Reebok 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.058

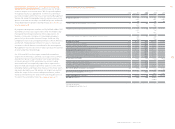

ANNUAL REPORT 2007 --- adidas Group GROUP MANAGEMENT REPORT – OUR GROUP -- Structure and Strategy - Internal Group Management System

CAPITAL EXPENDITURE TARGETED TO MAXIMIZE FUTURE

RETURNS Improving the effectiveness of the Group’s capital

expenditure is another lever to maximize the Group’s free cash

fl ow. Our capital expenditure is controlled with a top-down,

bottom-up approach: In a fi rst step, Group Management

defi nes focus areas and an overall investment budget based

on investment requests by brand management. Our operating

units then align their initiatives within the scope of assigned

priorities and available budget. We evaluate potential return on

planned investments utilizing the net present value or internal

rate of return method, in relation to the cost of capital. Specifi c

investments are assessed according to the principles of risk-

weighted returns. For large investment projects, timelines and

deviations versus budget are monitored on a monthly basis

throughout the course of the project.

M & A ACTIVITIES FOCUS ON LONG-TERM VALUE CREATION

POTENTIAL We expect the majority of our Group’s growth to

come from organic business. However, as part of our commit-

ment to ensuring sustainable profi table development, we

regularly review merger and acquisition options that may pro-

vide additional commercial and opera tional opportunities.

Acquisitive growth focus is primarily related to a potential for

increasing market penetration, strengthening our Group’s

positioning within a sports category or addressing new con-

sumer segments. The strategies of any potential acquisition

candidate must correspond with the Group’s long-term

direc tion. Maximizing return on invested capital above the cost

of capital is a core consideration in our decision-making pro-

cess. Of particular importance is evaluating the potential

impact on our Group’s free cash fl ow. We assess current and

future projected key fi nancial metrics to evaluate a target’s

contribution potential. In addition, careful consideration is

given to any potential fi nancing implications which may be

required to complete a prospective acquisition.

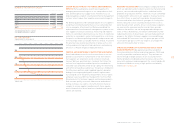

COST OF CAPITAL METRIC USED TO MEASURE INVESTMENT

POTENTIAL Creating value for our shareholders by earning a

return on invested capital above the cost of that capital is a

guiding principle of our Group strategy. We source capital from

equity and debt markets. Therefore, we have a responsibility

that our return on capital meets the expectations of both equity

shareholders and creditors. Our Group calculates the cost of

capital utilizing the weighted average cost of capital (WACC)

formula. This metric allows us to calculate the minimum

required fi nancial returns of planned capital investments. The

cost of equity is computed utilizing the risk-free rate, market

risk premium and beta. Cost of debt is calculated using the

risk-free rate, credit spread and average tax rate.

STRUCTURED PERFORMANCE MEASUREMENT SYSTEM Our

Group has developed an extensive performance measurement

system, which utilizes a variety of tools to measure the per-

formance of the adidas Group and our brand segments. To

evaluate the Group’s current sales and profi tability develop-

ment, we monitor our annual budget on a monthly basis,

addressing shortfalls and identifying additional opportunities.

Further, we monitor operating margin developments at all

brands on a monthly basis. To optimize the Group’s balance

sheet, we control operating working capital movement via a

monthly monitoring system. When negative deviations exist

between actual and target numbers, we perform a detailed

analysis to identify and address the cause. In addition, we

benchmark the Group and brand results with those of our major

competitors on a quarterly basis. We measure the Group’s

future top-line development on the basis of our order backlog

development. Order backlogs comprise orders received within

a period of up to nine months in advance of the actual sale. Our

order book represents approximately 70 % of future anti cipated

revenues. Also increasingly important are other indicators

such as our own-retail activities and at-once business, which

are not represented in the order book. We provide updates on

these developments as part of our quarterly reports. see Outlook,

p. 118

TIGHT OPERATING WORKING CAPITAL MANAGEMENT Due to

a comparatively low level of fi xed assets required in our busi-

ness, operating working capital management is a major focus

of our efforts to improve the effi ciency of the Group’s balance

sheet. We have made major strides in this area through tight

working capital management focused on continuously improv-

ing our Group’s inventories, accounts receivable and accounts

payable.

Our key metric is operating working capital as a percentage of

net sales. Monitoring the development of this key metric facili-

tates the measurement of our progress in improving the effi -

ciency of our business cycle. We strive to manage our

inventory levels to meet market demand and ensure fast re-

plenishment. Inventory ageing is controlled to reduce inventory

obsolescence and to optimize clearance activities. As a result,

stock turn development is the key performance indicator as it

measures the number of times the average inventory is sold

during a year, highlighting the amount of capital locked in

products in relation to our Group’s business. To minimize capi-

tal tied up in accounts receivable, we strive to continuously

improve collection efforts in order to reduce the Days of Sales

Outstanding (DSO) and improve the ageing of accounts receiv-

able. Likewise, we strive to continuously optimize payment

terms with our suppliers to best manage our accounts payable.