Reebok 2007 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162

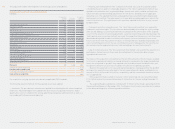

ANNUAL REPORT 2007 --- adidas Group CONSOLIDATED FINANCIAL STATEMENTS - Notes

RECOGNITION OF REVENUES Sales are recognized at the fair value of the consideration received

or receivable, net of returns, trade discounts and volume rebates, when the signifi cant risks and

rewards of ownership of the goods are transferred to the buyer, and when it is probable that the

economic benefi ts associated with the transaction will fl ow to the Group.

Royalty and commission income is recognized based on the contract terms on an accrual

basis.

ADVERTISING AND PROMOTIONAL EXPENDITURES Production costs for media campaigns are

included in prepaid expenses (other current and non-current assets) until the advertising is

fi nalized, after which they are expensed in full. Signifi cant media buying costs (e.g. broadcasting

fees) are expensed over the original duration of the campaign after usage.

Promotional expenses, including one-time up-front payments for promotional contracts, are

expensed systematically over the term of the agreements.

INTEREST Interest is recognized as income or expense as incurred (using the effective interest

method) and is not capitalized.

INCOME TAXES Current income taxes are computed in accordance with the applicable taxation

rules established in the countries in which the Group operates.

The Group computes deferred taxes for all temporary differences between the carrying

amount and the tax base of its assets and liabilities and tax loss carry-forwards. As it is not

permitted to recognize a deferred tax liability for goodwill, the Group does not compute any

deferred taxes thereon.

Deferred tax assets arising from deductible temporary differences and tax loss carry-for-

wards which exceed taxable temporary differences are only recognized to the extent that it is

probable that the company concerned will generate suffi cient taxable income to realize the

associated benefi t.

Income tax is recognized in the income statement except to the extent that it relates to items

recognized directly in equity, in which case it is recognized in equity.

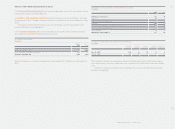

EQUITY COMPENSATION BENEFITS Stock options were granted to members of the Executive

Board of adidas AG as well as to the managing directors / senior vice presidents of its affi liated

companies and to further senior executives of the Group in connection with the Management

Share Option Plan (MSOP) of adidas AG. see also Note 32 The Company has the choice to settle

a potential obligation by issuing new shares or providing the equivalent cash compensation.

When options are exercised and the Company decides to issue new shares, the proceeds

received net of any transaction costs are credited to share capital and capital surplus. In the

past, the Company has chosen to issue new shares. It is planned to maintain this methodology

in the future.

In accordance with IFRS 2, an expense and a corresponding entry to equity for equity-settled

stock options and an expense and a liability for cash-settled stock options is recorded.

The Group has applied IFRS 2 retrospectively and has taken advantage of the transitional

provisions of IFRS 2 with respect to equity-settled awards. As a result, the Group has applied

IFRS 2 only to equity-settled awards granted after November 7, 2002, that had not yet vested on

January 1, 2005 [Tranche V (2003)].

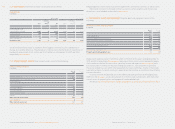

ESTIMATION UNCERTAINTIES The preparation of fi nancial statements in conformity with IFRS

requires the use of assumptions and estimates that affect reported amounts and related dis-

closures. Although such estimates are based on Management’s best knowledge of current

events and actions, actual results may ultimately differ from these estimates.

The key assumptions concerning the future and other key sources of estimation uncertainty

at the balance sheet date which have a signifi cant risk of causing a material adjustment to

the carrying amounts of assets and liabilities within the next fi nancial year are outlined in the

respective Notes, in particular goodwill see Note 11, trademarks see Note 12, provisions

see Note 16, pensions see Note 18 as well as deferred taxes see Note 27.