Reebok 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

039

ANNUAL REPORT 2007 --- adidas Group

01

1) At year-end 2007. Source: Bloomber

g

.

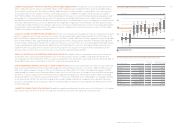

ANALYSTS RAISE RECOMMENDATIONS The adidas Group continued to receive strong analyst support in 2007. Around 30 analysts

regularly published research reports on adidas AG. In 2007, both Lehman Brothers and Goldman Sachs shifted coverage on our

share to Europe from North America. This follows a similar trend initiated by other banks in 2006, after our acquisition of Reebok,

which strongly consolidated the number of footwear and apparel suppliers in the USA. Now the majority of adidas coverage takes

place in Europe. Analyst recommendations improved considerably throughout 2007, as confi dence grew regarding our ability to deliver

sustainable operating margin improvement and earnings growth. The majority of analysts are confi dent about the medium- and long-

term potential of our Group. This is refl ected in the recommendation split for our share as of December 31, 2007. 84 % of analysts

recommended investors to “buy” our share in their last publication during the 12-month period (2006: 38 %). 16 % advised to hold

our share (2006: 56 %). No analyst recommended a “sell” rating (2006: 6 %).

AWARD-WINNING INVESTOR RELATIONS ACTIVITIES adidas AG strives to maintain continuous close contact to institutional and

private shareholders as well as analysts. In 2007, Management and the Investor Relations team spent almost twenty full days on

roadshows and presented at numerous national and international conferences. At the AGM in May 2007, we conducted a private

shareholder survey regarding satisfaction with our share as an investment as well as our Investor Relations services. Survey

results illustrated a high level of satisfaction from long-term shareholders and included feedback that more than one third of

shareholders in attendance at our AGM use our Investor Relations website on a regular basis. In August, we held our eighth

Investor Day in Canton, Massachusetts, USA, where Management presented updates on Group and brand strategies. The effective-

ness of our Group’s Investor Relations activities was highlighted by the Institutional Investor’s 2007 Rankings, where buy-side

participants ranked us as the best Investor Relations program in our sector. Further, adidas AG achieved the number two position

in Extel’s Pan-European Survey 2007 for the luxury goods sector. Our Investor Relations products also ranked strongly. The print

version of our 2006 Annual Report took third place in the DAX-30 by the “manager magazin” competition “The Best Annual

Reports” including the top ranking for

content. Our IR Website and Online Annual Report were ranked number one in the consumer

goods industry in the annual MZ awards.

EXTENSIVE FINANCIAL INFORMATION AVAILABLE ONLINE We offer extensive information around our share as well as the Group’s

strategy and fi nancial results on our corporate website. www.adidas-Group.com/investors Our event calendar lists all conferences we

attend and provides all presentations for download. In addition to live webcasts of all major events such as our Analyst Conference,

the AGM and our Investor Day, we also offer podcasts of our quarterly conference calls. In 2007, we introduced a quarterly online

chat and an RSS feed. In January 2008, we launched an event reminder service to ensure timely notifi cation about upcoming

cor porate events to interested shareholders.

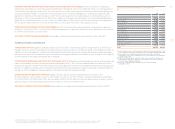

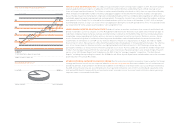

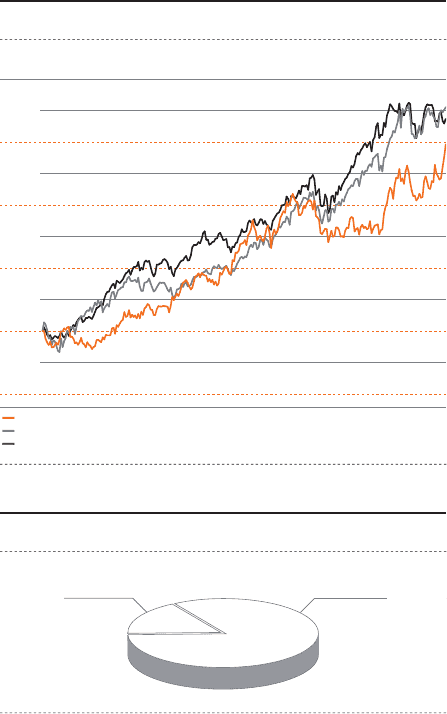

FIVE-YEAR SHARE PRICE DEVELOPMENT 1)

Dec. 31, 2002 Dec. 31, 2007

2

50

2

00

150

100

50

—adidas AG

—DAX-

30

—

M

SC

I World Textiles, Apparel

&

Luxury

G

ood

s

1) Index: December 31, 2002 = 100

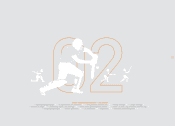

RECOMMENDATION SPLIT 1)

Hold

1

6

%

84

%

Buy