Rogers 2003 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

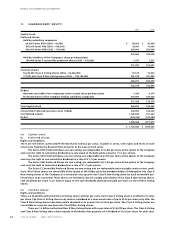

2003 Annual ReportRogers Communications Inc. 91

Notes to Consolidated Financial Statements

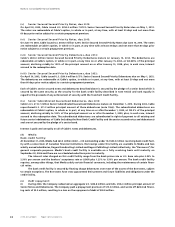

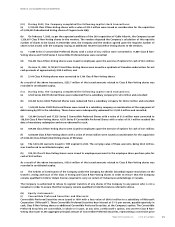

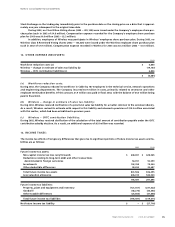

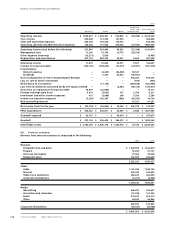

(iii) During 2003, the Company completed the following capital stock transactions:

(a) 2,700,000 Class B Non-Voting shares with a value of $35.2 million were issued as consideration for the acquisition

of 3,000,000 Subordinated Voting shares of Cogeco (note 6(b));

(b) On February 7, 2003, as per the expected conditions of the 2001 acquisition of Cable Atlantic, the Company issued

1,329,007 Class B Non-Voting shares to the vendors. The vendors disputed the Company’s calculation of the requisite

number of shares to be issued. In December 2003, the Company and the vendors agreed upon the requisite number of

shares to be issued, with the Company issuing an additional 736,395 Class B Non-Voting shares to the vendors;

(c) 11,889 Series E Convertible Preferred Shares with a value of $0.2 million were converted to 11,889 Class B Non-

Voting shares and 19,459 Series E Convertible Preferred shares were cancelled;

(d) 952,250 Class B Non-Voting shares were issued to employees upon the exercise of options for cash of $8.6 million;

(e) On June 12, 2003, 12,722,647 Class B Non-Voting shares were issued to a syndicate of Canadian underwriters for net

cash proceeds of approximately $239.0 million; and

(f) 5,100 Class A Voting shares were converted to 5,100 Class B Non-Voting shares.

As a result of the above transactions, $252.7 million of the issued amounts related to Class B Non-Voting shares was

recorded in contributed surplus.

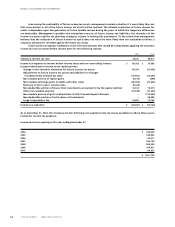

(iv) During 2002, the Company completed the following capital stock transactions:

(a) 4,500 Series XXIII Preferred Shares were redeemed from a subsidiary company for $4.5 million and cancelled;

(b) 300,000 Series XXXII Preferred Shares were redeemed from a subsidiary company for $300.0 million and cancelled;

(c) 1,042,049 Series XXXIII Preferred Shares were issued to a subsidiary company as consideration of the repayment of

debt owing by RCI to the subsidiary. These shares were subsequently redeemed for $1,042.0 million and cancelled;

(d) 120,984 Series B and 17,525 Series E Convertible Preferred Shares with a value of $1.8 million were converted to

138,509 Class B Non-Voting shares. 4,631 Series B Convertible Preferred Shares with a value of $0.1 million reached the

date of mandatory redemption and were redeemed for cash;

(e) 449,045 Class B Non-Voting shares were issued to employees upon the exercise of options for cash of $4.1 million;

(f) 4,305,830 Class B Non-Voting shares with a value of $104.8 million were issued as consideration for the acquisition

of 4,925,300 Class B Restricted Voting shares of Wireless;

(g) The 5,333,333 warrants issued in 1999 expired in 2002. The carrying value of these warrants, being $24.0 million,

was transferred to contributed surplus; and

(h) 339,100 Class B Non-Voting shares were issued to employees pursuant to the employee share purchase plan for

cash of $4.8 million.

As a result of the above transactions, $130.6 million of the issued amounts related to Class B Non-Voting shares was

recorded in contributed surplus.

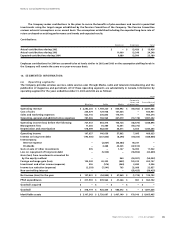

(v) The Articles of Continuance of the Company under the Company Act (British Columbia) impose restrictions on the

transfer, voting and issue of the Class A Voting and Class B Non-Voting shares in order to ensure that the Company

remains qualified to hold or obtain licences required to carry on certain of its business undertakings in Canada.

The Company is authorized to refuse to register transfers of any shares of the Company to any person who is not a

Canadian in order to ensure that the Company remains qualified to hold the licences referred to above.

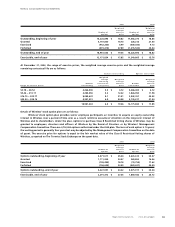

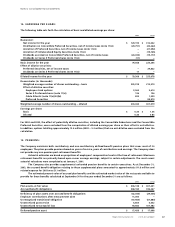

(b) Equity instruments:

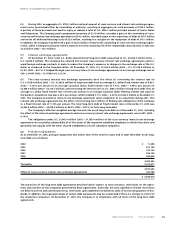

(i) Convertible Preferred Securities and Warrants:

Convertible Preferred Securities were issued in 1999 with a face value of $600.0 million to a subsidiary of Microsoft

Corporation (“Microsoft”). These Convertible Preferred Securities bear interest at 51/2% per annum, payable quarterly in

cash, Class B Non-Voting shares or additional Convertible Preferred Securities, at the Company’s option. The Convertible

Preferred Securities are convertible, in whole or in part, at any time, at Microsoft’s option, into 28.5714 Class B Non-

Voting shares per $1,000 aggregate principal amount of Convertible Preferred Securities, representing a conversion price