Reebok 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

037

ANNUAL REPORT 2007 --- adidas Group

01

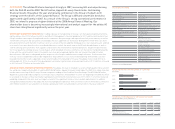

STRONG SUSTAINABILITY TRACK RECORD REFLECTED IN INDEX MEMBERSHIPS In recognition of our social and environmental

efforts, adidas AG is part of several sustainability indices. In 2007, adidas AG was included in the Dow Jones Sustainability Indexes

for the eighth consecutive year. The indexes rated the adidas Group as an industry leader on sustainability issues and corporate

social responsibility in the category “footwear, clothing & accessories”. In addition, the adidas Group was again included in

the FTSE4Good Index. This positive reassessment acknowledges the Group‘s social, environmental and ethical engagement, and

encourages us to continue and intensify our efforts to improve our sustainability performance. Also, adidas AG was included in

the Vigeo Group’s Ethibel Excellence, Ethibel Pioneer and ASPI Indices. The Ethibel Indices consist of companies that meet fi nancial

and sustainability performance criteria established by the independent organization Forum Ethibel. The ASPI Eurozone Index

is the European index of reference for companies and investors wishing to commit themselves in favor of sustainable development

and corporate social responsibility. Further, the adidas Group was included for the third consecutive time in the list of The Global

100 Most Sustainable Corporations in the World.

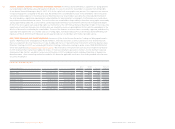

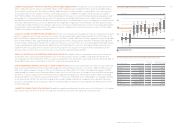

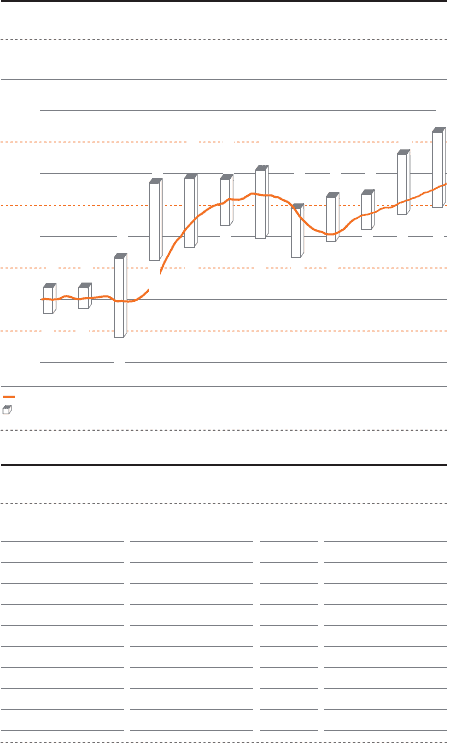

ADIDAS AG SHARE OUTPERFORMS MAJOR INDICES 2007 was a successful year for the adidas AG share. Our share price increased

by 36 % compared to the 2006 year-end level. As a result, our share signifi cantly outperformed the DAX-30 (+ 22 %) as well as the

MSCI World Textiles, Apparel & Luxury Goods Index (+ 8 %). The DAX-30 and the MSCI World Textiles, Apparel & Luxury Goods Index

both started strongly in 2007, supported by positive macroeconomic trends, strong corporate news fl ow and merger and acquisition

activity. However, index growth stalled in the second half of the year as a result of the crisis on the US subprime mortgage market,

rising commodity prices and increasing fears about the US economy falling into a recession. Although the Federal Reserve inter-

vened three times by cutting interest rates by a total of 75 basis points, the situation on the US market remained diffi cult with

spill-over effects on the country’s economy as well as international credit and capital markets.

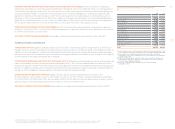

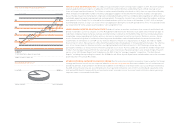

ADIDAS AG HISTORICALLY OUTPERFORMS BENCHMARK INDICES The adidas Group is committed to continuously enhancing

shareholder value. The long-term development of our share price refl ects investor confi dence and the growth potential of

our Group. Since our IPO in November 1995, our share has gained 490 %. This represents a clear outperformance of both the DAX-30

and the MSCI Index, which increased 266 % and 167 % respectively during the period.

ADR OUTPERFORMS COMMON STOCK DUE TO EURO APPRECIATION Since its launch on December 30, 2004, our Level 1 American

Depositary Receipt (ADR) facility has enjoyed great popularity among American investors. The Level 1 ADR closed the year at

US $ 37.20, representing an increase of 48 % versus the prior year (2006: US $ 25.11). Due to the appreciating euro, the ADR

outperformed our common stock. Despite growing volumes in the fi rst half of the year, the number of year-end ADRs outstanding

declined as a result of capital market uncertainty from the subprime mortgage crisis. The number of Level 1 ADRs outstanding

decreased slightly to 11.1 million at year-end 2007 (2006: 11.3 million). In November 2007, we decided to list the adidas AG ADR

on the international OTCQX. This electronic trading forum includes leading international companies with substantial operating

businesses and credible disclosure policies. With this listing, we expect to further increase trading of our ADRs by US investors

in 2008 and beyond.

CONVERTIBLE BOND TRADES AT A PREMIUM The publicly-traded convertible bond closed the year at € 202.65, which is 31 % higher

than its prior year level (2006: € 154.90). This represents a premium of around 0.8 % above par value of the share.

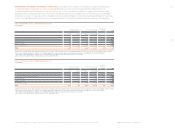

HIGH AND LOW SHARE PRICES PER MONTH

Jan. 2007 Dec. 2007

50

45

40

35

—

3

0-day movin

g

avera

ge

H

ig

h and low share pr

i

ces

38.8

3

3

6.

3

6

3

8.80

3

6.7

5

41.24

3

4.

50

47.19

4

0.6

3

47.55

41.70

47.4

7

4

3

.4

0

48.16

4

2

.4

0

45.17

40

.

8

4

4

6

.

08

42.1

5

46.

2

7

43

.1

0

49.44

44.29

51.26

44.87

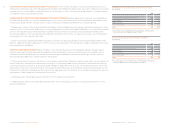

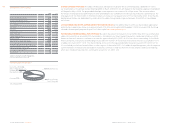

SHAREHOLDER RIGHTS NOTIFICATIONS RECEIVED IN 2007

Threshold Voting rights of total

Date of notifi cation Notifying party crossed shares outstanding

Dec. 20 FMR LLC > 3 % 3.06 %

May 31 UBS AG < 3 % 2.67 %

May 29 UBS AG > 3 % 3.23 %

May 14 Michael Ashley < 3 % 2.87 %

May 04 UBS AG < 3 % 2.09 %

Apr. 30 UBS AG > 3 % 3.12 %

Mar. 23 Michael Ashley > 3 % 3.14 %

Mar. 20 + 21 AMVESCAP PLC > 5 % 5.087 %