Reebok 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

080

ANNUAL REPORT 2007 --- adidas Group GROUP MANAGEMENT REPORT – OUR FINANCIAL YEAR -- Group Business Performance - Income Statement

Revenue synergies mainly occurred in the Reebok segment.

Sales increased incrementally in several countries for which

Reebok had purchased the distribution rights in order to better

control brand management and gain market share. Revenues

grew particularly strongly in Russia and China, where Reebok

took full control of distribution effective January 1, 2007. Reve-

nue synergies also had a small positive impact on sales devel-

opment in the adidas segment. This was a result of higher

revenues from the licensed business, in particular from our

partnership with the NBA.

Cost synergies resulting from the combination of adidas and

Reebok sourcing activities had a positive impact on the cost of

sales of both segments, in particular for adidas due to the

higher volume of products sourced compared to Reebok. Due

to the timing of sourcing improvements, cost synergies were

weighted towards the second half of the year. On a full year

basis, the positive impact on the Group’s gross margin was

largely offset by integration costs which negatively impacted

the Group’s operating expenses. These costs were recorded

in the HQ / Consolidation segment and to a lesser extent at

adidas and Reebok. In line with our initial expectations, we

realized revenue synergies of around € 100 million. Net cost

synergies exceeded initial expectations and amounted to

around € 20 million in the full year 2007.

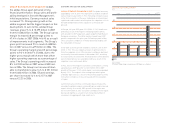

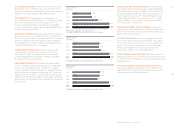

ADIDAS GROUP CURRENCY-NEUTRAL SALES GROW 7 %

In 2007, Group revenues increased 7 % on a currency-neutral

basis, mainly as a result of sales growth in the adidas seg-

ment. This development was in line with initial Management

expec tations of mid-single-digit growth. Currency movements

negatively impacted Group sales in euro terms. Group reve-

nues grew 2 % in euro terms to € 10.299 billion in 2007 from

€ 10.084 billion in 2006. On a like-for-like basis, including

Reebok’s revenues for the full twelve-month periods of both

years and excluding the effect from the dives titure of the GNC

wholesale business, Group sales also increased 7 %.

I

NCOME STATEMENT

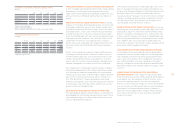

NO CHANGES IN ACCOUNTING POLICY The Group’s consoli-

dated fi nancial statements are prepared in accordance with

International Financial Reporting Standards (IFRS). In line with

IFRS, several new or amended standards and interpretations

were applied for the fi rst time in 2007. see Note 1, p. 157 Never-

theless, there were no changes in the Group’s consolidation

and accounting prin ciples. Therefore, changes in accounting

policy and changes in management discretion in the application

of accounting standards had no impact on Group business

per formance in the reporting period.

TWELVE MONTHS OF REEBOK RESULTS CONSOLIDATED

Several factors infl uenced the comparison of 2007 reported

results for the Group and our segments with the prior year.

Only eleven months of Reebok’s results were consolidated in

2006 due to the acquisition date (February 1, 2006). In 2007,

twelve months of the segment’s results were consolidated. This

had a positive impact on the comparison of Reebok segment

sales to the prior year. The segment’s operating margin, how-

ever, was negatively affected, as the month of January is

tradi tio nally characterized by higher-than-average clearance

activities. In ad dition, Reebok’s operating profi t was negatively

impacted by purchase price allocation charges, however

to a signifi cantly lesser extent compared to the prior year.

In 2007, the negative effect on Reebok’s operating profi t amounted

to € 12 million (2006: € 89 million). Sales and operating

margin

at TaylorMade-adidas Golf were negatively affected by the

divestiture of the Greg Norman Collection (GNC) wholesale

business, which was completed on November 21, 2006.

SYNERGIES SUPPORT OPERATIONAL PERFORMANCE The

operational performance of the adidas and Reebok segments

was positively impacted by the realization of revenue and cost

synergies resulting from the integration of the Reebok business

into the adidas Group.

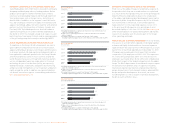

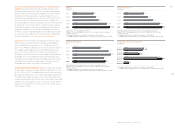

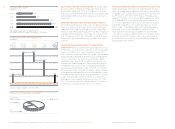

NET SALES

€

in milli

o

n

s

2003

2004 1)

2005 1)

2006 2)

2007

1

) Figures refl ect continuing operations as a result of the divestiture of the Salomon

b

usiness se

g

ment

.

2

)

Includin

g

Reebok business se

g

ment from February 1, 2006 onwards.

I

ncluding Greg Norman apparel business from February 1, 2006 to November 30, 2006.

5,860

6,636

10,084

10

,

29

9

6,267

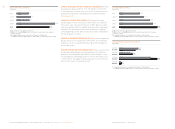

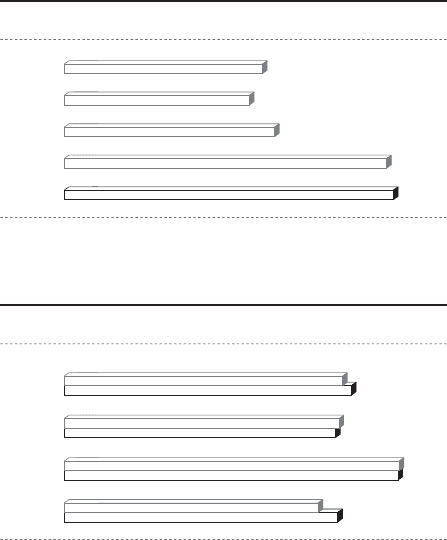

NET SALES BY QUARTER 1)

€

in milli

o

n

s

Q1 2006

Q

1 200

7

Q2 2006

Q

2 200

7

Q3 2006

Q3

200

7

Q4 2006

Q

4 200

7

1)

Includin

g

Reebok business se

g

ment from February 1, 2006 onwards.

I

ncluding Greg Norman apparel business from February 1, 2006 to November 30, 2006.

2,

941

2,949

2

,

40

0

2,428

2,53

8

2,459

2

,

41

9

2,248