Reebok 2007 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164

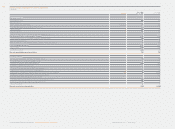

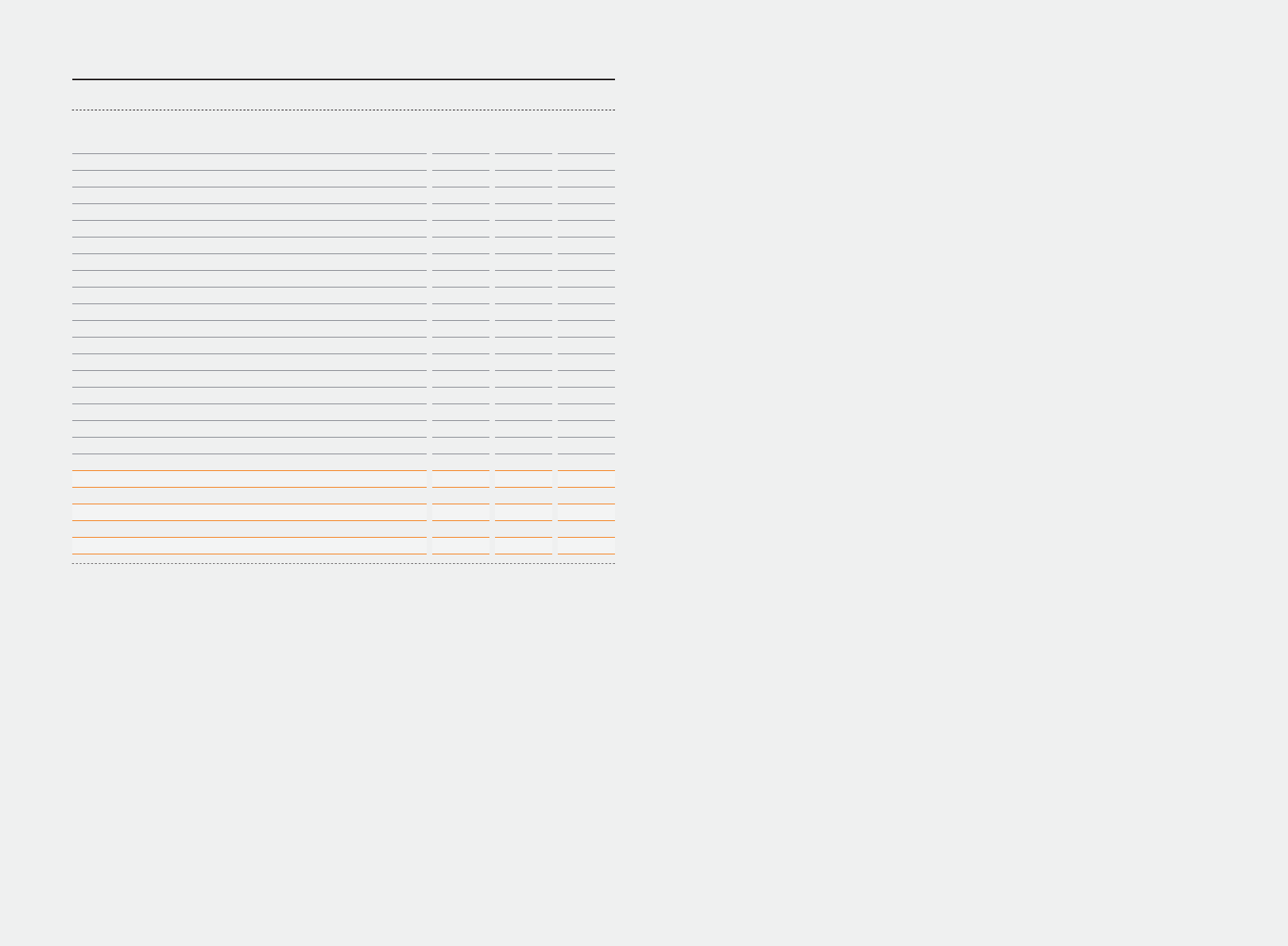

ANNUAL REPORT 2007 --- adidas Group CONSOLIDATED FINANCIAL STATEMENTS - Notes - Notes to the Consolidated Balance Sheet

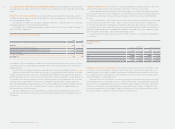

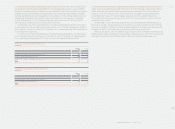

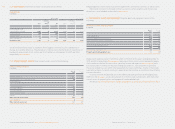

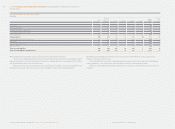

The acquisition had the following effect on the Group’s assets and liabilities:

REEBOK’S NET ASSETS AT THE ACQUISITION DATE

€

in milli

o

n

s

Pre-aquisition Recognized

carrying Fair value values on

amounts adjustments acquisition

Cash and cash equivalents

Accounts receivable

Inventories

Other current assets

Property, plant and equipment, net

Trademarks and other intangible assets, net

Long-term fi nancial assets

Deferred tax assets

Other non-current assets

Borrowings

Accounts payable

Income taxes

Accrued liabilities and provisions

Other current liabilities

Pensions and similar obligations

Deferred tax liabilities

Other non-current liabilities

Minority interests

Ne

t

asse

t

s

Goodwill arising on acquisition

P

urchase pr

i

ce settled

i

n cas

h

Cash and cash equivalents acquired

C

ash outfl ow on acquisitio

n

539 — 539

453 — 453

447 55 502

103 (3) 100

293 (33) 260

68 1,674 1,742

— 4 4

198 44 242

16 — 16

(506) — (506)

(109) — (109)

(59) — (59)

(329) (30) (359)

(418) — (418)

(7) — (7)

(11) (578) (589)

(2) — (2)

(3) — (3)

1,133 1,806

673

1,165

2,971

539

2,432

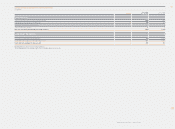

Pre-acquisition carrying amounts were based on applicable IFRS standards.

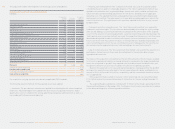

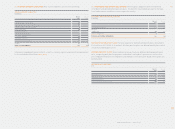

The following valuation methods for the acquired assets were applied:

-- Inventories: The pro rata basis valuation was applied for estimating the fair value of acquired

inventories. Realized margins were added to the book values of acquired inventories. Subse-

quently, the costs for completion for selling, advertising and general administration as well as a

reasonable profi t allowance were deducted.

-- Property, plant and equipment: The “comparison method” was used for acquired land by

considering the prices paid for comparable properties. The “direct capitalization method” was

applied for the valuation of all acquired buildings. Annual rents which could be realized in the

future were discounted following adjustments for risk factors and deduction of applicable

operating costs. The acquired machinery and equipment was valued utilizing the depreciated

replacement cost method. The replacement costs were determined by applying an index to the

asset’s historical cost. The replacement costs were then adjusted for the loss in value caused

by depreciation.

-- Trademarks and other intangible assets: The “relief-from-royalty method” was applied for

trademarks and technologies. The fair value was determined by discounting the royalty savings

after tax and adding a tax amortization benefi t, resulting from the amortization of the acquired

asset. For the valuation of licensing agreements, customer relationships and order backlogs, the

“multi-period-excess-earnings method” was used. The respective future excess cash fl ows were

identifi ed and adjusted in order to eliminate all elements not associated with these assets.

Future cash fl ows were measured on the basis of the expected sales by deducting variable and

sales-related imputed costs for the use of contributory assets. Subsequently, the outcome was

discounted using the appropriate discount rate and adding a tax amortization benefi t.

-- Long-term fi nancial assets: The “discounted cash fl ow method” was used for the valuation of a

participation. Future free cash fl ows were discounted back to the valuation date using an

appropriate discount rate.

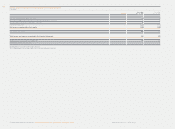

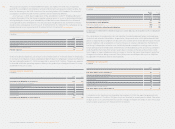

The excess of the acquisition cost paid versus the net of the amounts of the fair values assigned

to all assets acquired and liabilities assumed, taking into consideration the respective deferred

taxes, was recognized as goodwill. Any acquired asset that did not meet the identifi cation and

recognition criteria for an asset was included in the amount recognized as goodwill.

Based on the expected cost of sales and operating expenses synergy potential, the goodwill

arising on this acquisition was allocated to the cash-generating units adidas and Reebok in an

amount of € 699 million and € 466 million, respectively, and was converted in functional curren-

cies as appropriate.

If this acquisition had occurred on January 1, 2006, total Group net sales would have been

€ 10.2 billion and net income would have been € 448 million for the year ending December 31,

2006.

The acquired Reebok subsidiaries contributed € 92 million to the Group’s operating profi t for

the period from February to December 2006. Contribution to net income cannot be disclosed due

to the advanced integration of fi nancing and tax activities.