Reebok 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.119

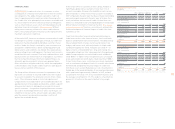

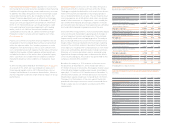

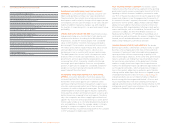

ANNUAL REPORT 2007 --- adidas Group

03

In Asia, the region’s most populous countries, such as China

and India, are expected to remain the largest contributors

to the region’s growth in 2008. Compared to 2007, growth

in Asia excluding Japan is likely to slow slightly to a level

around 9 %, with consumer confi dence in most countries

expected to continue to grow strongly despite fi nancial market

volatility. For Japan, increased global fi nancial market

insta bility has clouded the near-term outlook and economic

growth is projected to slow to a level of no more than 2 %.

Sound corporate earnings, rising employment and encour-

aging export signals are expected to be tempered by a

weakening in domestic demand led by lackluster consumer

spending.

Growth in Latin America is likely to decline slightly compared

to the prior year to a level below 4.5 %. As in previous years,

private consumption as well as buoyant exports will be the key

drivers of economic growth. Never theless, consumer confi -

dence in the region is expected to moderate.

MIXED OUTLOOK FOR THE GLOBAL SPORTING GOODS

IN DUSTRY In 2008, the global sporting goods industry is pro-

jected to grow modestly. Although strong increases are expected

in Asia, Latin America and Europe’s emerging markets, the

US market is forecasted to decline modestly.

EUROPEAN SPORTING GOODS INDUSTRY TO GROW MODER-

ATELY We expect the European sporting goods market to grow

at a low-single-digit rate. During the fi rst half of 2008, the

industry is expected to largely focus on the UEFA EURO 2008™.

This should provide positive impetus to otherwise slow retail

markets in Western Europe. However, the impact is likely

to be somewhat less than what was initially anticipated due

to the failure of England to qualify. Traditionally, England has

been the region’s largest football licensed apparel market.

Following the event, regional growth for the sector is likely to

be driven by emerging markets, in particular Russia.

NORTH AMERICAN SPORTING GOODS MARKET EXPECTED TO

DECLINE In North America, we project a declining market in 2008.

Lower overall consumer spending coupled with promotional

activity among mall-based retailers and a polarization of price

points are likely to further burden the market. Mixed development

of product categories and distribution channels is expected to

continue throughout 2008. Whereas growth in running and soccer

footwear as well as training apparel is projected to continue, sales

in the basketball and Classics categories are expected to decline.

In addition, we expect the region’s golf market to remain highly

competitive in 2008 as many market participants introduce new

technologies that capitalize on the recent rulings by the USGA

(United States Golf Association), allowing for a broader inter-

pretation of adjustability in both metalwoods and irons.

ASIAN SPORTING GOODS INDUSTRY FORECASTED TO

EXPAND FURTHER The sporting goods market in Asia is

expected to continue to grow at a high-single-digit rate. In Japan,

weak overall private consumption may affect average selling

prices in the industry. In the emerging markets, especially

China, the industry is likely to grow at low-double-digit levels

driven by the upcoming Olympics Games in Beijing.

INCREASING TRADE BARRIERS DAMPEN LATIN AMERICAN

SPORTING GOODS INDUSTRY GROWTH Mid-single-digit

industry growth rates are expected in Latin America. The

momentum of the region’s sporting goods industry is projected

to remain intact, but there are concerns related to increasing

trade barriers being implemented in certain markets such

as Argentina and Brazil.

EXPIRATION OF AMER SOURCING AGREEMENT TO NEGA-

TIVELY IMPACT HQ / CONSOLIDATION SALES Sales recorded

in the HQ / Consolidation segment will decrease during 2008,

as a result of the expiration of the Group’s cooperation agree-

ment with Amer Sports Corporation in the fi rst quarter. Under

this agreement, the adidas Group sourced product for Salomon

at a fi xed buying commission for a limited period in an effort

to support the transfer of Salomon’s business activities to

Amer Sports Corporation. However, as this agreement includes

margins below the Group’s average, the expiration of this

contract is expected to have a positive impact on the Group’s

gross and operating margins. However, this impact will be

limited due to the small size of the business contained in the

cooperation agreement.

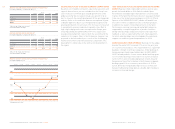

SLOWDOWN IN GLOBAL ECONOMIC EXPANSION PROJECTED

IN 2008 According to the World Bank, growth of the global

econ omy is expected to decline in 2008 with a projected GDP

growth rate of around 3 %. Recent turbulence in fi nancial

markets triggered by the US subprime crisis and its spillover

effects are seen as the main catalyst.

In Europe, GDP in the Euro Zone is expected to grow at a level

of below 2 % in 2008. Financial market uncertainties, lower

exports and a further strengthening of the euro are all expected

to hamper growth in the region. Consumer confi dence is fore-

casted to continue to decline mainly due to tight credit and

unstable fi nancial market conditions as well as increasing

energy prices. The region’s emerging markets will remain

largely unaffected by these uncertainties, with GDP growth fore-

casted to be around 5 %.

In North America, GDP growth is projected to decline versus

the prior year to a level below 2 %. Of particular concern is

an expected further weakening of consumer spending in the

fi rst six months of the year, driven by the persistent chal-

lenges of the housing market and continuing high oil prices.

A government-sponsored stimulus package, however, is

expected to help US consumer confi dence improve modestly

in the second half of 2008.