Reebok 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

092

ANNUAL REPORT 2007 --- adidas Group GROUP MANAGEMENT REPORT - OUR FINANCIAL YEAR -- Group Business Performance - Treasury

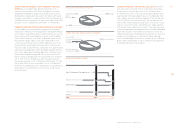

CURRENCY MIX BROADLY UNCHANGED The majority of our

Group’s gross borrowings are denominated in euros and US

dollars. In an effort to minimize the level of short-term variable

interest rate borrowings, 2007 debt reduction was targeted at

euro-denominated instruments, which are mainly variable-rate

fi nancing arrangements. In addition, our US dollar- denominated

fi nancing declined in absolute terms mainly as a result of the

US dollar depreciation versus the euro. Consequently, the

currency split of our gross borrowings at the end of 2007 was

broadly unchanged versus the prior year. Gross borrowings

denominated in euros accounted for 51 % of total gross

borrowings (2006: 51 %). The share of gross borrowings held

in US dollars increased slightly to 45 % (2006: 44 %).

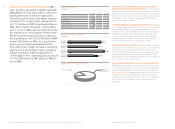

INTEREST RATE INCREASES The weighted average interest

rate on the Group’s gross borrowings rose 0.5 percentage

points to 5.3 % in 2007 (2006: 4.8%), mainly as a result of higher

interest rates in the Euro Zone. As a result, our debt reduction

in 2007 focused primarily on decreasing the Group’s variable

fi nancing arrangements to better protect against future interest

rates increases. see Risk and Opportunity Report, p. 104 Long-term

fi xed-rate fi nancing amounted to around 70 % of the Group’s

total fi nancing at the end of 2007 (2006: around 65 %). Variable

fi nancing amounted to around 30 % of total fi nancing at the

end of the year (2006: around 35 %).

STANDARD FINANCIAL COVENANTS Under our committed

credit facilities we have entered into various covenants. These

covenants include limits on our disposal of fi xed assets and the

amount of debt secured by liens we may incur. In addition, our

fi nancial arrangements contain equity ratio covenants, mini-

mum equity covenants as well as net loss covenants. If we fail

to meet any covenant and are unable to obtain a waiver from

a majority of partner banks, borrowings would become due

and payable immediately. As at December 31, 2007, we were

in full compliance with all of our covenants. Going forward, we

are highly confi dent that we will continue to be compliant with

these covenants as we expect sustainable strong cash fl ows for

the foreseeable future. see Outlook, p. 118 We currently believe

that cash generated by operations, together with access to

external sources of funds, will be suffi cient to meet our oper-

ating and capital needs in the foreseeable future.

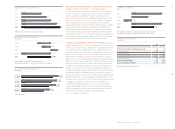

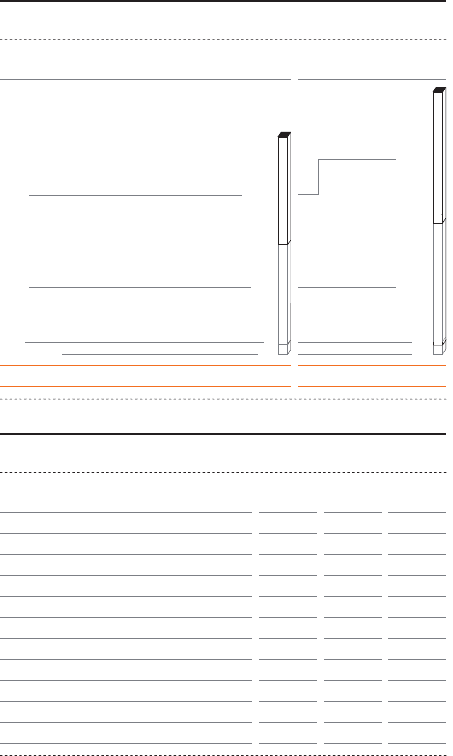

GROSS BORROWINGS SIGNIFICANTLY REDUCED Gross

borrowings decreased by 17 % to € 2.146 billion at the end of

2007 from € 2.578 billion in the prior year. Bank borrowings

decreased 28 % to € 198 million from € 275 million in the prior

year. Our private placements in the USA, in Europe and in Asia

decreased 12 % to € 1.564 billion in 2007 (2006: € 1.784 billion).

The current value of the convertible bond increased 2 % to

€ 384 million in 2007 from € 375 million in the prior year,

refl ect ing the accrued interest on the debt component in

accordance with IFRS requirements. No commercial paper was

outstanding at the end of 2007 (2006: € 144 million).

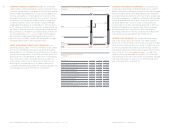

ISSUED BONDS AT A GLANCE

€

in millions

Issued Bonds Volume Coupon Maturity

Asian Private Placement

Asian Private Placement

Asian Private Placement

Asian Private Placement

German Private Placement

French Private Placement

US Private Placement

US Private Placement

Convertible Bond

Other Private Placements

USD 218 variable 2009

JPY 3,000 fi xed 2009

EUR 26 variable 2010

AUD 16 variable 2010

EUR 150

fi xed/variable

2010

EUR 150 variable 2011 – 2012

USD 175 fi xed 2015

USD 1,000 fi xed 2009 – 2016

EUR 400 2.50 % 2018

EUR 399

fi xed/variable

2008 – 2012

200

7 2006

T

otal

2

,146 2,578

87

1,314

1,145

32

CURRENCY SPLIT OF GROSS BORROWINGS

€

in milli

o

n

s

JPY

5

USD 959

All others 90

EUR

1,

092