Reebok 2007 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

169

ANNUAL REPORT 2007 --- adidas Group

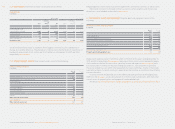

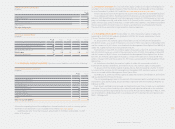

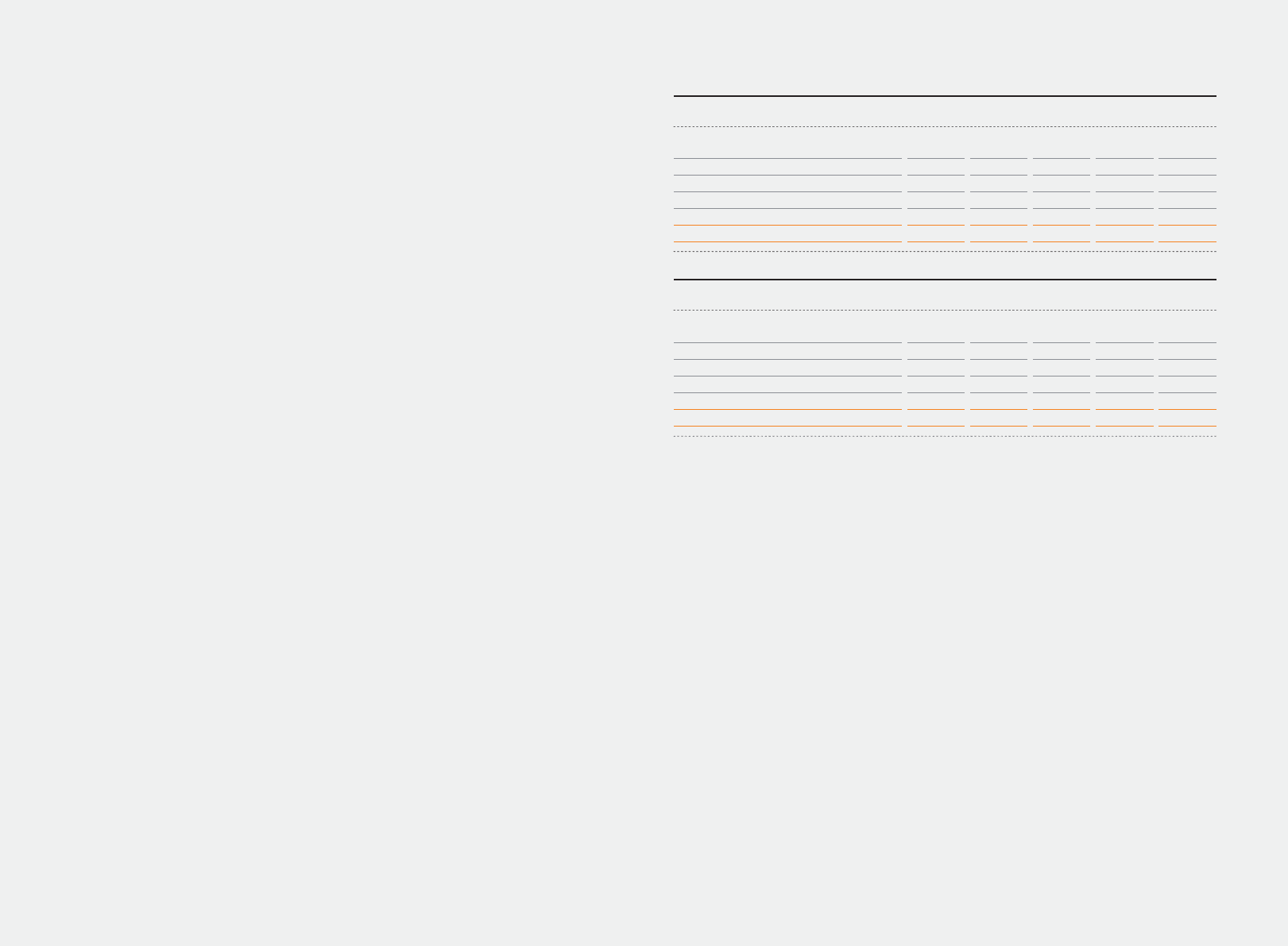

Gross borrowings decreased by € 432 million in 2007 compared to an increase of € 1.543 billion

in 2006.

Borrowings are denominated in a variety of currencies in which the Group conducts its busi-

ness. The largest portions of effective gross borrowings (before liquidity swaps for cash manage-

ment purposes) as at December 31, 2007 are denominated in euros (2007: 51 %; 2006: 51 %)

and US dollars (2007: 45 %; 2006: 44 %).

Month-end weighted average interest rates on borrowings in all currencies ranged from

5.2 % to 5.6 % in 2007 and from 4.2 % to 5.3 % in 2006.

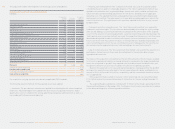

As at December 31, 2007, the Group had cash credit lines and other long-term fi nancing

arrangements totaling € 6.3 billion (2006: € 6.9 billion); thereof unused credit lines accounted

for € 4.1 billion (2006: € 4.4 billion). In addition, the Group had separate lines for the issuance

of letters of credit in an amount of approximately € 0.2 billion (2006: € 0.3 billion).

The Group’s outstanding fi nancings are unsecured.

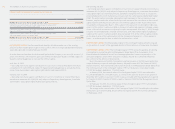

The private placement and convertible bond documentation each contain a negative-pledge

clause. Additionally, the private placement documentation contains minimum equity covenants

and net loss covenants. As at December 31, 2007, actual shareholders’ equity was well above the

amount of the minimum equity covenant.

The amounts disclosed as borrowings represent outstanding borrowings under the following

arrangements with aggregated expiration dates as follows:

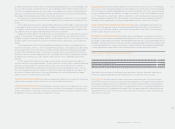

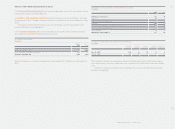

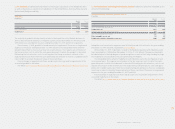

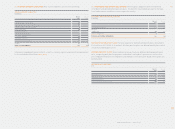

GROSS BORROWINGS AS AT DECEMBER 31, 2007

€

in milli

o

n

s

Between Between

Up to 1 year 1 and 3 years 3 and 5 years After 5 years

To

t

al

Bank borrowings incl. commercial paper

Private placements

Convertible bond

T

ota

l

— — 198 — 1

98

186 583 376 419

1,564

— 384 — — 384

186 967 574 419 2,146

9

7

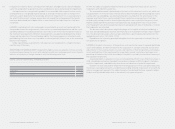

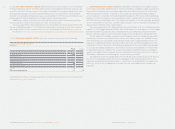

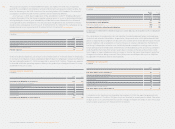

GROSS BORROWINGS AS AT DECEMBER 31, 2006

€

in milli

o

n

s

Between Between

Up to 1 year 1 and 3 years 3 and 5 years After 5 years

To

t

al

Bank borrowings incl. commercial paper

Private placements

Convertible bond

T

ota

l

144 — 275 —

419

109 610 474 591 1

,

784

— — 375 — 37

5

253 610 1,124 591 2,578

0

As all short-term borrowings are based upon long-term arrangements, the Group reports them

as long-term borrowings.

The borrowings related to our outstanding convertible bond changed in value, refl ecting the

accruing interest on the debt component in accordance with IFRS requirements.

05