Reebok 2007 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

160

ANNUAL REPORT 2007 --- adidas Group CONSOLIDATED FINANCIAL STATEMENTS - Notes

Irrespective of whether there is an impairment indication, intangible assets with an indefi nite

useful life and goodwill acquired in business combinations are tested annually for impairment.

An impairment loss recognized in goodwill is not reversible. With respect to other assets,

an impairment loss recognized in prior periods is reversed if there has been a change in the

estimates used to determine the recoverable amount. An impairment loss is reversed only to

the extent that the asset’s carrying amount does not exceed the carrying amount that would

have been determined (net of depreciation or amortization) if no impairment loss had been

recognized.

LEASES If substantially all risks and rewards associated with an asset are transferred to the

Group under fi nance lease agreements, the asset less accumulated depreciation and the corre-

sponding liability are recognized at the fair value of the asset or the lower net present value of

the minimum lease payments. Minimum lease payments are apportioned between the fi nance

charge and the reduction of the outstanding liability. The fi nance expense is allocated to each

period during the lease term so as to produce a constant periodic interest rate on the remaining

balance of the liability.

Under operating lease agreements, rent expenses are recognized on a straight-line basis

over the term of the lease.

IDENTIFIABLE INTANGIBLE ASSETS Acquired intangible assets are valued at cost less accumu-

lated amortization (except for assets with indefi nite useful lives) and impairment losses. Amorti-

zation is calculated on a straight-line basis with the following useful lives:

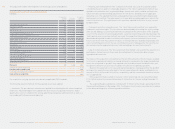

USEFUL LIVES OF IDENTIFIABLE INTANGIBLE ASSETS

Years

Trademarks

Software

Patents, trademarks and concessions

indefi nite

3 – 5

5 – 15

In 2007, the adidas Group determined that there was no impairment necessary for any of its

trademarks with indefi nite useful lives.

The recoverable amount is determined on the basis of fair value less costs to sell, which are

calculated with 1 % of the fair value. The fair value is determined through discounting the royalty

savings after tax and adding a tax amortization benefi t, resulting from the amortization of the

acquired asset (relief-from-royalty method). These calculations use projections of net sales

related royalty savings, based on fi nancial planning which covers a period of fi ve years in total.

Royalty savings beyond this period are extrapolated using steady growth rates of 2.5% (2006:

2%). The growth rates do not exceed the long-term average growth rate of the business to which

the trademarks are allocated.

The discount rate is based on a weighted average cost of capital calculation considering a

fi ve-year average debt/equity structure and fi nancing costs including the Group’s major competi-

tors. The discount rate used is after-tax rates and refl ects specifi c equity and country risk. The

applied discount rate is 7.5 % (2006: 7.5 %).

Expenditures for internally generated intangible assets are expensed as incurred if they do

not qualify for recognition.

GOODWILL Goodwill is the excess of the purchase cost over the fair value of acquired identifi able

assets and liabilities. Goodwill arising from the acquisition of a foreign entity and any fair value

adjustments to the carrying amounts of assets and liabilities of that foreign entity, are treated as

assets and liabilities of the reporting entity respectively, and are translated at exchange rates

prevailing at the date of the initial consolidation. Goodwill is carried in the functional currency of

the acquired foreign entity.

Acquired goodwill is valued at cost less accumulated impairment losses. Effective January 1,

2005, scheduled amortization of goodwill ceased due to changes in IFRS. Goodwill is tested an-

nually for impairment, and additionally when there are indications of potential impairment.

Goodwill has been allocated for impairment testing purposes to three cash-generating units.

The Group’s cash-generating units are identifi ed according to brand of operations in line with the

internal management approach. The adidas Group has thus defi ned the three segments adidas,

Reebok and TaylorMade-adidas Golf as the relevant cash-generating units.