Rogers 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

92

Notes to Consolidated Financial Statements

of $35 per Class B Non-Voting share. The Convertible Preferred Securities mature on August 11, 2009, and are callable by

the Company on or after August 11, 2004, subject to certain conditions. The Company has the option of repaying the

Convertible Preferred Securities in cash or Class B Non-Voting shares.

As part of the transaction to issue the Convertible Preferred Securities, the Company issued 5,333,333 warrants to

Microsoft, each exercisable into one Class B Non-Voting share. These warrants expired on August 11, 2002.

The Company received cash proceeds of $600.0 million for the issue of the Convertible Preferred Securities and

warrants, which were allocated to Convertible Preferred Securities, including the conversion feature, in the amount of

$576.0 million and the warrants in the amount of $24.0 million. Upon expiration of the warrants in 2002, $24.0 million was

transferred to contributed surplus. Interest on the Convertible Preferred Securities is recorded for accounting purposes as

a charge to the consolidated statements of deficit, similar to a dividend.

(ii) Preferred Securities:

On August 10, 2000, the Company issued $1,154.4 million principal amount of Preferred Securities due June 30, 2003, with

an interest rate of 7.27% per annum, compounded quarterly. The Preferred Securities could have been settled, in whole

or in part, at the Company’s option, with Class B Non-Voting shares, the number of which was based on the daily average

trading prices of the Class B Non-Voting shares. Interest of approximately $216.9 million to June 30, 2003 was prepaid,

with the Company receiving net proceeds of $937.5 million, which, less fees and expenses of $12.2 million, resulted in

$925.3 million of net proceeds. Contemporaneously, the Company entered into an interest exchange agreement, effec-

tively converting the fixed interest rate to a floating interest rate at bankers’ acceptance rate plus 1.25%. The Company

could have settled its obligation under this interest exchange agreement, at its option, in cash or Class B Non-Voting

shares of the Company.

On October 8, 2002, the Company settled its obligation under the Preferred Securities using cash (note 6(c)).

(iii) Collateralized Equity Securities:

On October 23, 2001, the Company entered into certain equity derivative contracts that served to monetize an additional

portion of the accreted floor price of its AT&T Canada Deposit Receipts, after taking into account the monetization

through the Preferred Securities issued in August 2000. The Company received proceeds of $248.9 million, which, less fees

and expenses, resulted in net proceeds of $245.6 million. The settlement terms of these contracts enabled the Company to

settle or net-settle in Class B Non-Voting shares, the number of which was based on the trading value of the Class B Non-

Voting shares, or physically settle or net cash settle these contracts, in whole or in part, or in any combination thereof, at

the Company’s option.

On October 8, 2002, the Company paid its obligation under the Collateralized Equity Securities in cash (note 6(c)).

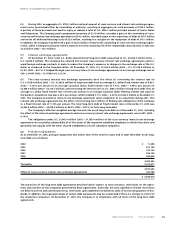

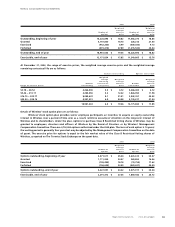

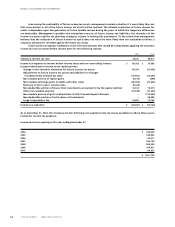

(c) Distributions and accretions on Preferred Securities and Collateralized Equity Securities:

The distribution on Convertible Preferred Securities are recorded net of future income taxes of $3.2 million (2002 –

$12.7 million). In 2002, the accretion on Preferred Securities were recorded net of future income taxes of $9.7 million.

In addition, in 2002, the accretion on the Collateralized Equity Securities and Preferred Securities included issue costs of

$3.2 million and $12.2 million, respectively, which previously were recorded as a reduction of the carrying value of these

securities (notes 6(c)) and 11(b)(ii) and (iii)).

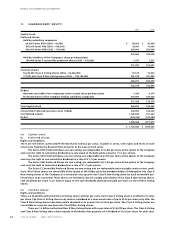

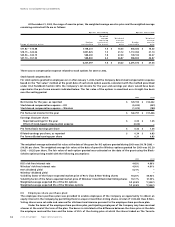

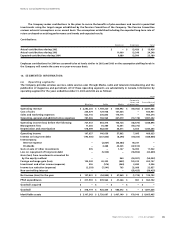

(d) Stock option and share purchase plans:

(i) Stock option plans:

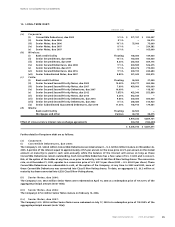

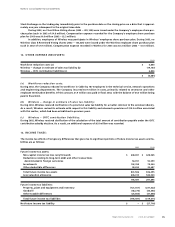

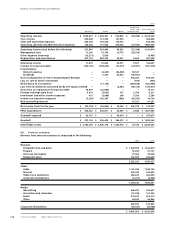

Details of the RCI stock option plan are as follows:

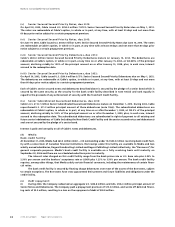

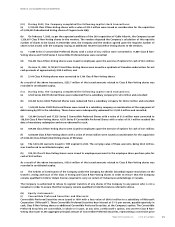

The Company’s stock option plan provides senior employee participants an incentive to acquire an equity owner-

ship interest in the Company over a period of time and, as a result, reinforces executives’ attention on the long-term

interest of the Company and its shareholders. Under the plan, options to purchase Class B Non-Voting shares of the

Company on a one-for-one basis may be granted to employees, directors and officers of the Company and its affiliates by

the Board of Directors or by the Company’s Management Compensation Committee. There are 11.0 million options autho-

rized under the 2000 plan, 12.5 million options authorized under the 1996 plan, and 4.75 million options authorized under

the 1994 plan. The term of each option is 10 years; the vesting period is generally four years but may be adjusted by the

Management Compensation Committee on the date of grant. The exercise price for options is equal to the fair market

value of the Class B Non-Voting shares, as quoted on The Toronto Stock Exchange on the grant date.