Rogers 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 105

Notes to Consolidated Financial Statements

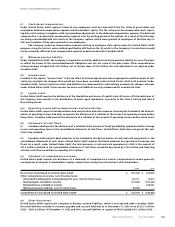

(i) Stock-based compensation:

Under United States GAAP, options issued to non-employees must be measured at the fair value at grant dates and

recorded as deferred compensation expense and shareholders’ equity. The fair value must be remeasured at each report-

ing date until vesting is complete, with corresponding adjustments to the deferred compensation expense. The deferred

compensation is recognized as compensation expense over the vesting period of the options. As a result of the Blue Jays

not being consolidated with the results of the Company, options which were granted to employees of the Blue Jays in

2001 are treated as if they were granted to non-employees.

The Company measures compensation expense relating to employee stock option plans for United States GAAP

purposes using the intrinsic value method specified by APB Opinion No. 25, which in the Company’s circumstances would

not be materially different from compensation expense as determined under Canadian GAAP.

(j) Minimum pension liability:

Under United States GAAP, the Company is required to record an additional minimum pension liability for one of its plans

to reflect the excess of the accumulated benefit obligation over the fair value of the plan assets. Other comprehensive

income has been charged with $5.0 million, net of income taxes of $2.9 million. No such adjustments are required under

Canadian GAAP.

(k) Income taxes:

Included in the caption “Income taxes” is the tax effect of various adjustments where appropriate and the impact of sub-

stantively enacted rate changes that would not have been recorded under United States GAAP until enacted. Under

Canadian GAAP, future income tax assets and liabilities are remeasured for substantively enacted rate changes, whereas

under United States GAAP, future income tax assets and liabilities are only remeasured for enacted tax rates.

(l) Capital stock:

United States GAAP requires the disclosure of the liquidation preference of capital stock. All series of Preferred shares of

the Company share equally in the distribution of assets upon liquidation, in priority to the Class A Voting and Class B

Non-Voting shares.

(m) Operating income before depreciation and amortization:

United States GAAP requires that depreciation and amortization and other expense (recovery) be included in the determi-

nation of operating income and does not permit the disclosure of a subtotal of the amount of operating income before

these items. Canadian GAAP permits the disclosure of a subtotal of the amount of operating income before these items.

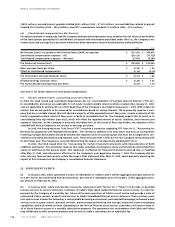

(n) Statements of cash flows:

(i) Canadian GAAP permits the disclosure of a subtotal of the amount of funds provided by operations before change

in non-cash operating items in the consolidated statements of cash flows. United States GAAP does not permit this sub-

total to be included.

(ii) Canadian GAAP permits bank advances to be included in the determination of cash and cash equivalents in the

consolidated statements of cash flows. United States GAAP requires that bank advances be reported as financing cash

flows. As a result, under United States GAAP, the total decrease in cash and cash equivalents in 2003 in the amount of

$37.2 million reflected in the consolidated statements of cash flows would be decreased by $10.3 million and financing

activities cash flows would be increased by $10.3 million.

(o) Statement of comprehensive income:

United States GAAP requires the disclosure of a statement of comprehensive income. Comprehensive income generally

encompasses all changes in shareholders’ equity, except those arising from transactions with shareholders.

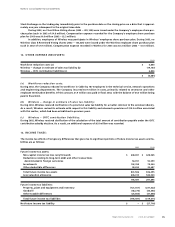

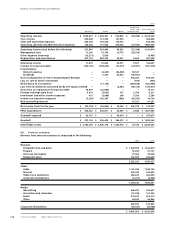

2003 2002

Net income (loss) based on United States GAAP $ (57,150) $ 349,878

Other comprehensive income, net of income taxes:

Unrealized holding gains arising during the year, net of income taxes 67,727 17,611

Realized gains included in income (17,902) (747,231)

Realized losses included in income – 238,921

Minimum pension liability, net of income taxes (4,982) –

Comprehensive loss based on United States GAAP $ (12,307) $ (140,821)

(p) Other disclosures:

United States GAAP requires the Company to disclose accrued liabilities, which is not required under Canadian GAAP.

Accrued liabilities included in accounts payable and accrued liabilities as at December 31, 2003 were $1,072.7 million

(2002 – $850.2 million). At December 31, 2003 and 2002, accrued liabilities in respect of PP&E totalled $90.3 million (2002 –