Rogers 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

60

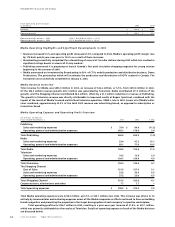

of Cable’s 7.60% Senior Secured Second Priority Notes due 2007, $253.5 million for the repayment of Wireless’ 8.30%

Senior Secured Notes due 2007 and $231.4 million for the repayment of Wireless’ 8.80% Senior Subordinated Notes due

2007. In 2008, required repayments total $568.6 million comprised of $430.6 million for the repayment of Wireless’ 93/8%

Senior Secured Debentures due 2008, and the $138.0 million outstanding under the Wireless bank credit facility at

December 31, 2003.

Cable expects to continue to incur significant PP&E expenditures. In 2004, Cable expects to incur PP&E expenditures,

excluding the telephony initiative, of between $440.0 million and $465.0 million primarily relating to the purchase and

placement of CPE associated with new digital and Internet subscribers, the upgrading of certain portions of our network

and scalable infrastructure, the extension of its network into newly constructed areas and buildings, as well as for infor-

mation technology and other general capital initiatives, including the forced movement of the plant associated with

municipal and other improvement projects. In 2004, including the telephony issue, Cable anticipates an additional invest-

ment of between $140 million and $170 million during 2004 associated with the deployment of an advanced Internet

Protocol multimedia network to support primary line voice-over-cable telephony and other new services across its cable

service areas as discussed in “Overview – Telephony Initiative” above. Cable expects operating profit to increase in 2004

and anticipates incurring a net cash shortfall in 2004. Cable believes it will have sufficient capital resources to satisfy its

cash funding requirements in 2004, taking into account cash from operations and the amount that will be available under

the $1.075 billion amended and restated bank credit facility.

Cable’s amended and restated $1.075 billion bank credit facility, which was established in January 2002, is com-

prised of two tranches (1) the $600 million Tranche A that matures on January 2, 2009 and (2) the $475 million Tranche B

that reduces by 25% annually on each of January 2, 2006, 2007, 2008 and 2009. In September, 2003, Cable amended its bank

credit facility to eliminate the possibility of earlier than scheduled maturity of Tranche B and availability on a $400.0 million

portion of Tranche B has been reserved to repay Cable’s Senior Secured Notes due 2005. The $400 million reserved amount

will be reduced by an amount equal to any repayment of the Notes due 2005 made from time to time from any source

including Tranche B and, as a result, an amount equal to such repayments becomes available to Cable under Tranche B.

Wireless’ $700 million bank credit facility reduces by 20% on April 30, 2006 and again on April 30, 2007 with the

final 60% reduction on April 30, 2008. However, the bank credit facility will mature on May 31, 2006 if the Company’s

Senior Secured Notes due 2006 are not repaid (by refinancing or otherwise) on or prior to December 31, 2005. If these

notes are repaid, then the bank credit facility will mature on September 30, 2007 if the Company’s Senior Secured Notes

due 2007 are not repaid (by refinancing or otherwise) on or prior to April 30, 2007.

Rogers believes that Wireless will have a net cash surplus in 2004 so that Wireless will have sufficient capital

resources to satisfy its cash funding requirements in 2004, taking into account cash from operations.

Rogers believes that Cable will have a net cash shortfall in 2004 but that Cable will have sufficient capital resources

to satisfy its cash funding requirements in 2004, taking into account cash from operations and the amount that will be

available under its $1.075 billion amended and restated bank credit facility.

Rogers believes that Media will be in a cash surplus position in 2004. Rogers believes that if Media were to incur a

cash shortfall, it would have sufficient capital resources to satisfy its cash funding requirements in 2004, taking into account

cash from operations and the amount that will be available to be borrowed under its $500.0 million bank credit facility.

Rogers believes that, on an unconsolidated basis, it will have, taking into account interest income and repayments

of intercompany advances together with the receipt of management fees paid by the operating subsidiaries and regular

$6 million monthly distributions from Cable and investments and cash on hand, sufficient capital resources to satisfy its

cash funding requirements in 2004.

In the event that Rogers or any of its operating subsidiaries do require additional funding, Rogers believes that

any such funding requirements would be satisfied by issuing additional debt financing, which may include the restructur-

ing of existing bank credit facilities or issuing public or private debt at any of the operating subsidiaries or at Rogers or

issuing equity of Rogers or of Wireless, all depending on market conditions. In addition, Rogers or its subsidiaries may

refinance a portion of existing debt subject to market conditions and other factors.

On February 7, 2003, Moody’s revised its ratings on Cable’s senior secured and senior subordinated public debt

downward from Baa3 and Ba1 to Ba2 and Ba3, respectively. In addition, Moody’s revised its ratings on RCI’s senior unse-

cured debt rating downward from Ba1 to B2. Moody’s provided a stable outlook for these newly revised Cable and RCI

debt ratings. On October 24, 2003, Moody’s changed the ratings outlook on the Wireless senior secured and senior subor-

dinated public debt, which are rated Ba3 and B2 respectively, to positive from stable.

On March 5, 2003, Standard & Poor’s revised its ratings outlook downward on both Cable’s senior secured and

senior subordinated public debt, which are rated BBB- and BB- respectively, as well as on RCI’s BB- senior unsecured debt

rating to negative from stable. On October 30, 2003, Standard & Poor’s revised its ratings outlook upwards on Wireless’

senior secured and senior subordinated public debt, which are rated BB+ and BB- respectively, to positive from stable.

The Company does not have any off-balance sheet arrangements other than the cross-currency interest rate

exchange agreements described below.

Interest Rate and Foreign Exchange Management

Rogers uses derivative financial instruments to manage risks from fluctuations in foreign exchange rates and interest rates.

These instruments include cross-currency interest rate exchange agreements, “swaps”, foreign exchange forward contracts,

and, from time-to-time, foreign exchange option agreements. All such agreements are used for risk management purposes

Management’s Discussion and Analysis