Reebok 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

ANNUAL REPORT 2007 --- adidas Group

03

2009 REVENUE SYNERGIES FROM REEBOK INTEGRATION

We have an ambitious target to generate around € 500 million

of incremental revenues by 2009 related to the Reebok

inte gration. We estimate one-time expenses associated with

the generation of revenue synergies to be between € 15 mil-

lion and € 25 million in 2009. Specifi c initiatives to generate

revenue synergies include:

- Branded apparel: We expect to deliver around € 100 million

from leveraging adidas’ industry-leading branded apparel

know-how to strengthen and expand Reebok’s branded apparel

efforts.

- Licensed products: At brand adidas, we expect to generate

around € 100 million of additional sales in licensed products.

Having transferred the NBA contract to adidas, we can further

expand this exclusive partnership more effectively – in particu-

lar outside of North America. We will also focus on utilizing

Reebok’s sales and production capabilities for licensed prod-

ucts of brand adidas, particularly in North America.

- Regional initiatives: We expect around € 100 million of

incremental revenue synergies from greater regional traction

in Europe and Asia. This will result from Reebok product

category initiatives in underdeveloped markets with a strong

existing adidas infrastructure.

- Distributor buyouts: We project around € 200 million in

incremental sales synergies to result from exercising more

control over the Reebok brand around the globe, particularly

in high-growth markets in Asia and Latin America as well as

Emerging Europe. This will be achieved by buying out distrib-

utors and joint venture partners.

2009 COST SYNERGIES FROM REEBOK INTEGRATION During

our integration planning phase, we identifi ed signifi cant annual

cost of sales and operating expense synergy potential. We

expect to realize the full amount of around € 175 million in

2009. In particular, we project cost savings to come from the

following areas:

- Cost of sales: By integrating Reebok into our Global Opera-

tions function, we expect to achieve a cost of sales reduction

through optimized purchasing processes by 2009.

- Sales and marketing, distribution, administration and IT:

We have also identifi ed the opportunity to generate operating

expense savings by realizing various initiatives such as joint

media buying, offi ce consolidation in Europe and Asia, harmo-

nizing and consolidating our IT systems, eliminating duplicative

corporate functions and sharing fi nance and administrative

services across the Group.

2009 OUTLOOK CONFIRMED As a result of continued under-

lying growth of our brands and the synergies from the Reebok

integration, we expect a strong top- and bottom-line development

again in 2009. We project Group sales to increase at a high-

single-digit rate on a currency-neutral basis. This development

will be driven by continued strength at adidas and TaylorMade-

adidas Golf as well as the ongoing revitalization of the Reebok

business segment. The Group’s gross margin is expected to be

between 46 and 48 % in 2009. Positive effects from an improv-

ing product and geographical mix, own-retail expansion and

cost synergies derived as a result of the integration of Reebok

will be largely offset by increasing input prices driven by higher

raw material prices, freight rates and labor costs. We also

expect the Group’s operating margin to increase to approxi-

mately 11 % in 2009, driven by a modestly lower marketing

working budget as well as effi ciency gains largely related

to Reebok integration cost synergies. This is expected to lead

to an improvement of the Group’s operating expenses as a

percentage of sales. Net income is forecasted to increase at

a double-digit rate in 2009 as a result of our continuing top-line

growth and improved profi tability projected at all brands.

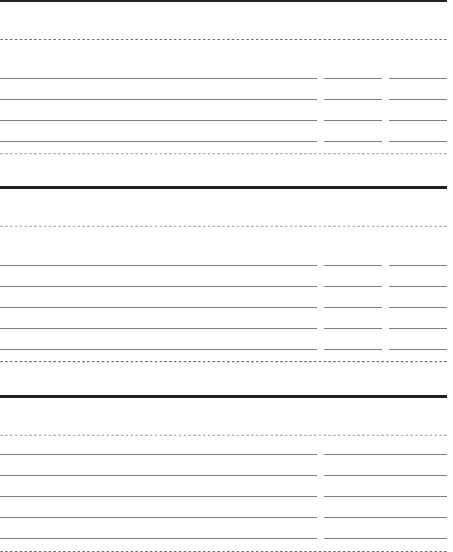

GROUP 2009 FINANCIAL TARGETS

Currency-neutral sales growth high-single-digit

Gross margin 46 % to 48 %

Operating margin approx. 11 %

Net income growth double-digit

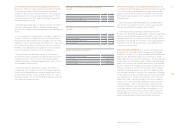

PHASING OF INTEGRATION REVENUE SYNERGIES

€

in million

s

PHASING OF INTEGRATION COST SYNERGIES

€ in million

s

2008 2009

Annual revenue synergies

Average one-time cost per year

2008 2009

Annual cost savings

Average one-time cost per year

Net cost savings

250 500

15 – 25 15 – 25

175 175

70 —

105 175