Reebok 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

ANNUAL REPORT 2007 --- adidas Group

03

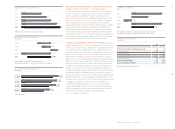

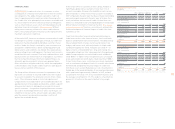

CURRENCY-NEUTRAL REVENUES GROW IN NEARLY ALL

REGIONS TaylorMade-adidas Golf currency-neutral sales grew

in all regions except North America in 2007. Sales in Europe

increased 5 % on a currency-neutral basis, driven by strong

growth in the UK. In North America, sales declined 9 % on a

currency-neutral basis. While revenues in Canada increased,

declines in the USA resulting from the divestiture of the GNC

wholesale business could not be offset by underlying sales

increases. TaylorMade-adidas Golf sales in Asia increased 20 %

on a currency-neutral basis, driven by strong double-digit

growth in Japan and South Korea. In Latin America, currency-

neutral sales grew 32 %. Revenue increases were driven by

strong growth in Argentina and Mexico.

Currency translation effects negatively impacted segment rev-

enues in euro terms. In euro terms, sales in Europe increased

3 % to € 95 million in 2007 from € 92 million in 2006. Revenues

in North America decreased 16 % to € 422 million in 2007 from

€ 505 million in 2006. In Asia, sales grew 11 % to € 282 million

in 2007 (2006: € 254 million), and in Latin America revenues

increased 20 % to € 6 million in 2007 (2006: € 5 million). On

a like-for-like basis, excluding the impact from the GNC dives-

titure, sales increased by double-digit rates in Asia and Latin

America. In Europe, like-for-like revenues grew at a high-single-

digit rate. Like-for-like sales in North America increased at

a low-single-digit rate.

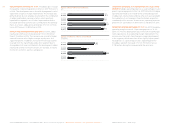

GROSS MARGIN INCREASES TO 44.7 % TaylorMade-adidas Golf

gross margin increased 0.8 percentage points to 44.7 % in 2007

(2006: 43.9 %). This development was in line with Management’s

initial expectation of a gross margin improvement. The increase

was due to higher margins in the metalwoods and irons cate-

gories. The GNC divestiture also had a positive impact on the

segment’s gross margin development. Gross profi t, however,

decreased by 4 % to € 360 million in 2007 versus € 376 million

in 2006.

ADIDAS GOLF SALES GROWTH DRIVES ROYALTY AND

COMMIS SION EXPENSE INCREASE Royalty and commission

expenses at TaylorMade-adidas Golf increased 10 % to € 18 mil-

lion in 2007 (2006: € 16 million). This development was driven

by signifi cantly higher adidas Golf sales, which generated

higher intra-Group royalties paid to the adidas segment.

OPERATING EXPENSES AS A PERCENTAGE OF SALES INCREASE

Operating expenses as a percentage of sales at TaylorMade-

adidas Golf increased 0.9 percentage points to 34.4 % in 2007

from 33.5 % in 2006. A main reason for this increase was the

divestiture of the GNC wholesale business, which had lower

marketing expenditures as a percentage of sales. Operating

overhead expenses as a percentage of sales were almost stable

compared to the prior year. In absolute terms, operating

expenses decreased 3 % to € 277 million in 2007 from € 287 mil-

lion in 2006.

OPERATING PROFIT DECLINES The TaylorMade-adidas Golf

operating margin decreased 0.4 percentage points to 8.1 %

in 2007 from 8.5 % in 2006. This development was in line with

Management’s initial expectation. The higher gross margin was

unable to offset higher operating expenses as a percentage

of sales. Operating profi t for TaylorMade-adidas Golf declined

10 % to € 65 million in 2007 versus € 73 million in 2006.

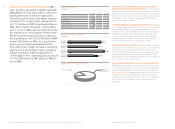

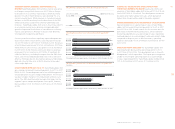

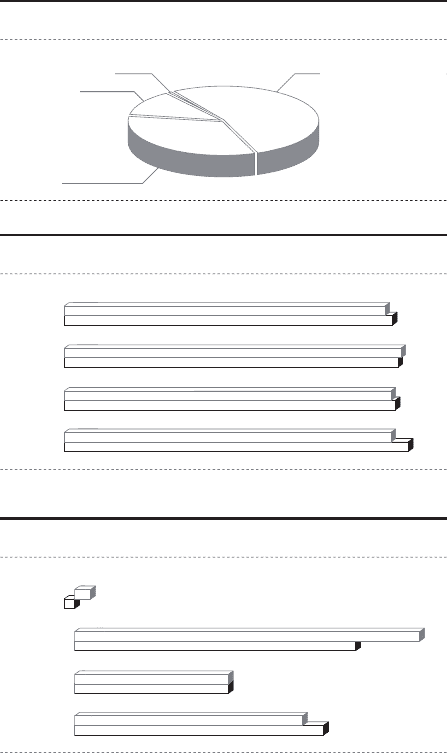

TAYLORMADE-ADIDAS GOLF GROSS MARGIN BY QUARTER 1)

in

%

TAYLORMADE-ADIDAS GOLF OPERATING PROFIT BY QUARTER 1)

€ in million

s

Q1 2006

Q

1 200

7

Q2 2006

Q2

2007

Q3 2006

Q

3 200

7

Q4 2006

Q

4 200

7

1)

Including Greg Norman apparel business from February 1, 2006 to November 30, 2006.

Q1 2006

Q

1

2007

Q2 2006

Q2

2007

Q3 2006

Q

3 200

7

Q4 2006

Q

4

2007

1

) Including Greg Norman apparel business from February 1, 2006 to November 30, 2006.

44.

3

15

43.7

15

4

4.7

27

45.0

33

43.

9

(

1

)

42.9

2

46.

0

24

43.7

22

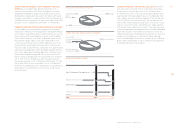

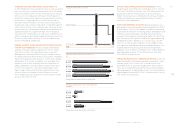

TAYLORMADE-ADIDAS GOLF 2007 NET SALES BY REGION

Latin America

1

%

Europe 12 %

Asia

3

5

%

5

2

%

North America