Rogers 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 61

only and are designated to hedge specific debt instruments. In order to minimize the risk of counterparty default under

these agreements, Rogers assesses the creditworthiness of its counterparties. At December 31, 2003, all of Rogers’ coun-

terparties in these agreements are financial institutions with a Standard & Poor’s rating (or other equivalent) ranging

from A+ to AA.

The incurrence of U.S. dollar-denominated debt has caused substantial foreign exchange exposure as Rogers’ oper-

ating cash flow is almost exclusively denominated in Canadian dollars. Rogers has established a target of hedging at least

50% of its foreign exchange exposure through the use of hedging instruments outlined above. At December 31, 2003 and

2002, Rogers had U.S. dollar-denominated long-term debt of US$2,868.3 million and US$2,845.9 million, respectively.

At December 31, 2003 and 2002, US$1,943.4 million and US$1,768.4 million, respectively, or 67.8% and 62.1%, respectively,

was hedged with cross-currency interest rate exchange agreements at an average exchange rate of C$1.4647 and

C$1.4766, respectively to U.S.$1.00. The increase in Rogers’ hedged position in 2003 was due to the repayment of U.S. dollar-

denominated debt during 2003, as discussed above. The decrease in the average exchange rate to $1.4647 in 2003 was due

to entering into a new swap in Cable in the notional amount of US$175.0 million at an exchange rate of $1.3445 concur-

rent with the incurrence of U.S. dollar-denominated debt and US$350 million debt issue at Cable.

Management will continue to monitor its hedged position with respect to foreign exchange fluctuations and,

depending upon market conditions and other factors, may adjust its hedged position with respect to foreign exchange

fluctuations in the future by unwinding certain existing hedges or by entering into cross-currency interest rate exchange

agreements or by using other hedging instruments.

The cross-currency interest rate exchange agreements had the effect at December 31, 2003 of converting the inter-

est rate on US$1,558.4 million of long-term debt from an average U.S. dollar fixed interest rate of 8.82% per annum to an

average Canadian dollar fixed interest rate of 9.70% per annum on $2,346.0 million, compared with the 2002 effect of con-

verting US$1,383.4 million of long-term debt from an average U.S. dollar fixed interest rate of 9.15% per annum to an

average Canadian dollar fixed interest rate of 9.94% per annum on $2,110.7 million; and converting the interest rate on

U.S.$385.0 million of long-term debt from an average U.S. dollar fixed interest rate of 9.38% per annum to $500.5 million at

a weighted average floating interest rate equal to the bankers’ acceptances rate plus 2.35% per annum, which totalled

5.11% at December 31, 2003, as compared with 5.22% in 2002. The Company also assumed an interest rate exchange

agreement upon an acquisition during 2001. This interest rate exchange agreement has the effect of converting $30.0 mil-

lion of floating rate obligations of the Company to a fixed interest rate of 7.72% per annum.

The total long-term debt at fixed interest rates at December 31, 2003 and 2002, was $4,560.6 million and $5,024.2 mil-

lion, respectively, or 86.0% and 88.3%, respectively, of total long-term debt. Historically, Rogers has targeted to maintain

fixed interest rates on at least 80% of its outstanding long-term debt.

Rogers’ effective weighted average interest rate on all long-term debt as at December 31, 2003 and 2002, including

the effect of the interest exchange agreements and cross-currency interest rate exchange agreements, was 8.48% and

8.74%, respectively.

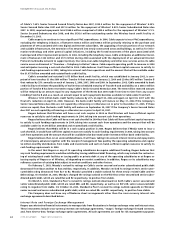

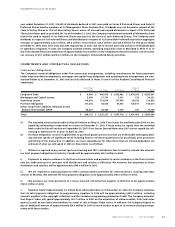

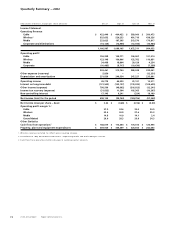

The following table presents a summary of the effect of changes in the foreign exchange rate on the unhedged

portion of Rogers’ U.S. dollar-denominated debt and the resulting change in the principal carrying amount of debt, inter-

est expense and earnings per share, based on a full year impact.

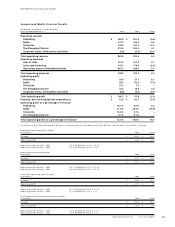

Change in Change in

debt principal interest Earnings

amounts expense per

Change in Cdn$ vs. US$1($ millions) ($ millions) share2

$0.01 $ 9.2 $ 0.6 $ 0.042

0.03 27.7 1.8 0.127

0.05 46.2 3.0 0.211

$0.10 $ 92.5 $ 6.1 $ 0.422

1 Canadian equivalent of unhedged U.S. dollar-denominated debt if U.S. dollar costs an additional Canadian cent.

2 Assumes no income tax effect. Based on the number of shares outstanding as at December 31, 2003.

At December 31, 2003, interest expense would have increased by $7.4 million per year if there was a 1% increase in the

interest rate on the portion of long-term debt that is not at fixed interest rates.

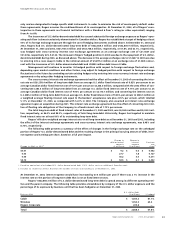

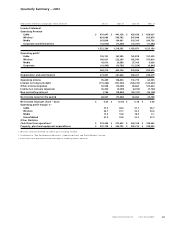

Rogers’ US$2,868.3 million of U.S. dollar-denominated long-term debt is spread among its different operating enti-

ties and the parent company. The following table provides a breakdown by company of the U.S. dollar exposure and the

percentage of its exposure by business unit that has been hedged as at December 31, 2003.

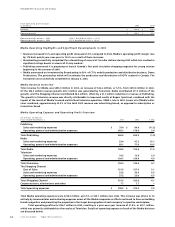

U.S. dollar Debt

Business Unit ($ millions) % hedged

Cable $ 1,305.2 81.1%

Wireless 1,353.3 65.4

Rogers Corporate 209.8 –

Total $ 2,868.3 67.8%

Management’s Discussion and Analysis