Reebok 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

ANNUAL REPORT 2007 --- adidas Group

03

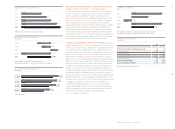

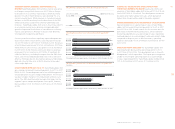

CURRENCY-NEUTRAL OWN-RETAIL SALES GROW 31 %

In 2007, Reebok own-retail sales grew 31 % on a currency- neutral

basis. In euro terms, revenues increased 22 % to € 371 million

from € 304 million in 2006. The fi rst-time inclusion of January,

which was not consolidated in 2006 due to the timing of the

acquisition, had a positive impact on revenue growth. On a like-

for-like basis, comparing sales for the full year periods of

both 2006 and 2007, Reebok own-retail sales increased 23 %.

Reebok own-retail activities made up 16 % of Reebok segment

sales in 2007, up from 12 % in the prior year. The share of own-

retail activities as a percentage of brand sales at Rockport was

signifi cantly above the segment average. The store base at

the end of 2007 comprised 142 concept stores and 288 factory

outlets. During the year, Reebok opened 95 concept stores and

52 factory outlets. Major openings in 2007 included concept

stores in Hong Kong and Moscow.

REEBOK SEGMENT GROSS MARGIN SUPPORTED BY REALIZA-

TION OF COST SYNERGIES The gross margin of the Reebok

segment increased 3.7 percentage points to 38.7 % in 2007

from 35.0 % in 2006. This development was in line with

Management’s initial expectation of a gross margin increase.

The improvement was driven by the non-recurrence of negative

impacts from purchase price allocation. In 2006, these charges

amounted to € 76 million. In addition, cost synergies in the

segment’s cost of sales resulting from the combination of

adidas and Reebok sourcing activities had a positive effect.

A shift in the segment’s sales mix towards regions with

higher margins was partly offset by negative effects from

selective clearance initiatives in North America. In euro

terms, Reebok gross profi t grew 4 % to € 902 million in 2007

versus € 865 million in 2006.

ROYALTY AND COMMISSION INCOME INCREASES In 2007,

Reebok royalty and commission income grew 24 % to € 42 mil-

lion from € 34 million in the prior year. This improvement was

mainly due to the fi rst-time inclusion of January revenues.

Higher royalty rates also contributed to the increase. Reebok’s

royalty and commission income primarily relates to royalty

income for fi tness equipment.

OPERATING EXPENSES INCREASE Operating expenses as a

percentage of sales increased by 3.0 percentage points to 35.8 %

in 2007 versus 32.8 % in 2006. Additional expenses amounting

to around € 50 million for marketing, product development and

initiatives to grow the brand in emerging markets drove this

increase. These expenses mainly impacted the fi rst half of the

year. The majority was spent for the brand’s largest advertising

campaign of the year, “Run Easy”. see Reebok Strategy, p. 050 One-

time costs for the Reebok integration into the adidas Group

also negatively affected operating overhead development. The

negative effect from purchase price allocation on operating

expenses was € 12 million in 2007 (2006: € 13 million). Reebok’s

operating expenses grew 3 % to € 835 million in 2007 from

€ 812 million in the prior year.

OPERATING MARGIN UP 1.2 PERCENTAGE POINTS In 2007, the

operating margin of the Reebok segment increased by 1.2 per-

centage points to 4.7 % from 3.5 % in the prior year. This

de velopment was in line with Management’s initial expecta-

tions. Gross margin improvement more than offset the higher

operating expenses as a percentage of sales. As a result, Reebok’s

operating profi t increased 27 % to € 109 million in 2007 versus

€ 86 million in the prior year.

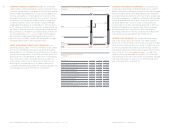

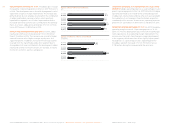

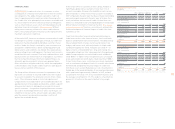

REEBOK GROSS MARGIN BY QUARTER

in

%

Q1 2006 1)

Q

1

2007

Q2 2006

Q2

2007

Q3 2006

Q

3 200

7

Q4 2006

Q

4

2007

1

) Only includes two months of the three-month

p

eriod

.

4

0

.

2

36.4

39.1

31.9

3

6.

8

35.7

38.

1

35.4

REEBOK OPERATING PROFIT BY QUARTER

€ in million

s

Q1 2006 1)

Q

1

2007

Q2 2006

Q2

2007

Q3 2006

Q

3 200

7

Q4 2006

Q

4

2007

1)

Only includes two months of the three-month period

.

84

58

(

1

)

(4)

6

17

21

15

200

7 2006

Tota

l

43

0 283

47

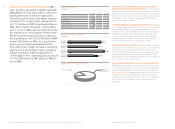

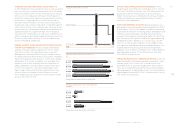

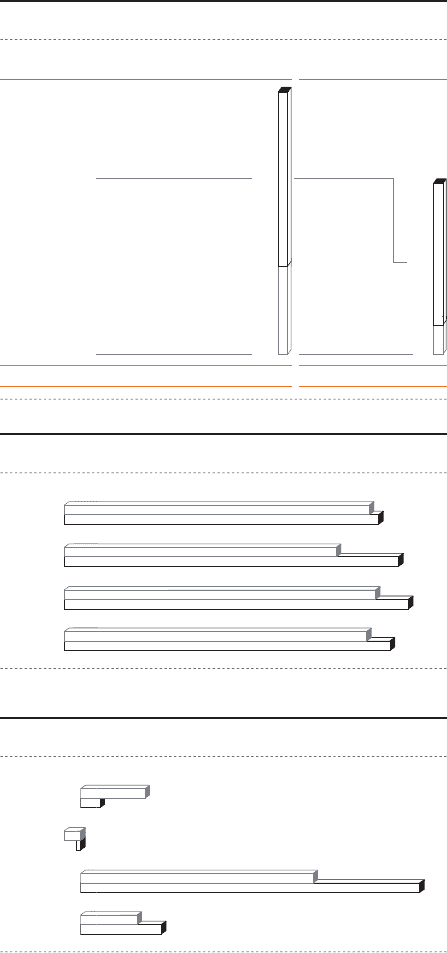

REEBOK OWN-RETAIL STORES

Concept Stores 142

236

F

actor

y

O

utlets

288