Reebok 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

090

ANNUAL REPORT 2007 --- adidas Group GROUP MANAGEMENT REPORT - OUR FINANCIAL YEAR -- Group Business Performance - Balance Sheet and Cash Flow Statement - Treasury

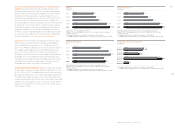

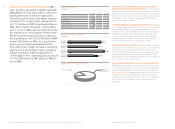

CAPITAL EXPENDITURES FOCUS ON OWN-RETAIL ACTIVITIES

Capital expenditure is the total cash expenditure for the pur-

chase of tangible and intangible assets and the construction

of tangible assets. Group capital expenditures increased 4 % to

€ 289 million in 2007 (2006: € 277 million). The adidas seg-

ment accounted for 52 % of Group capital expenditures (2006:

49 %). Expenditures in the Reebok segment accounted for

20 % of total expenditures (2006: 26 %). The majority of adidas

and Reebok expenditures focused on the expansion of own-

retail activities. TaylorMade-adidas Golf capital expenditures

accounted for 4 % of total expenditures (2006: 5 %). The

remaining 24 % of total capital expenditures was recorded

in the HQ / Consolidation segment (2006: 20 %) and was mainly

related to integration initiatives such as the construction of

the shared warehouse facility in the UK and the Group-wide

harmonization of IT systems.

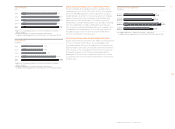

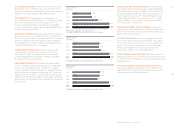

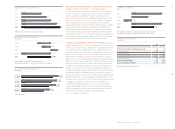

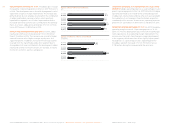

EQUITY BASE FURTHER STRENGTHENED The Group’s equity

base was further strengthened compared to the prior year.

Shareholders’ equity rose 7 % to € 3.023 billion at the end of

2007 versus € 2.828 billion in 2006. The net income generated

during the period more than offset negative currency trans-

lation effects.

EXPENSES RELATED TO OFF-BALANCE SHEET ITEMS Our

most important off-balance sheet assets are operating leases,

which are related to retail stores, offi ces, warehouses and

equipment. The Group has entered into various operating

leases as opposed to property acquisitions to reduce exposure

to property value fl uctuations. Rent expenses increased 21 %

to € 337 million in 2007 from € 278 million in the prior year,

mainly due to the continued expansion of adidas own-retail

activities.

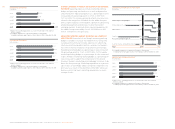

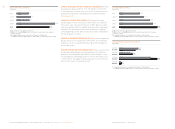

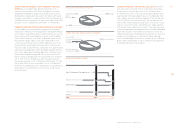

CASH FLOW DEVELOPMENT REFLECTS OPERATIONAL

STRENGTH In 2007, cash infl ow from operating activities was

€ 780 million. It was primarily used to fi nance working capital

needs in accordance with the seasonality of our business.

Cash outfl ow for investing activities was € 285 million and was

mainly related to spending for property, plant and equipment

such as investment in the furnishing and fi tting of adidas

and Reebok own-retail stores. In addition, investments also

related to the Reebok integration. Major integration projects

included the construction of the shared adidas and Reebok

ware housing and distribution center in the UK. Cash outfl ow

for fi nancing activities totaled € 510 million and was related

to the payment of dividends as well as the reduction of long-

term borrowings. Operating activities provided less cash than

used in investing and fi nancing activities. As a result of this

development and a negative exchange rate effect of € 1 mil-

lion, cash and cash equivalents decreased by € 16 million to

€ 295 million at the end of 2007 (2006: € 311 million).

SHAREHOLDERS’ EQUITY

€

in milli

o

n

s

2003 1)

2004 1)

2005

2006 2)

200

7

1

) Restated due to a

pp

lication of amendment to IAS 19.

2

) Includin

g

Reebok business se

g

ment from February 1, 2006 onwards.

1,544

2,684

2,828

3

,

02

3

1,285

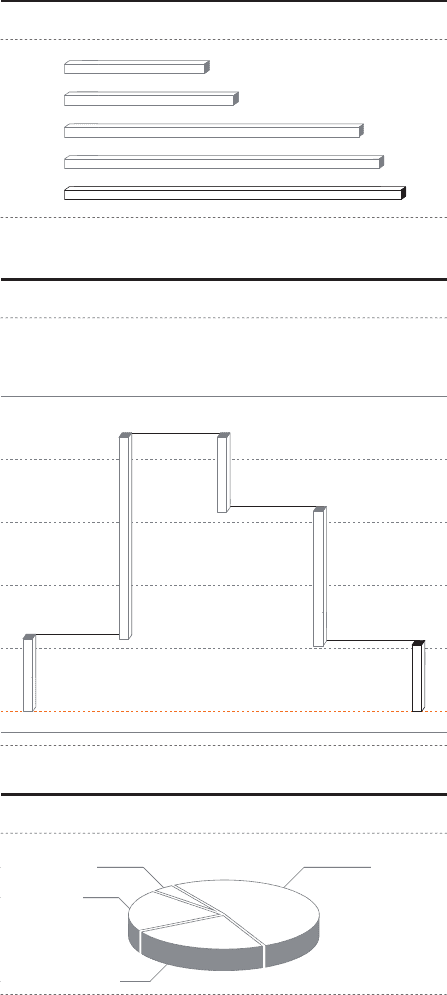

2007 CAPITAL EXPENDITURE BY SEGMENT

Reebok

2

0 %

5

2

%

adidas

TaylorMade-

adidas Golf 4

%

Cash

C

ash

and cash Net cash Net cash Net cash an

d

cas

h

equivalents provided by used in used in equivalents

at the end operating investing fi nancing

a

t th

e

e

n

d

of 2006 activities activities activities

o

f

2007

1

)

1)

Includes a negative exchange rate effect of € 1 million

.

CHANGE IN CASH AND CASH EQUIVALENTS

€ in millions

311

780 (285)

(510)

295

HQ /

Consolidation

2

4 %