Reebok 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

063

ANNUAL REPORT 2007 --- adidas Group

02

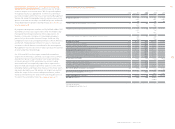

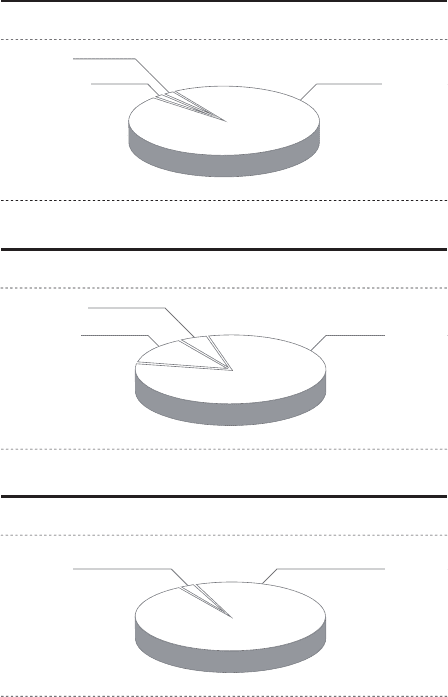

ASIA DOMINATES FOOTWEAR PRODUCTION 96 % of our total

2007 footwear volume for adidas, Reebok and adidas Golf was

produced in this region (2006: 97 %). Production in Europe and

the Americas combined accounted for 4 % of the sourcing

volume (2006: 3 %). China represents our largest source

country with approximately 49 % of the total volume, followed

by Vietnam with 28 % and Indonesia with 16 %. The only signifi -

cant change versus the prior year was a 3 percentage point

decline in Indonesia due to the closure of three factories in the

fourth quarter of 2006, which had manufactured Reebok foot-

wear. In 2007, our footwear suppliers produced approximately

201 million pairs of shoes (2006: approx. 200 million pairs).

The year-over-year increase was solely attributable to a higher

sourcing volume at adidas while footwear purchases at Reebok

declined. Our largest footwear factory produced approximately

11 % of the footwear sourcing volume (2006: 11 %).

Rockport purchased approximately 11 million pairs of foot-

wear in 2007, which represents an increase of 5 % versus the

prior year. Products were primarily sourced from factories

in China (81 %), Vietnam (11 %) and Indonesia (6 %). The

largest factory accounted for 30 % of the total sourcing vol-

ume of the Rockport brand.

PORTION OF ASIAN-PRODUCED APPAREL GROWS STRONGLY

In 2007, we sourced 82 % of the total apparel volume for

adidas, Reebok and adidas Golf from Asia (2006: 76 %). The

higher proportion of Asian-sourced apparel was attributable

to continued sales growth in Asia, which in turn required

higher sourcing volumes from the region. Europe remained

the second largest apparel sourcing region, representing

13 % of the volume (2006: 16 %). The Americas accounted for

5 % of the volume (2006: 8 %). China was the largest source

country, representing 32 % of the produced volume, followed

by Thailand with 13 % and Indonesia with 11 %. In total, our

suppliers produced approximately 252 million units of apparel

in 2007 (2006: approx. 225 million units). The largest apparel

factory produced approximately 12 % of this apparel volume

in 2007 (2006: 8 %). In addition, Reebok-CCM Hockey sourced

around 2 million units of apparel (primarily hockey jerseys) in

2007. The vast majority of this volume was also produced in

Asia, while small portions were sourced from the Americas

(partic ularly Canada) and Europe.

The Sports Licensed Division sourced approximately 21 million

units of apparel and 18 million units of headwear (2006:

24 million and 18 million, respectively). The majority of pur-

chased apparel products were sourced as unfi nished goods

from Central America (67 %) and Asia (21 %), and were sub-

sequently fi nished in our own screenprinting facilities in the

USA. On the other hand, the majority of headwear sourced was

fi nished products manufactured predominately in Asia (79 %)

and the USA (20 %).

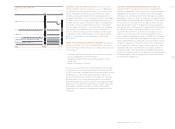

LION’S SHARE OF HARDWARE PRODUCED IN ASIA In 2007,

the bulk (i. e. 96 %) of adidas and Reebok branded hardware

products, such as balls and bags, was also produced in Asia

(2006: 97 %). China remained our largest source country,

accounting for 65 % of the sourced volume, followed by

Vietnam with 17 % and Pakistan with 13 %. The remaining 5 %

was sourced via other Asian and European countries. The

total 2007 hardware sourcing volume was approximately

39 million units (2006: approximately 37 million units) with

the largest factory accounting for 28 % of production.

TaylorMade and Reebok-CCM Hockey sourced 92 % and 98 %

of their hardware volumes from Asia, respectively. In addition,

both brands sourced a small portion of hardware products in

the Americas. At TaylorMade, the majority of golf club compo-

nents were manufactured by suppliers in China and assembled

by TaylorMade in the USA, China and Japan.

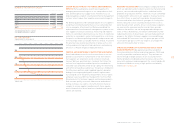

BEING CLOSEST TO EVERY CONSUMER All efforts of our

Global Operations team revolve around the vision to be closest

to every consumer. This means meeting consumer demand in

various distribution channels with the right product (in terms

of quality, size, color, style and material) in the right store at

the right time. In addition, it means quickly replenishing fast-

selling products at retail by sharing real-time customer sell-

through data with our suppliers. Being closest to every con-

sumer enables the Group to achieve:

- Higher sales by consistently providing those products

at retail where consumer demand is high.

- Higher gross and operating margins as well as lower Group

inventory levels due to lower product markdowns and faster

sell-throughs.

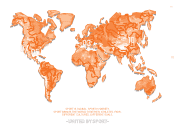

FOOTWEAR PRODUCTION BY REGION 1)

APPAREL PRODUCTION BY REGION 1)

1

)

Fi

g

ures only include adidas, Reebok and adidas Golf brands

.

1

)

Fi

g

ures only include adidas, Reebok and adidas Golf brands

.

Americas

2

%

Americas

5

%

Europe 2

%

Europe

13

%

9

6

%

Asia

82

%

Asia

HARDWARE PRODUCTION BY REGION 1)

1) Figures only include adidas and Reebok brands.

Europe 4

%

96

%

Asia