Reebok 2007 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

183

ANNUAL REPORT 2007 --- adidas Group

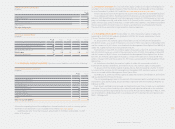

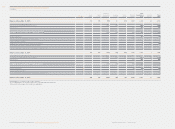

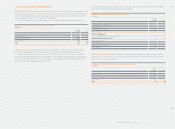

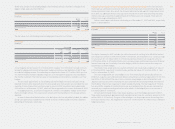

Of the total amount of outstanding hedges, the following contracts related to coverage of the

biggest single exposure, the US dollar:

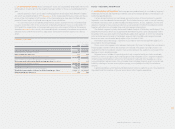

NOTIONAL AMOUNTS OF US DOLLAR HEDGING INSTRUMENTS

€

in million

s

D

ec.

3

1 Dec. 31

200

7 2006

Forward contracts

Currency options

Total

1,

885 656

56

2

543

2,447 1,199

9

The fair value of all outstanding currency hedging instruments is as follows:

Dec.

3

1 200

7

Dec. 31 2006

Positive Negative

Positive Negative

fair fair

fair fair

value value

value value

Forward contracts

Currency options

To

t

al

FAIR VALUE

€

in millions

11 (79

9)

7 (26)

5 (23

3)

6 (9)

5)

16 (102) 13 (35

2)

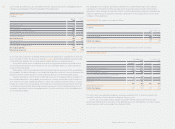

A total negative net fair value of € 61 million (2006: negative € 22 million) for forward contracts

related to hedging instruments falling under hedge accounting as per defi nition of IAS 39 was

recorded in hedging reserve. The remaining net negative fair value of € 7 million (2006: positive

€ 3 million) mainly related to liquidity swaps for cash management purposes was recorded in

the income statement. The total fair value of outstanding currency options related to cash fl ow

hedges.

The fair value adjustments of outstanding cash fl ow hedges for forecasted sales will be

reported in the income statement when the forecasted sales transactions are recorded. The vast

majority of these transactions are forecasted to occur in 2008. Inventories were adjusted by

€ 22 million as at December 31, 2007, which will be recognized in the income statement in 2008.

In hedging reserves, an amount of negative € 3 million is included for hedges of net invest-

ments in foreign entities. This reserve will remain until the investment in the foreign entity is

divested.

In order to determine the fair values of its derivatives that are not publicly traded, the adidas

Group uses generally accepted fi nance-related economic models based on market conditions

prevailing at the balance sheet date.

FINANCIAL INSTRUMENTS FOR THE HEDGING OF INTEREST RATE RISK In the last two years

the Group has switched concentration from short-term fi nancing to long-term fi nancing, due to

increasing interest rates. As a result, the Group is better protected against rising interest rates.

As in 2006, no additional interest rate caps were entered into in 2007 and remaining maturing

interest rate caps amounting to approximately € 50 million were not renewed. There were no

interest rate swaps entered into in 2007.

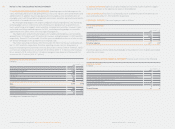

Interest rate hedges which were outstanding as at December 31, 2007 and 2006, respectively

expire as detailed below:

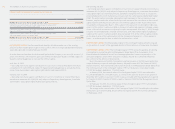

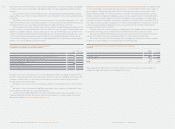

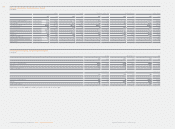

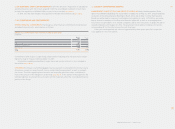

EXPIRATION DATES OF INTEREST RATE HEDGES

€

in milli

o

n

s

Dec. 3

1

Dec. 31

2

00

7

2006

Within 1 year

Between 1 and 3 years

Between 3 and 5 years

After 5 years

T

ota

l

—

50

16

2

19

1

5

0 184

68

181

380 434

4

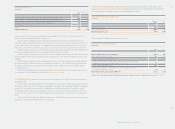

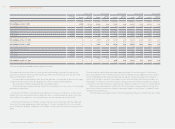

The above summary for 2007 includes the notional amount of one long-term US dollar interest

rate swap in an amount of € 68 million (2006: € 76 million), two long-term cross-currency swaps

for an amount of € 33 million (2006: € 29 million) and three interest rate swaps for a total of

€ 279 million (2006: € 279 million). Both cross-currency swaps and the one long-term US dollar

interest rate swap are classifi ed as fair value hedges, while the three interest rate swaps are

classifi ed as cash fl ow hedges.

The interest rate swaps and cross-currency interest rate swaps had a negative fair value of

€ 10 million (2006: negative € 12 million) and a positive fair value of € 4 million (2006: € 3 mil-

lion) as at December 31, 2007.

The risks hedged with fair value hedges occur from fi nancing with private placements in

US dollars, Japanese yen and Australian dollars amounting to a notional equivalent of € 101 mil-

lion (2006: € 105 million). The aim of cross-currency swap hedges in Australian dollars and

Japanese yen was to turn the fi nancing into euro and retain the fi nancing method. The intent of

the US dollar interest rate swap was to obtain variable fi nancing. The total negative € 7 million

fair value (2006: negative € 2 million), which was recorded directly in the income statement as

incurred, was compensated by positive fair value effects of the hedged items in an amount of

€ 6 million (2006: € 12 million).

All euro-denominated interest rate swaps qualify as cash fl ow hedges pursuant to IAS 39.

They relate to euro private placements with variable interest rates for a notional amount of € 279

million (2006: € 279 million). The goal of these hedges is to lower exposure to increasing short-

term euro interest rates. The negative fair value of € 1 million (2006: € 4 million) was credited in

hedging reserves.

05