Rogers 2003 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

94

Notes to Consolidated Financial Statements

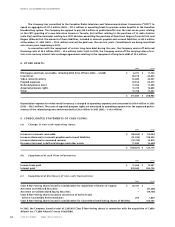

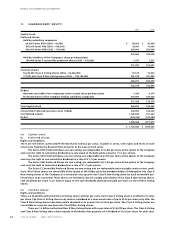

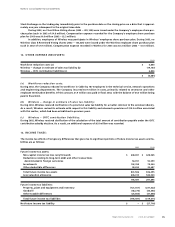

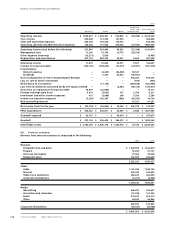

At December 31, 2003, the range of exercise prices, the weighted average exercise price and the weighted average

remaining contractual life are as follows:

Options outstanding Options exercisable

Weighted

average Weighted Weighted

remaining average average

Number contractual exercise Number exercise

Range of exercise prices outstanding life (years) price exercisable price

$11.82 – $16.88 1,158,272 7.6 $ 16.33 436,022 $ 16.02

$18.15 – $22.06 1,891,825 7.5 21.12 1,117,450 21.14

$25.96 – $32.75 588,200 7.8 27.00 149,100 30.07

$37.74 – $51.53 588,800 6.3 46.87 588,800 46.87

4,227,097 7.4 $ 24.22 2,291,372 $ 27.36

There was no compensation expense related to stock options for 2003 or 2002.

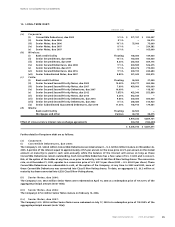

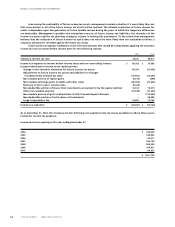

Stock-based compensation:

For stock options granted to employees on or after January 1, 2002, had the Company determined compensation expense

based on the “fair value” method at the grant date of such stock option awards, consistent with the method prescribed

under CICA Handbook Section 3870, the Company’s net income for the year and earnings per share would have been

reported as the pro forma amounts indicated below. The fair value of the options is amortized on a straight-line basis

over the vesting period.

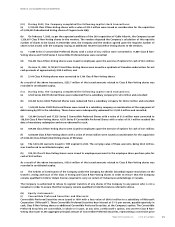

2003 2002

Net income for the year, as reported $ 129,193 $ 312,032

Stock-based compensation expense – RCI (5,323) (441)

Stock-based compensation expense – Wireless (1,073) (185)

Pro forma net income for the year $ 122,797 $ 311,406

Earnings (loss) per share:

Reported earnings for the year $ 0.35 $ 1.05

Effect of stock-based compensation expense (0.03) –

Pro forma basic earnings per share $ 0.32 $ 1.05

Diluted earnings per share, as reported $ 0.34 $ 0.83

Pro forma diluted earnings per share 0.31 0.83

The weighted average estimated fair value at the date of the grant for RCI options granted during 2003 was $10.78 (2002 –

$10.39) per share. The weighted average fair value at the date of grant for Wireless options granted for 2003 was $12.20

(2002 – $8.35) per share. The fair value of each option granted was estimated on the date of the grant using the Black-

Scholes option-pricing model with the following assumptions:

2003 2002

RCI’s risk-free interest rate 4.42% 4.86%

Wireless’ risk-free interest rate 4.50% 4.81%

RCI’s dividend yield 0.21% –

Wireless’ dividend yield ––

Volatility factor of the future expected market price of RCI’s Class B Non-Voting shares 50.20% 48.82%

Volatility factor of the future expected market price of Wireless’ Class B Restricted Voting shares 55.17% 51.95%

Weighted average expected life of the RCI options 6.6 years 5 years

Weighted average expected life of the Wireless options 5.3 years 5 years

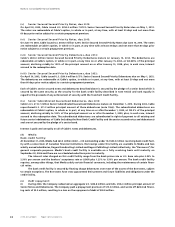

(ii) Employee share purchase plan:

The employee share purchase plan was provided to enable employees of the Company an opportunity to obtain an

equity interest in the Company by permitting them to acquire Class B Non-Voting shares. A total of 1,180,000 Class B Non-

Voting shares were set aside and reserved for allotment and issuance pursuant to the employee share purchase plan.

Under the terms of the employee share purchase plan, participating employees of the Company may have received

a bonus at the end of the term of the plan. The bonus is calculated as the difference between the share price at the date

the employee received the loan and the lesser of 85% of the closing price at which the shares traded on The Toronto