Rogers 2003 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 103

Notes to Consolidated Financial Statements

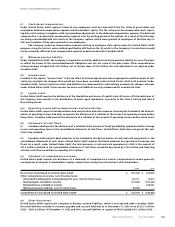

21. CONTINGENT LIABILITIES:

(a) There exist certain claims and potential claims against the Company, none of which is expected to have a material

adverse effect on the consolidated financial position of the Company.

(b) The Company requires access to support structures and municipal rights of way in order to deploy facilities. In a

2003 decision, the Supreme Court of Canada determined that the CRTC does not have the jurisdiction to establish the

terms and conditions of access to the poles of hydroelectric companies. As a result of this decision, the costs of obtaining

access to the poles of hydroelectric companies could be substantially increased on a prospective basis and, for certain

arrangements, on a retroactive basis. The Company, together with other Ontario cable companies, has applied to the

Ontario Energy Board to request that it assert jurisdiction over the fees paid by such companies to hydroelectric distribu-

tors. The amount of this contingency is presently not determinable.

22. CANADIAN AND UNITED STATES ACCOUNTING POLICY DIFFERENCES:

The consolidated financial statements of the Company have been prepared in accordance with GAAP as applied in

Canada. In the following respects, GAAP as applied in the United States differs from that applied in Canada.

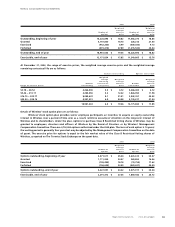

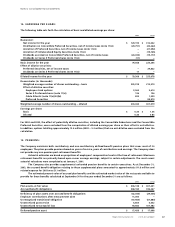

If United States GAAP were employed, the net income in each year would be adjusted as follows:

2003 2002

Net income for the year based on Canadian GAAP $ 129,193 $ 312,032

Gain on sale of cable systems (b) (4,028) (4,028)

Pre-operating costs (c) 11,150 12,580

Interest on equity instruments (d) (35,388) (92,372)

Capitalized interest (e) 5,405 7,837

Financial instruments (h) (217,514) 125,963

Stock-based compensation (i) (1,150) (1,892)

Other 516 9,872

Non-controlling interest 43,173 (42,508)

Income taxes (k) 11,493 22,394

Net income (loss) based on United States GAAP $ (57,150) $ 349,878

Basic earnings (loss) per share based on United States GAAP $ (0.25) $ 1.64

Diluted earnings (loss) per share based on United States GAAP (0.25) 1.23

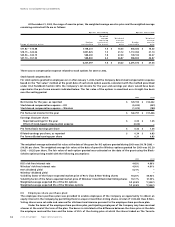

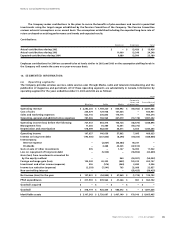

The cumulative effect of these adjustments on the consolidated shareholders’ equity of the Company is as follows:

2003 2002

Shareholders’ equity based on Canadian GAAP $ 1,767,380 $ 1,404,035

Gain on sale and issuance of subsidiary shares to non-controlling interest (a) 46,245 46,245

Gain on sale of cable systems (b) 124,965 128,993

Pre-operating costs (c) (8,854) (20,004)

Equity instruments (d) (586,410) (584,022)

Capitalized interest (e) 37,986 32,581

Unrealized holding gain on investments (f) 78,596 17,611

Acquisition of Cable Atlantic (g) 34,673 34,673

Financial instruments (h) (59,593) 157,921

Stock-based compensation (i) 661 1,173

Minimum pension liability (j) (7,858) –

Other (17,701) (18,217)

Income taxes (k) (253,567) (253,567)

Non-controlling interest effect of adjustments (58,401) (101,574)

Shareholders’ equity based on United States GAAP $ 1,098,122 $ 845,848

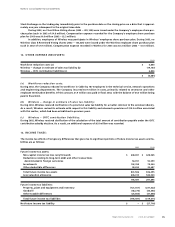

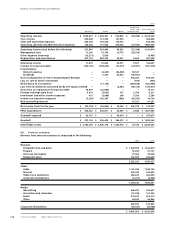

The areas of material difference between Canadian and United States GAAP and their impact on the consolidated finan-

cial statements of the Company are described below:

(a) Gain on sale and issuance of subsidiary shares to non-controlling interest:

Under United States GAAP, the carrying value of the Company’s investment in Wireless would be lower than the carrying

value under Canadian GAAP as a result of certain differences between Canadian and United States GAAP, as described

herein. This results in an increase to the gain on sale and dilution under United States GAAP.