Reebok 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

ANNUAL REPORT 2007 --- adidas Group

03

MID-SINGLE-DIGIT SALES INCREASE EXPECTED AT

TAYLORMADE- ADIDAS GOLF We expect our strong product

pipeline to help increase currency-neutral TaylorMade-

adidas Golf sales at a mid-single-digit rate in 2008. Growth

will mainly be driven by new product launches including

TaylorMade metal woods and irons as well as adidas Golf

footwear and apparel.

Because the order profi le in golf differs from other parts of

our Group’s business, we do not provide order in for mation for

TaylorMade-adidas Golf. However, trade show performance

and ongoing dialog with customers both support our expecta-

tion of con tinued positive development in the segment.

LOW- TO MID-SINGLE-DIGIT SALES INCREASE EXPECTED

FOR REEBOK SEGMENT Currency-neutral Reebok segment

sales are projected to grow at a low- to mid-single-digit

rate in 2008. Sales are expected to increase at Reebok, Reebok-

CCM Hockey and Rockport. At brand Reebok, we continue to

focus on improving the brand’s position in performance sports.

This effort will be driven by several product launches in Reebok’s

running and women’s categories. see Reebok Products and Campaigns,

p. 138 In addition, product launches in American sports will

highlight additional focus on the key North American market.

Our efforts to broaden the brand’s lifestyle offering will also

become more visible. We anticipate a positive sales

development at Reebok-CCM Hockey and Rockport, supported

by the launch of new product lines. Retailer and trade show

feedback, especially in emerging markets, supports Reebok’s

2008 growth expectations.

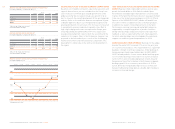

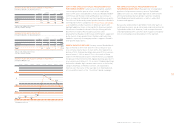

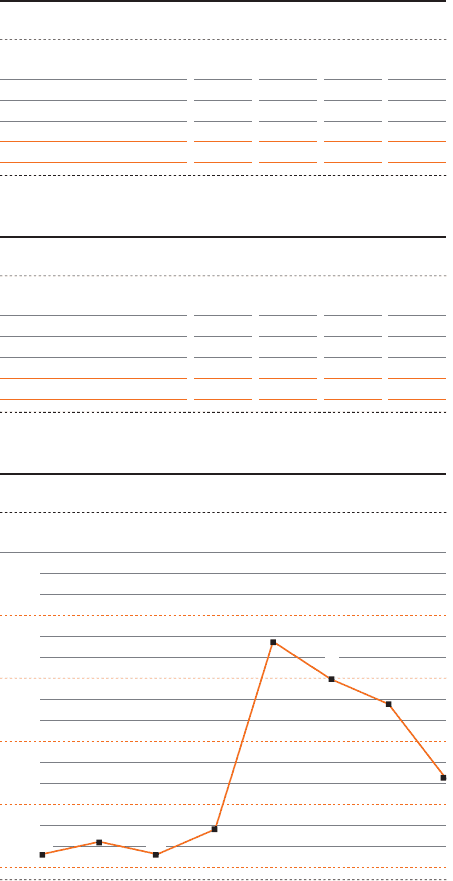

REEBOK BACKLOGS DECLINE Currency-neutral Reebok back-

logs at the end of 2007 were down 8 % versus the prior year

on a currency-neutral basis. In euro terms, this represents a

decline of 14 %. Footwear backlogs decreased 12 % in currency-

neutral terms (– 18 % in euros). This is the result of lower

orders from mall-based retailers in North America scheduled

for delivery in the fi rst half of 2008. Apparel backlogs grew by 3 %

on a currency-neutral basis (– 3 % in euros). Hardware backlogs

declined at a double- digit rate due to decreases in the hockey

category. Backlogs at Reebok, however, are expected to

improve over the course of the year due to an improved prod-

uct mix and the launch of the “Your Move” brand campaign.

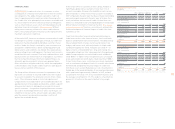

REEBOK ORDER BACKLOGS (IN €) 1)

Development by product cate

g

ory and re

g

ion in

%

North

Europe America Asia

T

ota

l

Footwear

Apparel

To

t

al

2

)

1) At year-end, change year-over-year.

2) Includes hardware backlogs

.

North

Europe America Asia

To

t

al

Footwear

Apparel

T

ota

l

2

)

1

)

At year-end, chan

g

e year-over-year.

2

)

Includes hardware backlogs

.

9 (30) 6

(

1

2

2)

(13) 19 20

3

3

(1) (20) 12 (8

8)

2

0)

)

6 (36) (0)

(

18

)

(16) 8 14

(

3

)

(4) (27) 5 (14

)

)

)

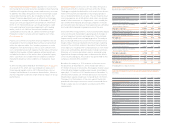

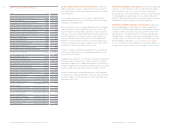

REEBOK ORDER BACKLOGS (CURRENCY-NEUTRAL) 1)

Development by product cate

g

ory and re

g

ion in

%

REEBOK ORDER BACKLOGS (CURRENCY-NEUTRAL) 1)

Develo

p

ment by

q

uarter in

%

Q1 / 06 Q2 / 06 Q3 / 06 Q4 / 06 Q1 / 07 Q2 / 07 Q3 / 07 Q4 / 07

5

0

(

5

)

(

10

)

(

15

)

1

)

Chan

g

e year-over-year

.

()

(

14

)

()

(

13

)

()

(

14

)

()

(

12

)

3

()

(

0

)

()

(

2

)

()

(

8

)