 16,570 14,627

$ 229,221 $ 223,937

(a) Investments accounted for by the equity method:

Toronto Blue Jays Baseball Club:

Effective December 31, 2000, the Company purchased an 80% interest in the Toronto Blue Jays Baseball Club (“Blue Jays”)

for cash of $163.9 million. The Company has the option to acquire the 20% minority interest in the Blue Jays at any time,

and the minority interest owner has the right to require the Company to purchase its interest at any time after December 15,