Rogers 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

86

Notes to Consolidated Financial Statements

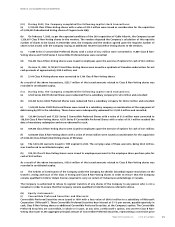

(v) Senior Notes, due 2007:

The Company’s $165.0 million Senior Notes were redeemed on August 6, 2003 at a redemption price of 102.917% of the

aggregate principal amount (note 10(e)).

The Company’s senior notes and debentures described above are senior unsecured general obligations of the

Company ranking equally with each other. Interest is paid semi-annually on all notes and debentures, except for the

Convertible Debentures, due 2005, as described above.

(b) Wireless:

(i) Bank credit facility:

At December 31, 2003, $138.0 million (2002 – $149.0 million) of debt was outstanding under the bank credit facility, which

provides Wireless with, among other things, up to $700.0 million from a consortium of Canadian financial institutions.

Under the credit facility, Wireless may borrow at various rates, including the bank prime rate to the bank prime

rate plus 13/4% per annum, the bankers’ acceptance rate plus 1% to 23/4% per annum and the London Inter-Bank Offered

Rate (“LIBOR”) plus 1% to 23/4% per annum. Wireless’ bank credit facility requires, among other things, that Wireless sat-

isfy certain financial covenants, including the maintenance of certain financial ratios.

Subject to the paragraph below, this credit facility is available on a fully revolving basis until the first date speci-

fied below, at which time, the facility becomes a revolving/reducing facility and the aggregate amount of credit available

under the facility will be reduced as follows:

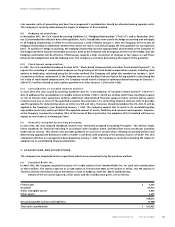

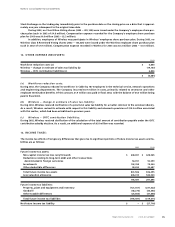

Date of reduction* Reduction at each date

On April 30:

2006 $ 140,000

2007 140,000

2008 420,000

* The bank credit facility will mature on May 31, 2006 if Wireless’ Senior Secured Notes, due 2006 are not repaid (by refinancing or otherwise)

on or prior to December 31, 2005. If these notes are repaid, then the bank credit facility will mature on September 30, 2007 if Wireless’

Senior Secured Notes, due 2007 are not repaid (by refinancing or otherwise) on or prior to April 30, 2007.

The credit facility requires that any additional senior debt (other than the bank credit facility described above) that is

denominated in a foreign currency be hedged against foreign exchange fluctuations on a minimum of 50% of such addi-

tional senior borrowings in excess of the Canadian equivalent of U.S. $25.0 million.

Borrowings under the credit facility are secured by the pledge of a senior bond issued under a deed of trust, which is

secured by substantially all the assets of Wireless and certain of its subsidiaries, subject to certain exceptions and prior liens.

(ii) Senior Secured Notes, due 2006:

Wireless’ $160.0 million Senior Secured Notes mature on June 1, 2006. These notes are redeemable, in whole or in part, at

Wireless’ option, at any time subject to a certain prepayment premium.

(iii) Senior Secured Notes, due 2007:

Wireless’ U.S. $196.1 million Senior Secured Notes mature on October 1, 2007. These notes are redeemable, in whole or in

part, at Wireless’ option, on or after October 1, 2002, at 104.15% of the principal amount, declining ratably to 100% of the

principal amount on or after October 1, 2005, plus, in each case, interest accrued to the redemption date.

(iv) Senior Secured Debentures, due 2008:

Wireless’ U.S. $333.2 million Senior Secured Debentures mature on June 1, 2008. These debentures are redeemable, in whole

or in part, at Wireless’ option, at any time on or after June 1, 2003, at 104.688% of the principal amount, declining ratably to

100% of the principal amount on or after June 1, 2006, plus, in each case, interest accrued to the redemption date.

(v) Senior Secured Notes, due 2011:

Wireless’ U.S. $490.0 million Senior Secured Notes mature on May 1, 2011. During 2002, Wireless repurchased U.S. $10.0 mil-

lion principal amount of these notes (note 10(e)). These notes were redeemable, in whole or in part, at Wireless’ option,

at any time subject to a certain prepayment premium.

(vi) Senior Secured Debentures, due 2016:

Wireless’ U.S. $154.9 million Senior Secured Debentures mature on June 1, 2016. These debentures are redeemable, in

whole or in part, at Wireless’ option, at any time, subject to a certain prepayment premium.

Each of Wireless’ Senior Secured Notes and Debentures described above is secured by the pledge of a senior bond that is

secured by the same security as the security for the bank credit facility described in note 10(b)(i) and ranks equally with

the bank credit facility.