Reebok 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

093

ANNUAL REPORT 2007 --- adidas Group

03

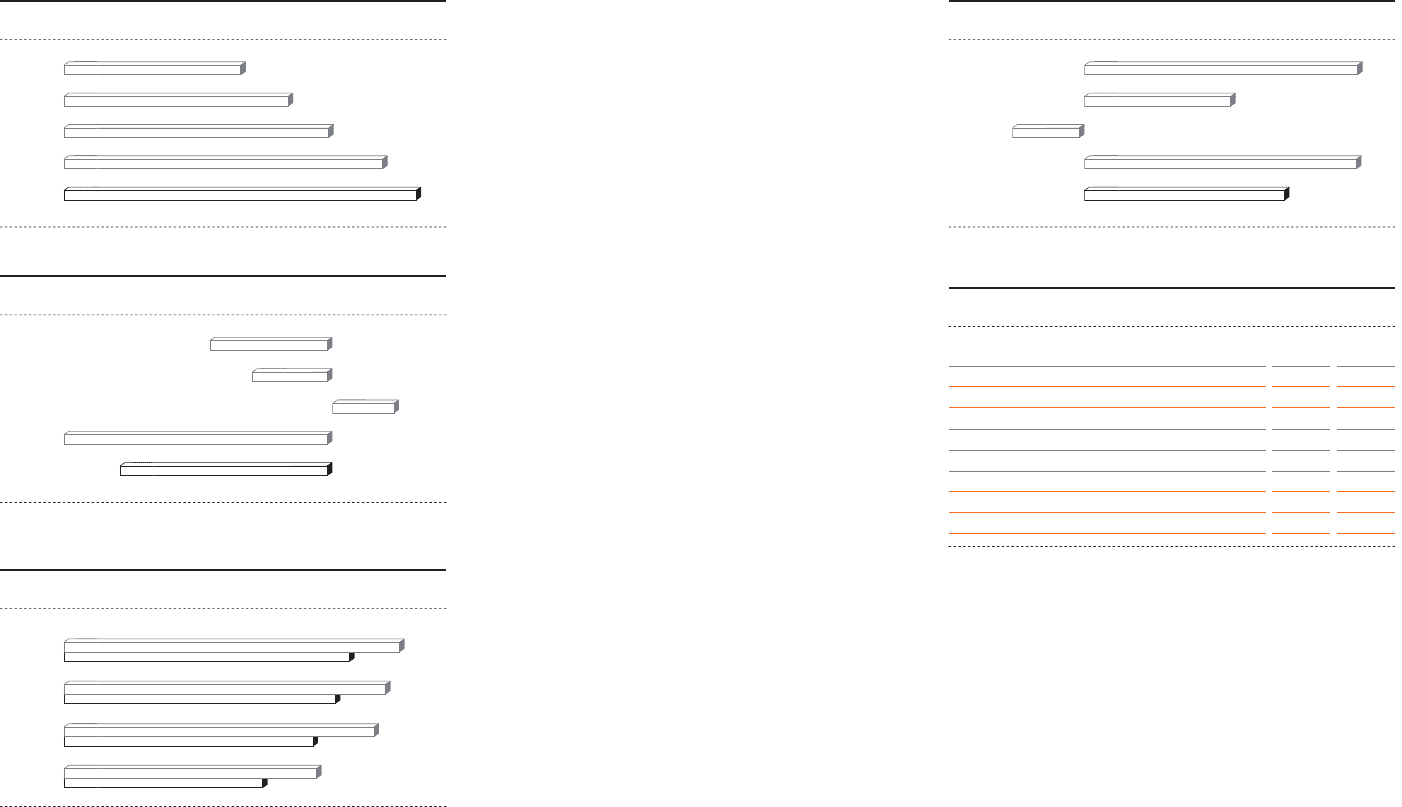

NET DEBT POSITION REDUCED BY NEARLY € 500 MILLION

Net borrowings at December 31, 2007 amounted to

€ 1.766 billion, which represents a reduction of € 465 million,

or 21%, versus € 2.231 billion in the prior year. This improve-

ment was signifi cantly better than our original target of

below € 2 billion as communicated at the beginning of 2007.

see Internal Group Management System, p. 056 The Group’s strong profi t-

ability improvement and continued tight working capital

management were the primary drivers of this decline. In addi-

tion, positive currency effects contributed € 98 million to

the net borrowings improvement. Consequently, the Group’s

fi nancial leverage also improved signifi cantly to 58.4 % at the

end of 2007 versus 78.9 % in the prior year. On a net debt basis,

the utilization of the available credit facilities for the Group at

the end of 2007 was 28 % versus 32 % in the prior year.

CURRENCY MANAGEMENT FURTHER OPTIMIZED Due to the

Group’s global activity, currency management is a key focus of

the Group’s central Treasury department. Hedging US dollars is

the central pillar of our program. This is a direct result of our

Asian-dominated sourcing, which is largely denominated in US

dollars. see Global Operations, p. 062 In 2007, the central Treasury

department managed a net defi cit of around US $ 1.5 billion

against the euro. This represents a decrease of approximately

US $ 200 million from around US $ 1.7 billion in the prior year,

mainly as a result of the non-recurrence of a one-time effect

related to the Reebok acquisition in 2006. As outlined in our

Group’s Treasury Policy, we have established a rolling 12 to

18 months hedging system, under which a large amount of the

anticipated seasonal hedging volume is secured six months

prior to the start of a season. As a result, we have already com-

pleted around 70 % of our anticipated hedging needs for 2008

at higher rates than those of 2007 and we have already started

to hedge our exposure for 2009. The use or combination

of different hedging instruments, such as cur rency options,

swaps and forward contracts, protects us against unfavorable

currency movements, while retaining the potential to benefi t

from future favorable exchange rate developments.

see Risk and Opportunity Report, p. 104

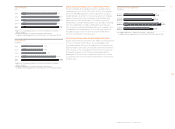

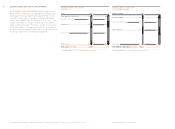

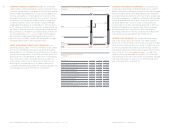

FINANCING STRUCTURE 1)

€ in millions

2

007

7

2006

T

otal cash and short-term fi nancial assets

Bank borrowings

Commercial paper

Private placements

Convertible bond

G

ross total borrowings

N

et cash / (Net borrowin

g

s) 1

)

1)

Roundin

g

differences may arise in totals.

381 347

7

198

275

0

144

1,564 1,784

4

3

8

4

375

2,146 2,578

(1,766) (2,231

)

)

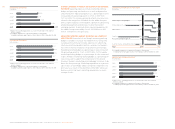

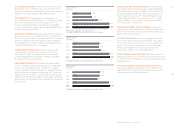

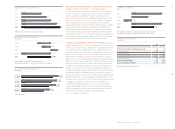

NET CASH / (NET BORROWINGS)

€

in million

s

2003 1)

2004 1)

2005

2006 2)

2

007

1) Restated due to a

pp

lication of amendment to IAS 39

.

2

)

Includin

g

Reebok business se

g

ment from February 1, 2006 onwards

.

(665)

551

(2,231)

(1,766)

(1,018)

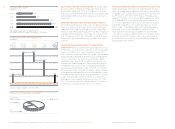

INTEREST RATE DEVELOPMENT 1)

i

n

%

2003

2004

2005

2006

2007

1

)

Wei

g

hted avera

g

e interest rate of

g

ross borrowin

g

s

.

3.4

4.0

4.8

5

.

3

2.7

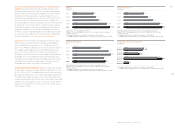

FINANCIAL LEVERAGE

i

n

%

2003 1)

2004 1)

2005

2006 2)

200

7

1)

Restated due to application of IAS 32/IAS 39 and amendment to IAS 19

.

2)

Including Reebok business segment from February 1, 2006 onwards.

43.1

(20.5)

78.9

58.4

79.2

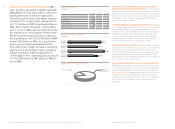

NET BORROWINGS BY QUARTER 1)

€

in milli

o

n

s

Q1 2006

Q

1

200

7

Q2 2006

Q

2 2007

Q3 2006

Q

3

2007

Q4 2006

Q

4

200

7

1

)

At end of period.

2

,

20

1

2,728

2,

395

2,829

2

,51

9

2,952

1,766

2,231