Rogers 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 89

Notes to Consolidated Financial Statements

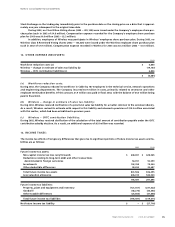

(ii) During 2002, an aggregate U.S. $796.1 million notional amount of cross-currency and interest rate exchange agree-

ments were terminated either by unwinding or maturity, resulting in aggregate net cash proceeds of $225.2 million.

A portion of these proceeds was used to repay or redeem a total of U.S. $326.1 million principal amount of Senior Notes

and Debentures. The Company paid a prepayment premium of $21.8 million, recorded a gain on the unwinding of cross-

currency and interest rate exchange agreements of $4.2 million, recorded a gain on the repurchase of debt of $30.7 million

and wrote off deferred financing costs of $3.0 million, resulting in a net gain on the repayment of debt of $10.1 million.

In addition, the Company has deferred a gain of $22.5 million related to the unwinding of cross-currency exchange agree-

ments, which is being amortized to interest expense over the remaining life of the related debt. Amortization in 2003 was

$2.6 million (2002 – $0.7 million).

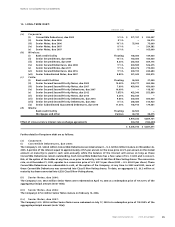

(f) Interest exchange agreements:

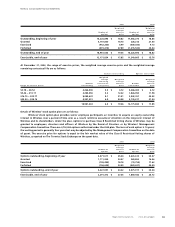

(i) At December 31, 2003, total U.S. dollar-denominated long-term debt amounted to U.S. $2,868.3 million (2002 –

U.S. $2,845.9 million). The Company has entered into several cross-currency interest rate exchange agreements and for-

ward foreign exchange contracts in order to reduce the Company’s exposure to changes in the exchange rate of the U.S.

dollar as compared to the Canadian dollar. At December 31, 2003, U.S. $1,943.4 million (2002 – U.S. $1,768.4 million) or

67.8% (2002 – 62.1%) is hedged through cross-currency interest rate exchange agreements at an average exchange rate of

Cdn. $1.4647 (2002 – $1.4766) to U.S. $1.00.

(ii) The cross-currency interest rate exchange agreements have the effect of: converting the interest rate on

U.S. $1,558.4 million (2002 – U.S. $1,383.4 million) of long-term debt from an average U.S. dollar fixed interest rate of 8.82%

(2002 – 9.15%) per annum to an average Canadian dollar fixed interest rate of 9.70% (2002 – 9.94%) per annum on

$2,346.0 million (2002 – $2,110.7 million); and converting the interest rate on U.S. $385.0 million of long-term debt from an

average U.S. dollar fixed interest rate of 9.38% per annum to an average Canadian dollar floating interest rate equal to

the bankers’ acceptance rate plus 2.35% per annum, which totalled 5.11% (2002 – 5.22%) on $500.5 million at December 31,

2003. The Company assumed an interest rate exchange agreement upon completion of an acquisition during 2001. This

interest rate exchange agreement has the effect of converting $30.0 million of floating rate obligations of the Company

to a fixed interest rate of 7.72% per annum. The total long-term debt at fixed interest rates at December 31, 2003 was

$4,560.6 million (2002 – $5,024.2 million) or 86.0% (2002 – 88.3%) of total long-term debt.

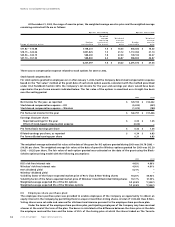

The Company’s effective weighted average interest rate on all long-term debt as at December 31, 2003, including

the effect of the interest exchange agreements and cross-currency interest rate exchange agreements, was 8.48% (2002 –

8.74%).

The obligations under U.S. $1,943.4 million (2002 – $1,768.4 million) of the cross-currency interest rate exchange

agreements are secured by substantially all of the assets of the respective subsidiary companies to which they relate and

generally rank equally with the other secured indebtedness of such subsidiary companies.

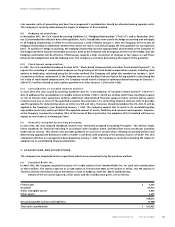

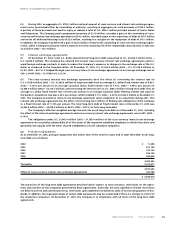

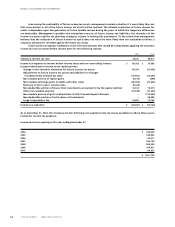

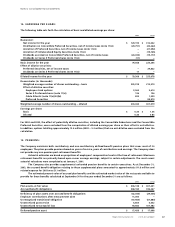

(g) Principal repayments:

As at December 31, 2003, principal repayments due within each of the next five years and in total thereafter on all long-

term debt are as follows:

2004 $ 11,498

2005 651,140

2006 323,125

2007 936,190

2008 568,608

2,490,561

Thereafter 2,479,671

4,970,232

Effect of cross-currency interest rate exchange agreements 334,784

$ 5,305,016

The provisions of the long-term debt agreements described above impose, in most instances, restrictions on the opera-

tions and activities of the companies governed by these agreements. Generally, the most significant of these restrictions

are debt incurrence and maintenance tests, restrictions upon additional investments, sales of assets and payment of divi-

dends. In addition, the repayment dates of certain debt agreements may be accelerated if there is a change in control of

the respective companies. At December 31, 2003, the Company is in compliance with all terms of the long-term debt

agreements.