Rogers 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

48

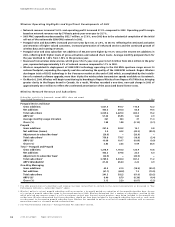

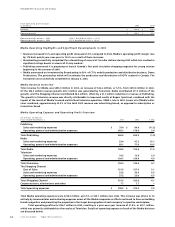

Average monthly operating expense per subscriber, excluding sales and marketing expenses and equipment cost

of sales, decreased $0.94, or 5.2%, to $17.22 in 2003, compared to $18.16 in 2002. This year-over-year reduction reflects

scale economies from the larger subscriber base, roaming cost reductions, and improved efficiencies in call centre and

network maintenance operations offset by increased costs related to customer retention.

At December 31, 2003, Wireless, as a result of its sales and retention strategies, had approximately 67% of its post-

paid wireless voice and data subscriber base under contracts with an initial term of greater than 12 months, up from 61%

at December 31, 2002.

Wireless Sales and Marketing Expenses

The 12.9% year-over-year increase in total sales and marketing expenses was due to higher variable acquisition costs

associated with the 12.2% year-over-year increase in the number of postpaid voice and data gross additions. In addition,

variable sales and marketing expenses increased in line with Wireless’ strategy to attract higher value business customers

and customers on longer term contracts. Wireless also invested more in advertising and promotion on a year-over-year

basis as it emphasized the value proposition related to data and other product offerings. Sales and marketing costs per

wireless subscriber gross addition were $397, an increase of $13, or 3.4%, from $384 in 2002 attributable to increases in

equipment subsidies required to match competitive offers.

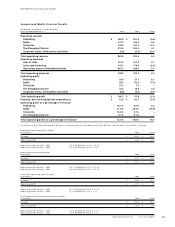

Wireless Operating Profit

Revenue increased at a faster rate than expenses, resulting in operating profit growth of $199.9 million, or 37.9%, to

$727.6 million in 2003 from $527.7 million in 2002. Operating profit as a percentage of network revenue, or operating

profit margin, improved in 2003 to 35.7% from 30.3% in 2002.

Wireless PP&E Expenditures

PP&E expenditures totaled $411.9 million in 2003, a decrease of $152.7 million, or 27.0%, from $564.6 million in 2002.

Network related PP&E expenditures of $338.2 million included $251.3 million for capacity expansion of the GSM/GPRS net-

work and transmission infrastructure and $66.1 million for expanded coverage as well as construction of new sites for

improved coverage in existing service areas. Wireless has continued to construct the infrastructure necessary for

enhanced digital coverage and lower cost incremental capacity by adding channels on existing sites. The cost to complete

the deployment of GSM/GPRS equipment in the 850 MHz frequency band that was initiated during the fourth quarter of

2002 and completed in late 2003 is included in the network capacity expansion costs above. The remaining balance of

$20.8 million in network PP&E expenditures related primarily to technical upgrade projects, the operational support sys-

tems, and the addition of new services. Other PP&E expenditures consisted of $51.1 million for information technology

initiatives, $8.7 million for the completion of the expansion of Wireless’ headquarters facilities, and $13.9 million for call

centres and other facilities and equipment.

Wireless Employees

Remuneration represents a material portion of Wireless’ expenses. Wireless ended 2003 with approximately 2,360 full-

time equivalent employees, an increase of 40 from 2,320 at December 31, 2002. The increase in staff was primarily

concentrated in the areas of sales and marketing as Wireless focused its subscriber acquisition programs and service and

retention efforts on customer segments that would yield greater value to Wireless.

Total remuneration paid to Wireless employees (both full and part-time) in 2003 was approximately $164.2 million,

an increase of $5.3 million or 3.3% from $158.9 million in the prior year.

WIRELESS RISKS AND UNCERTAINTIES

Wireless’ business is subject to several operating risks and uncertainties that could result in a material adverse effect on

its business and financial results as outlined below.

Risk of Insufficient Future Demand for Advanced Services

It is expected that a substantial portion of future revenue growth will be achieved from new and advanced wireless voice

and data transmission services. Accordingly and as discussed above, Wireless has invested and continues to invest signif-

icant capital resources in the development of its GSM/GPRS network in order to offer these services, and also intends to

invest in capital resources in the deployment of EDGE technology across its GSM/GPRS network. However, consumers may

not provide sufficient demand for these advanced wireless services. Alternatively, Rogers Wireless may fail to anticipate

demand for certain products and services, or may not be able to offer or market these new products and services success-

fully to subscribers. Rogers Wireless’ failure to attract subscribers to new products and services, or failure to keep pace

with changing consumer preferences for wireless services, would slow revenue growth and have a material adverse

effect on Wireless’ business and financial condition.

Management’s Discussion and Analysis