Reebok 2007 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

174

ANNUAL REPORT 2007 --- adidas Group CONSOLIDATED FINANCIAL STATEMENTS - Notes to the Consolidated Balance Sheet

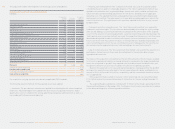

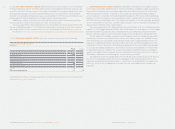

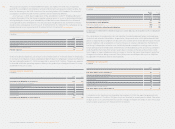

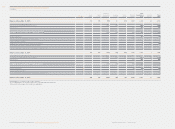

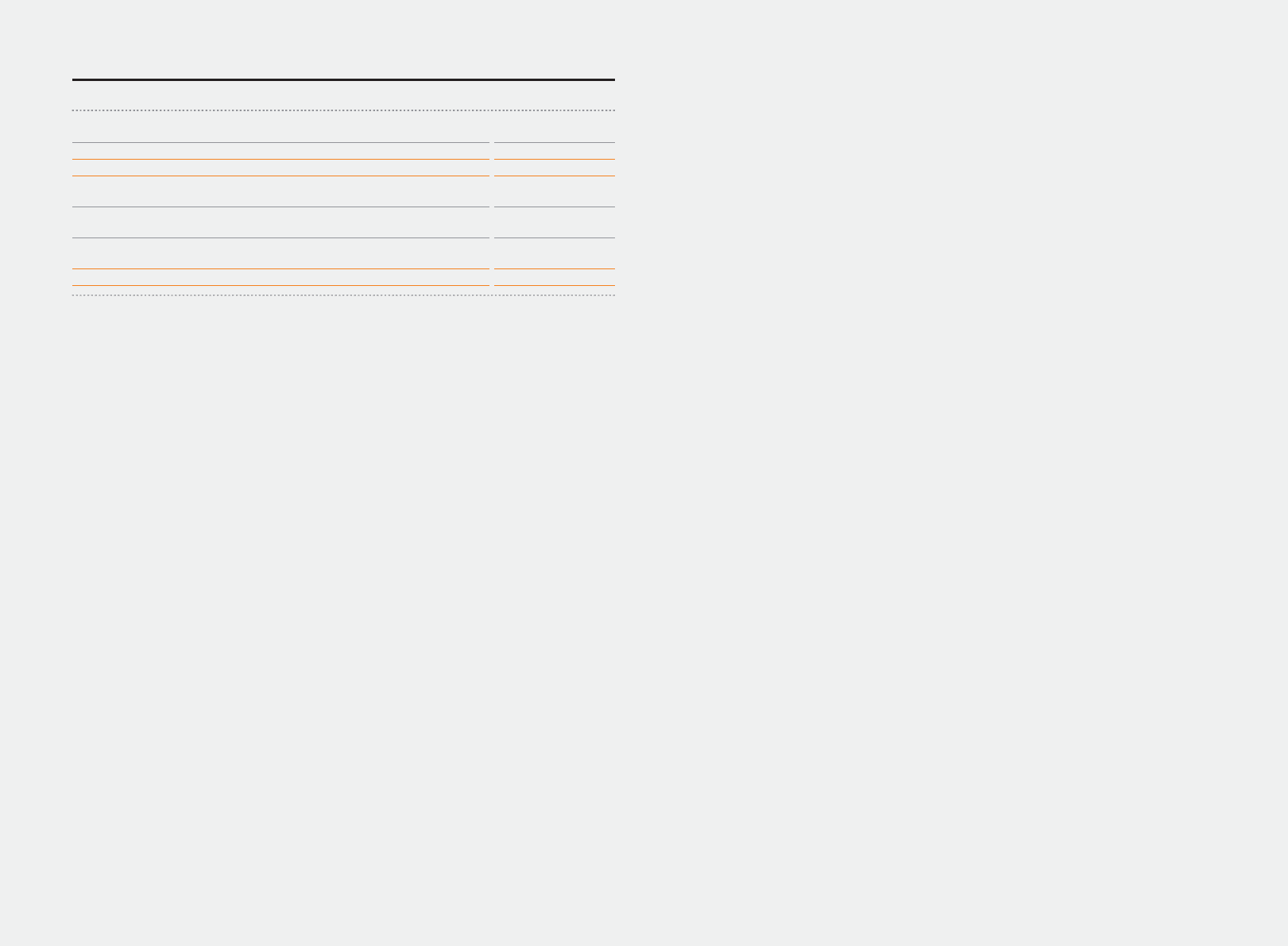

The number of shares in circulation is as follows:

DEVELOPMENT OF NUMBER OF SHARES IN CIRCULATION

Number of shares

N

umber of no-par-value shares issued as at Jan. 1,

200

7

Capital increase and issuance of no-par-value shares in January 2007

based on MSOP exercises in November 2006

Capital increase and issuance of no-par-value shares in July 2007

based on MSOP exercises in May 2007

Capital increase and issuance of no-par-value shares in October 2007

based on MSOP exercises in August 2007

N

umber of no-

p

ar-value shares issued as at Dec.

3

1, 200

7

203,536,860

30,200

58,000

3,900

203,628,960

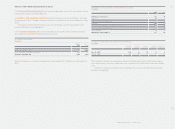

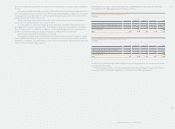

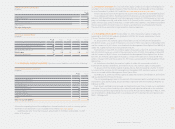

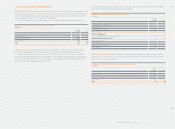

AUTHORIZED CAPITAL The Executive Board of adidas AG did not make use of the existing

amounts of Authorized Capital of up to € 90,312,500 in 2007 or in the period beyond the balance

sheet date up to and including February 15, 2008.

As at the balance sheet date, the Authorized Capital of the Company is set out in § 4 sections 2, 3

and 4 of the Articles of Association, pursuant to which the Executive Board is entitled, subject to

Supervisory Board approval, to increase the nominal capital

until June 19, 2010

-- by issuing new shares against contributions in cash once or several times by no more than

a maximum of € 64,062,500 and, subject to Supervisory Board approval, to exclude fractional

shares from shareholders’ subscription rights (Authorized Capital 2005 / I);

and until June 19, 2008

-- by issuing new shares against contributions in cash or in kind once or several times by no

more than a maximum of € 6,250,000 and, subject to Supervisory Board approval, to exclude

shareholders’ subscription rights (Authorized Capital 2005 / II);

and until May 28, 2011

-- by issuing new shares against contributions in cash once or several times by no more than a

maximum of € 20,000,000 and, subject to Supervisory Board approval, to exclude shareholders’

subscription rights for fractional amounts and when issuing the new shares at a value not

essentially below the stock market price of shares with the same features (Authorized Capital

2006). The authorization to exclude subscription rights pursuant to the last sentence, may,

however, only be used to the extent that the pro rata amount of the new shares in the nominal

capital together with the pro rata amount in the nominal capital of other shares which were

issued by the Company after May 11, 2006, subject to the exclusion of subscription rights pur-

suant to § 186 section 3 sentence 4 AktG on the basis of authorized capital or following a repur-

chase, or for which conversion or subscription rights were granted after May 11, 2006, through

issuance of convertible bonds or bonds with warrants, with subscription rights excluded pur-

suant to § 186 section 3 sentence 4 AktG, does not exceed 10 % of the nominal capital existing

on the date of entry of this authorization into the Commercial Register or – if this amount is

lower – as at the respective date on which the authorization is used.

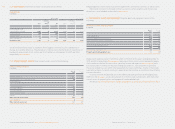

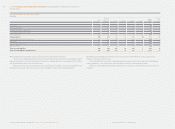

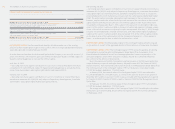

CONTINGENT CAPITAL The following description of the Contingent Capital amounts is based

on § 4 sections 5, 6 and 7 of the applicable Articles of Association as at the balance sheet date.

CONTINGENT CAPITAL 1999 / I The Contingent Capital 1999 / I serves the purpose of fulfi lling

stock options in connection with the Management Share Option Plan to members of the

Executive Board of adidas AG as well as to managing directors / senior vice presidents of its

affi liated companies and to other executives of adidas AG and of its affi liated companies

(§ 4 section 5 of the Articles of Association).

Due to the exercise of 23,025 stock options and the issuance of 92,100 shares within the

scope of the exercise periods ending in January, July and October 2007 for Tranche II (2000),

Tranche III (2001), Tranche IV (2002) and Tranche V (2003) of the Management Share Option Plan,

the nominal amount of the Contingent Capital 1999 / I at the balance sheet date totalled

€ 1,363,548 and was divided into 1,363,548 shares.

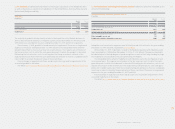

In January 2008, the nominal value of the Contingent Capital 1999 / I was reduced to

€ 1,347,548 divided into 1,347,548 shares, as a result of the exercise of 4,000 stock options in

November 2007 and the issuance of 16,000 shares associated with the expired exercise period

for Tranche III (2001), Tranche IV (2002) as well as Tranche V (2003) of the Management Share

Option Plan.

On February 15, 2008, the nominal value of the Contingent Capital 1999 / I amounted to

€ 1,347,548 and was divided into 1,347,548 shares.

The change to the nominal value of the Contingent Capital 1999 / I resulting from the above

transactions up to and including January 2008, was registered with the Commercial Register

on February 4, 2008.