Reebok 2007 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

191

ANNUAL REPORT 2007 --- adidas Group

33 OTHER INFORMATION

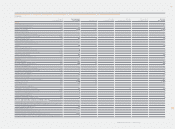

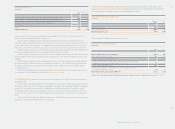

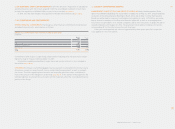

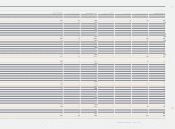

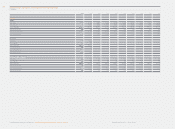

EMPLOYEES The average numbers of employees are as follows:

EMPLOYEES

Year ending Dec. 31

2007 2006

Own retail

Sales

Logistics

Marketing

Central functions and administration

Production

Research and development

Information technology

T

o

t

a

l

11,18

0

6,790

4,

0

65 5,527

4

,

55

0

4,000

2,84

2

2,552

2

,

929

2,619

1,

91

0

1,847

97

3

1,014

76

9

718

7

29,218 25,067

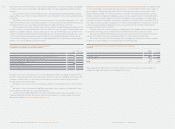

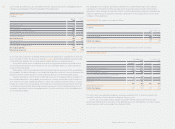

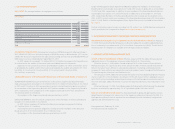

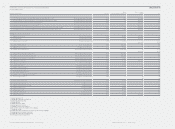

ACCOUNTANT SERVICE FEES Following the formation of KPMG Europe LLP effective October 1,

2007, KPMG LLP (UK) is an affi liated company of KPMG Germany as defi ned under § 271 section

2 HGB. The disclosure requirement for audit and accounting services fees provided by KPMG LLP

(UK) relate to services rendered after September 30, 2007.

In 2007, adidas AG recorded € 1.2 million (2006: € 0.5 million) as expense for the profession-

al service fee for the auditor of the annual and consolidated fi nancial statements.

Expenses for tax consultancy services provided by the auditor, for other confi rmation servic-

es provided by the auditor and for other services provided by the auditor amounted to € 0.1 mil-

lion (2006: € 0.3 million), € 0.0 million (2006: € 0.3 million) and € 0.5 million (2006:

€ 0.0 million), respectively.

wREMUNERATION OF THE SUPERVISORY BOARD AND THE EXECUTIVE BOARD OF ADIDAS AG

SUPERVISORY BOARD Pursuant to the Articles of Association, Supervisory Board members’

fi xed annual payment amounted to € 0.3 million (2006: € 0.3 million). Furthermore, € 0.2 million

in 2007 and € 0.5 million in 2006 was paid due to project-related fi xed-term advisory contracts

to one member of the Supervisory Board in 2007 and two members of the Supervisory Board in

2006, respectively. Total compensation of the Supervisory Board in 2007 thus amounted to

€ 0.5 million (2006: € 0.8 million).

No members of the Supervisory Board were granted loans in 2007.

EXECUTIVE BOARD In 2007, the overall compensation of the members of the Executive Board

totaled € 11.1 million (2006: € 9.4 million).

In 2007, former members of the Executive Board received pension payments totaling

€ 1.7 million (2006: € 1.9 million).

Pension provisions for pension obligations relating to former members of the Executive

Board amount to € 37.6 million (2006: € 42.1 million) in total.

No members of the Executive Board were granted loans in 2007.

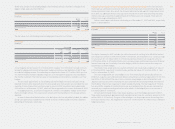

Under the Management Share Option Plan (MSOP) of adidas AG, members of the Executive

Board held non-transferable stock options for 0 and 2,800 shares of adidas AG as at December

31, 2007 and 2006, respectively. In addition, former members of the Executive Board held non-

transferable stock options on 0 and 1,300 shares of adidas AG as at December 31, 2007 and

2006, respectively. Members of the Executive Board have not received any stock options since

2003. In 2007, current and former members of the Executive Board exercised 4,100 stock options

(2006: 12,100). Details of the Management Share Option Plan are also included in these Notes.

see Note 32

Further information on disclosures according to § 314 section 1 no. 6a HGB (German commercial

law) is provided in the Compensation Report. see Compensation Report, p. 030

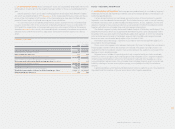

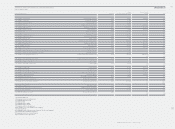

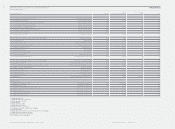

34 INFORMATION RELATING TO THE GERMAN CORPORATE GOVERNANCE CODE

INFORMATION PURSUANT TO § 161 GERMAN STOCK CORPORATION ACT (AKTG) On February

11, 2008, the Executive Board and Supervisory Board of adidas AG issued the updated declara-

tion of conformity in accordance with § 161 of the Stock Corporation Act (AktG). The full text of

the Declaration of Compliance is available on the Group’s corporate website.

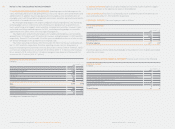

35 EVENTS AFTER THE BALANCE SHEET DATE

GROUP-SPECIFIC SUBSEQUENT EVENTS Effective January 2008, the adidas Group acquired

additional shares of its subsidiary in Greece, adidas Hellas A. E., Thessaloniki.

Effective January 3, 2008, adidas Canada acquired 100 % of the shares of Saxon Athletic

Manufacturing Inc. for a purchase price in the amount of CAD 4.6 million. Based in Brantford /

Ontario (Canada), Saxon Athletic is a design, development, marketing and manufacturing

company for team uniforms worn by professional and amateur teams throughout North America.

The purchase price allocation is not fi nalized so far.

On January 29, 2008, adidas AG announced the launch of a share buyback program. Treasury

shares of up to 5 % of the Company’s stock (up to 10,182,248 shares) with an aggregate value of

up to € 420 million (excluding incidental purchasing costs) shall be repurchased, exclusively via

the stock exchange. adidas AG intends to cancel the repurchased shares, thus reducing its stock

capital.

Effective February 11, 2008, TaylorMade-adidas Golf divested the Maxfl i brand. The divested

business accounted for approximately 1 % of TaylorMade-adidas Golf sales in 2007.

DATE OF AUTHORIZATION FOR ISSUE The Executive Board of adidas AG approved the consoli-

dated fi nancial statements for submission to the Supervisory Board on February 15, 2008. It is

the Supervisory Board’s task to examine the consolidated fi nancial statements and give their

approval and authorization for issue.

Herzogenaurach, February 15, 2008

The Executive Board of adidas AG

05