Reebok 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

038

ANNUAL REPORT 2007 --- adidas Group TO OUR SHAREHOLDERS - Our Share

HIGHER DIVIDEND PROPOSED The adidas AG Executive and Supervisory Boards will recommend paying a dividend of € 0.50 to

our shareholders at the Annual General Meeting (AGM) on May 8, 2008 (2006: € 0.42). Subject to the meeting’s approval, the dividend

will be paid on May 9, 2008. The proposed dividend per share represents an increase of € 0.08 per share. This increase refl ects

the Group’s strong operational performance in 2007 and highlights our confi dence in the Group’s future business performance. The

total payout of € 102 million (2006: € 85 million) refl ects an increase of our payout ratio to 19 % of net income (2006: 18 %). The divi-

dend proposal follows our dividend policy, under which the adidas Group intends to pay out between 15 and 25 % of consolidated

net income.

2007 AGM RESOLVES ON THE AUTHORIZATION FOR SHARE BUYBACK At the AGM on May 10, 2007, our share holders approved an

authorization to repurchase shares in an amount of up to 10 % of the stock capital until November 9, 2008. In January 2008, the Group

initiated a share buyback program of up to 5 % of share capital. see Subsequent Events, p. 117

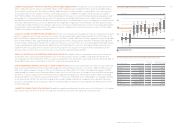

INCREASINGLY INTERNATIONAL INVESTOR BASE Based on the amount of invitations to our AGM in May 2007, we estimate that

adidas AG currently has around 80,000 shareholders. According to our latest ownership analysis conducted in February 2008,

known institutional investors continue to account for approximately 96 % (2007: 96 %) of our shares outstanding. In the North

American market, institutional shareholdings increased to 40 % (2007: 37 %). German institutional investors accounted for 11 %

of adidas AG shares (2007: 12 %). The shareholdings in the rest of Europe excluding Germany decreased to 38 % (2007: 40 %).

2 % are held by institutional shareholders in other regions of the world (2007: 2 %). adidas Group Management, which comprises

current members of the Executive and Supervisory Boards, continues to hold less than 5 % in total. Smaller, undisclosed holdings,

which also include private investors, continued to account for 4 % (2006: 4 %).

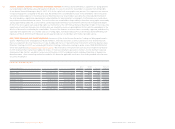

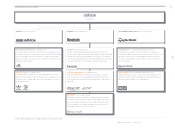

SHARE RATIOS AT A GLANCE

2007

2006

Basic earnings per share €

2

.7

1

2.37

Diluted earnings per share €

2

.57 2.25

Operating cash fl ow per share €

3

.8

3

3.74

Year-end price €

5

1.2

6

37.73

Year-high € 51.

26

44.00

Year-low €

3

4.

50

34.66

Dividend per share € 0.

50

1)

0.42

Dividend payout € in millions

102

85

Dividend payout ratio % 1

9

18

Dividend yield %

0

.9

8

1.11

Shareholders’ equity per share €

1

4.

8

5 13.90

Price-earnings ratio at year-end 1

9

.

9

16.8

Average trading volume per trading day shares

2,

231

,

48

5

5

2,039,527

DAX-30 ranking 2) at year-end

by market capitalization

21

24

by turnover 2

2

21

1

) Subject to Annual General Meeting approval

.

2

) As re

p

orted by Deutsche Börse AG.

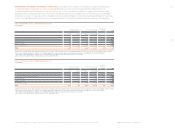

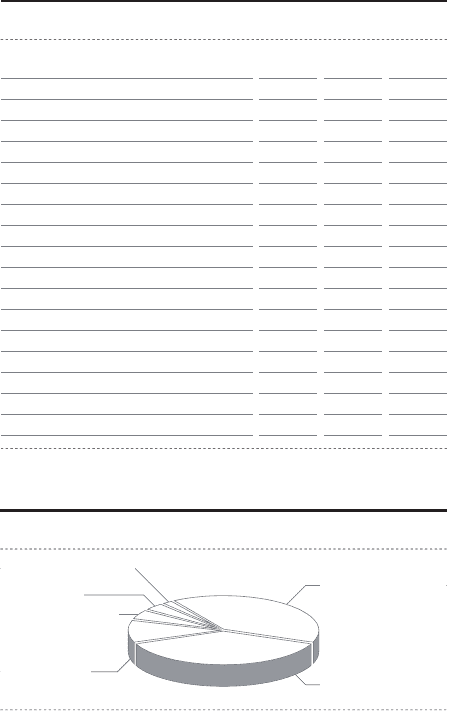

SHAREHOLDER STRUCTURE 1)

1

)

As at Februar

y

2008

.

Other, Undisclosed

Holdings

4

%

Rest of the World

2

%

Germany

1

1 %

Management < 5 %

40

%

North America

3

8

%

Rest of Europe

(excl. Germany)