Rogers 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

82

Notes to Consolidated Financial Statements

2003. On January 5, 2004, the Company acquired the 20% minority interest for approximately $39.1 million. This obligation

has been recorded as a liability by the Company. The 20% minority interest owner of the Blue Jays is not required to fund

operating losses of the Blue Jays and, as a result, as required under GAAP, the Company has recorded 100% of the operat-

ing losses of the Blue Jays since acquisition.

Effective April 1, 2001, Rogers Telecommunications Ltd. (“RTL”), a company controlled by the controlling share-

holder of the Company, acquired the Class A Preferred Shares of the subsidiary of RCI that owns the Blue Jays (“Blue Jays

Holdco”) for $30.0 million. These Class A Preferred Shares are voting, redeemable for cash of $30.0 million plus any accrued

unpaid dividends at the option of Blue Jays Holdco at any time after September 14, 2004. Any such redemption requires

the consent of a committee of the board of Blue Jays Holdco, comprising directors that are not related to RTL, RTL’s affili-

ates or its controlling shareholder and requires the prior written consent of the Board of Directors of the Company. These

Class A Preferred Shares may be acquired by the Company at its option at any time. The Class A Preferred Shares pay

cumulative dividends at a rate of 9.167% per annum. For periods up to July 31, 2004, Blue Jays Holdco may satisfy the

cumulative dividends on its Class A Preferred Shares in kind by transferring to RTL income tax loss carryforwards, having

an agreed value equal to the amount of the dividends. Until July 2004, such agreed value is equal to 10% of the amount of

the tax losses. During 2003, Blue Jays Holdco satisfied the dividend by transferring income tax loss carryforwards to RTL

of approximately $24.0 million (2002 – $27.0 million) with an agreed upon value of $2.4 million (2002 – $2.7 million).

As a result of the issuance of the Class A Preferred Shares of Blue Jays Holdco to RTL, the Company does not con-

trol the Blue Jays. Accordingly, effective April 1, 2001, the Company accounts for its investment in Blue Jays Holdco by the

equity method.

RCI agreed at the time of purchase with Major League Baseball that it will: (i) perform or cause the Toronto Blue

Jays Baseball Club (the “Club”) to perform all of the terms imposed by Major League Baseball acting under the scope of its

authority; (ii) perform or cause the Club to perform all duties and obligations of the Club under the governing documents

of Major League Baseball and under those agreements to which Major League Baseball entities are parties; and

(iii) assume and perform or cause the Club to perform all liabilities and obligations of the Club asserted by any party

against any Major League Baseball entity.

If E.S. Rogers is unable to exercise control over the Blue Jays and Major League Baseball (“MLB”) determines that a

sale or transfer of a control interest in the Blue Jays has occurred, then MLB is entitled to take such action as it considers

necessary in accordance with its guidelines, rules and regulations.

The change in the investment in Blue Jays Holdco is the result of cash contributions of $29.4 million (2002 –

$40.6 million) offset by the equity losses of $56.5 million (2002 – $101.7 million).

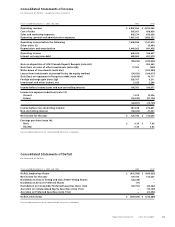

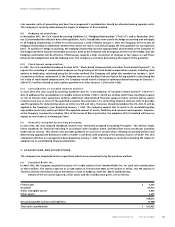

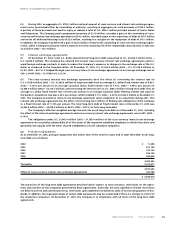

Condensed consolidated financial information of Blue Jays Holdco is presented below:

2003 2002

Assets

Cash and accounts receivable $ 11,942 $ 18,897

Deferred compensation 22,061 26,961

Goodwill 95,509 95,509

Player contracts 32,530 67,458

Other assets 26,504 25,944

$ 188,546 $ 234,769

Liabilities and Shareholders’ Equity

Accounts payable and accrued liabilities $ 31,234 $ 43,471

Deferred obligations 37,609 44,892

68,843 88,363

Shareholders’ equity 119,703 146,406

$ 188,546 $ 234,769

Revenue $ 133,510 $ 131,682

Operating expenses (152,599) (186,088)

(19,089) (54,406)

Depreciation and amortization (36,270) (41,615)

Interest expense (1,143) (1,272)

Write-down of investments – (4,449)

Loss for the year $ (56,502) $ (101,742)

(b) Cogeco Cable Inc.:

In March 2003, the Company entered into agreements to purchase 3.0 million Subordinate Voting shares of Cogeco Cable

Inc. (“Cogeco”) in exchange for 2.7 million Class B Non-Voting shares of the Company from a group of investors unaffiliated