Rogers 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

30

Amortization increased as a result of the increased amortization related to the AT&T brand licence, which provided

Wireless with, among other things, the right to use the AT&T brand name. During 2003, Wireless announced that it would

terminate its brand licence agreement in early 2004 and change its brand name to exclude the AT&T brand. Consequently,

the Company accelerated the amortization of the brand licence to reduce the carrying value to nil.

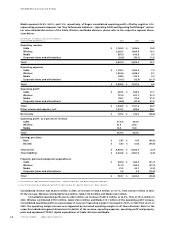

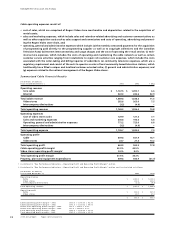

Operating Income Reconciliation Under GAAP

Operating income as defined under Canadian GAAP increased to $408.6 million in 2003, an increase of $242.0 million or

145.3% from the $166.6 million earned in 2002. The items to reconcile operating income to net income are as follows:

Interest Expense

Interest expense in 2003 was $488.9 million, a decrease of $2.4 million, or 0.5%, from $491.3 million in 2002. Reduced debt at RCI

was the primary reason for the decrease in interest expense year-over-year. The reduction in debt levels is directly related

to the impact of the change in foreign exchange related to the improvement in the Canadian dollar versus the U.S. dollar.

Losses from Investments Accounted for by the Equity Method

The Company records losses and income from investments that it does not control, but over which it is able to exercise sig-

nificant influence, by the equity method. The equity loss for 2003 and 2002 was $54.0 million and $100.6 million, respectively.

The equity loss consists of the Blue Jays’ loss of $56.5 million in 2003 and $101.7 million in 2002, offset by invest-

ments with equity income of $2.5 million in 2003 and $1.1 million in 2002 related to other equity investments.

In 2003 and 2002, the Company advanced $29.4 million and $40.6 million of cash, respectively, to the Blue Jays to

fund the Blue Jays’ cash deficit. In 2000, Rogers purchased an 80% interest in the Blue Jays for cash of $163.9 million from

Labatt Brewing Company Limited, a subsidiary of Interbrew Breweries S.A. (“Interbrew”). Rogers had the option to

acquire the 20% minority interest in the Blue Jays at any time after December 15, 2003. In January 2004, the Company con-

cluded the purchase from Interbrew of Interbrew’s remaining 20% minority ownership of the Blue Jays for approximately

$39.1 million pursuant to the agreement.

As the result of an April 2001 agreement with Rogers Telecommunications Ltd. (“RTL”), a company controlled by

the controlling shareholder of Rogers, RTL acquired voting control of the Blue Jays. The Company currently accounts for

this investment using the equity method and records 100% of the operating losses of the Blue Jays. The agreement with

RTL did not change as a result of the Company’s purchase of Interbrew’s 20% minority interest, and, accordingly, Rogers

expects to continue to account for this investment using the equity method.

The Blue Jays are expected to generate lower operating losses in 2004 than in 2003, reflecting efficiencies in its

operations and the benefit of the strengthened Canadian dollar. In 2004, cash funding by the Company to the Blue Jays is

expected to be approximately $20 million to $25 million.

At the time of purchase RCI agreed with Major League Baseball that it will: (i) perform or cause the Toronto Blue

Jays Baseball Club (the “Club”) to perform all of the terms imposed by Major League Baseball acting under the scope of its

authority; (ii) perform or cause the Club to perform all duties and obligations of the Club under the governing documents

of Major League Baseball and under those agreements to which Major League Baseball entities are parties; and

(iii) assume and perform or cause the Club to perform all liabilities and obligations of the Club asserted by any party

against any Major League Baseball entity.

If E.S. Rogers is unable to exercise control over the Blue Jays and Major League Baseball (“MLB”) determines that a

sale or transfer of a control interest in the Blue Jays has occurred, then MLB is entitled to take such action as it consider

necessary in accordance with its guidelines, rules and regulations.

Foreign Exchange Gain

The Canadian dollar continued to strengthen in relation to the U.S. dollar in 2003, continuing the trend experienced in

2002. Accordingly, the Company recorded a foreign exchange gain of $303.7 million in 2003, compared to $6.2 million in

2002, related to both realized and unrealized foreign exchange gains, the largest portion of which arose from the transla-

tion of the unhedged portion of U.S. dollar-denominated long-term debt.

Gain (loss) on Repayment of Long-Term Debt

During 2003, the Company redeemed an aggregate U.S.$334.8 million and $165.0 million principal amount of its Senior

Notes and Debentures. The Company paid a prepayment premium of $19.3 million, and wrote off related deferred financ-

ing costs of $5.5 million, resulting in a loss on the repayment of debt of $24.8 million.

During 2002, the Company repurchased or redeemed in aggregate U.S.$326.1 million principal amount of debt and

terminated U.S.$796.1 million notional amount of swaps for cash proceeds of $225.2 million. As a result of these transac-

tions, the Company recorded a net gain of $10.1 million and a deferred gain of $22.5 million on the termination of certain

of the swaps.

Gains (loss) on the Sale of Investments

During 2003, the Company recorded a gain on the sale of investments of $17.9 million compared to a loss on the sale of

investments of $0.6 million in 2002. The gain on the sale of investments in 2003 related primarily to the sale of shares of

various publicly traded companies that had been held by the Company for investment purposes.

Management’s Discussion and Analysis