Reebok 2007 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

172

ANNUAL REPORT 2007 --- adidas Group CONSOLIDATED FINANCIAL STATEMENTS - Notes to the Consolidated Balance Sheet

The actuarial valuations of the defi ned benefi t plans are made at the end of each reporting

period. The assumptions for employee turnover and mortality are based on empirical data, the

latter for Germany on the 2005 G version of the mortality tables of Dr. Heubeck. The actuarial

assumptions in Germany and in other countries are not materially different.

As of January 1, 2005, due to application of the amendment to IAS 19 “Employee Benefi ts”

issued in December 2004, the Group recognizes actuarial gains or losses of defi ned benefi t plans

arising during the fi nancial year immediately outside the income statement in the statement

of recognized income and expense. The actuarial gain recognized in the statement of recog-

nized income and expense for 2007 was € 18 million (2006: € 2 million). The cumulative recog-

nized actuarial losses amounted to € 12 million (2006: € 30 million). see also Note 21

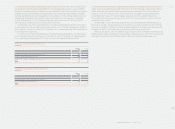

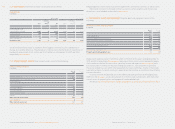

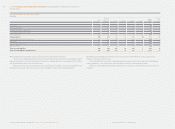

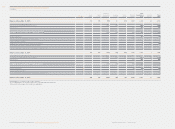

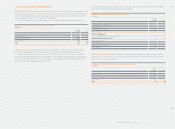

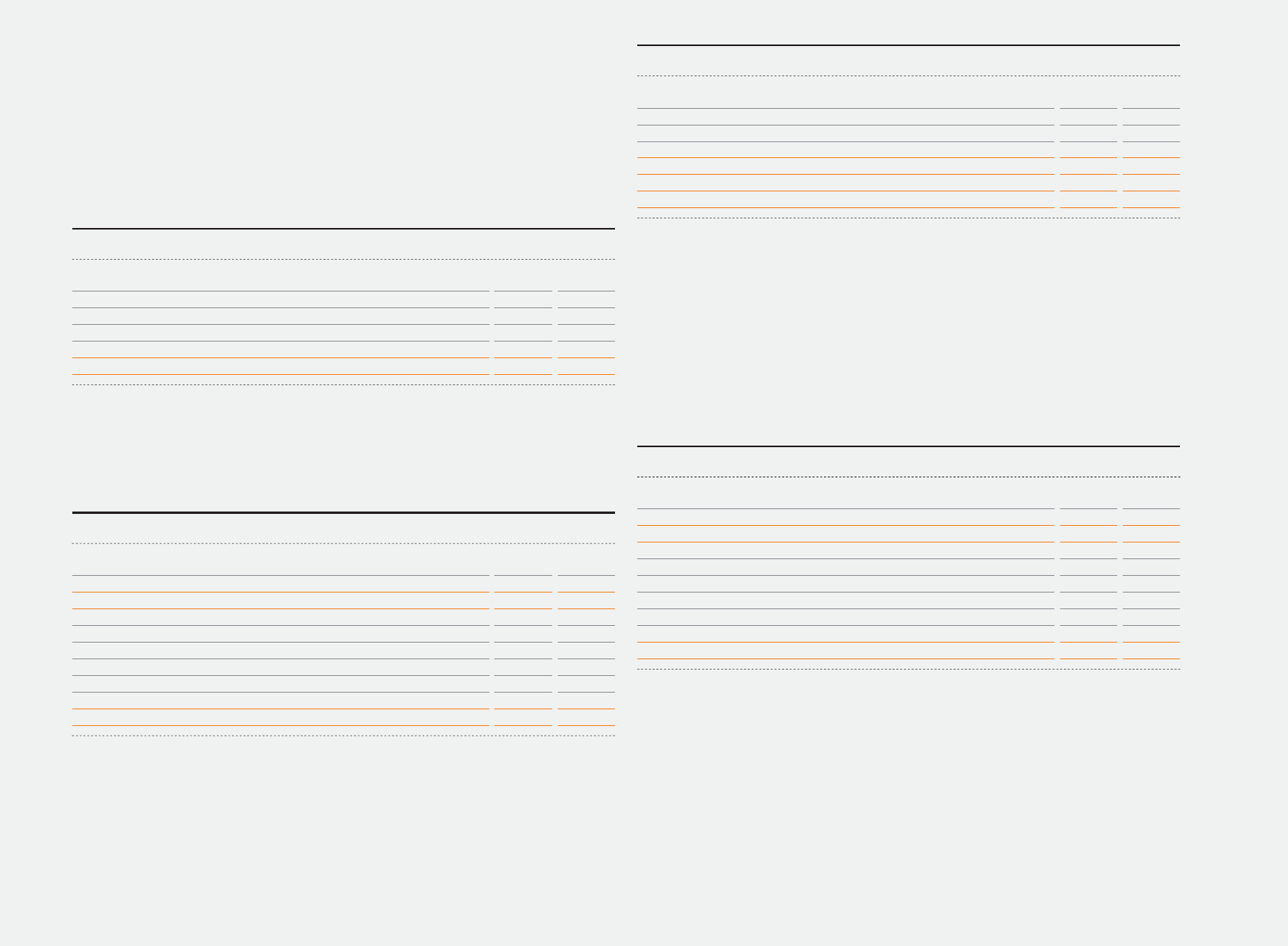

PENSION EXPENSES FOR DEFINED BENEFIT PLANS

€ in millions

Year ending Dec. 31

2

007 2006

Current service cost

Interest cost

Expected return on plan assets

P

ension expense

s

1

2 7

7

5

(4) (1)

15 11

Of the total pension expenses, an amount of € 12 million (2006: € 7 million) relates to employees

in Germany. Contributions to post-employment benefi t plans for employees living in Germany for

the year ending December 31, 2008, are expected to amount to € 7 million. The pension expense

is recorded within the operating expenses whereas the production-related part thereof is recog-

nized within the cost of sales.

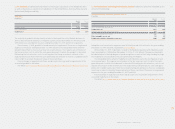

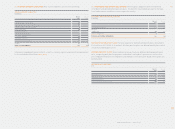

DEFINED BENEFIT OBLIGATION

€ in millions

2

007 2006

D

e

fi

ned bene

fi

t obli

g

ation as at January

1

Increase in companies consolidated

Currency translation differences

Current service cost

Interest cost

Pensions paid

Actuarial gain

D

efi ned benefi t obli

g

ation as at December

31

170 131

—

34

2

1

1

2 7

7

5

(

6

)

(6)

(

14

)

(2)

171 170

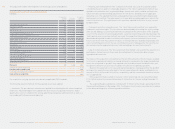

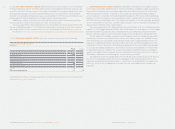

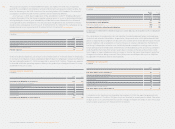

STATUS OF FUNDED AND UNFUNDED OBLIGATIONS

€

in milli

o

n

s

D

ec. 31 Dec. 31

2

007

2006

Present value of unfunded obligation

Present value of funded obligation

Present value o

f

total obligations

Fair value of plan assets 1)

Recognized liability for defi ned benefi t obligations

1) A portion of the € 60 million (2006: € 46 million) total of plan assets cannot be deducted, as it is not possible to use the exceeding amount

f

or another

p

lan.

1

14 110

57

60

171

1

7

0

(

56

)

(44)

115

1

2

6

6

The calculations of recognized assets and liabilities from defi ned benefi t plans are based upon

statistical and actuarial calculations. In particular, the present value of the defi ned benefi t obli-

gation is impacted by assumptions on discount rates used to arrive at the present value of future

pension liabilities and assumptions on future increases in salaries and benefi ts. Furthermore,

the Group’s independent actuaries use statistically based assumptions covering areas such as

future participant plan withdrawals and estimates on life expectancy. The actuarial assumptions

used may differ materially from actual results due to changes in market and economic condi-

tions, higher or lower withdrawal rates, or longer or shorter life spans of participants and other

changes in the factors being assessed. These differences could impact the assets or liabilities

recognized in the balance sheet in future periods.

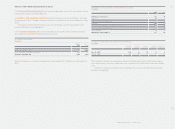

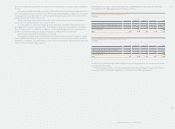

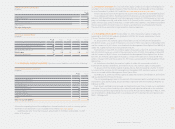

MOVEMENT IN PLAN ASSETS

€

in million

s

2007

2006

Fair value of plan assets at January 1

Increase in companies consolidated

Currency translation differences

Pensions paid

Contributions paid into the plan

Actuarial gain

Expected return on plan assets

Fair value of

p

lan assets at December

3

1

46 —

—

25

(

3

)

—

(

1

)

—

1

0

20

4

—

4

1

60 46

Contributions into the plan are only paid by the employer. In 2008, the expected payments into

the plan amount to € 1 million. The plan assets are invested in several pension funds. The return

on plan assets is in conformity with the current strategy of the pension funds. In 2007, the actual

return on plan assets was € 7 million (2006: € 2 million).