Reebok 2007 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

175

ANNUAL REPORT 2007 --- adidas Group

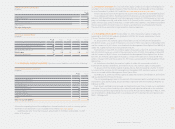

CONTINGENT CAPITAL 2003 / II As at the balance sheet date, the nominal capital is conditionally

increased by up to a further € 35,998,040, divided into no more than 35,998,040 shares (Contin-

gent Capital 2003 / II, § 4 section 6 of the Articles of Association). Shares from this contingent

capital will be issued only to the extent that the holders of bonds issued in October 2003 with the

exclusion of shareholders’ subscription rights exercise their conversion rights. In the event of

the exercise of all conversion rights, the total number of shares to be issued to this group of

persons amounts to 15,684,315 at the balance sheet date. In addition, the Executive Board is

authorized, subject to Supervisory Board approval, to issue up to 20,313,723 shares to the

holders of the subscription or conversion rights or the persons obligated to exercise the sub-

scription or conversion duties based on the bonds with warrants or convertible bonds, which are

issued by the Company or a Group subsidiary, pursuant to the authorization of the Executive

Board by the shareholder’s resolution dated May 8, 2003, in the version of the shareholder’s

resolution dated May 11, 2006, to the extent that they make use of their subscription or conver-

sion rights or, if they are obligated to exercise the subscription or conversion rights, they meet

their obligations to exercise the warrant or convert the bond.

The Executive Board of adidas AG did not issue any shares from the Contingent Capital

2003 / II in the period beyond the balance sheet date up to and including February 15, 2008.

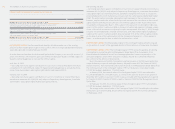

CONTINGENT CAPITAL 2006 At the balance sheet date, the nominal capital was conditionally

increased by up to a further € 20,000,000 divided into no more than 20,000,000 shares (Contin-

gent Capital 2006; § 4 section 7 of the Articles of Association). The contingent capital increase

will be implemented only to the extent that the holders of the subscription or conversion rights

or the persons obligated to exercise the subscription or conversion duties based on the bonds

with warrants or convertible bonds, which are issued or guaranteed by the Company or a sub-

ordinate Group company pursuant to the authorization of the Executive Board by the share-

holder’s resolution dated May 11, 2006, make use of their subscription or conversion rights or,

if they are obligated to exercise the subscription or conversion rights, they meet their obligations

to exercise the warrant or convert the bond. The Executive Board is authorized, subject to Super-

visory Board approval, to fully suspend the shareholders’ rights to subscribe the bonds with

warrants and / or convertible bonds, if the bonds with warrants and / or convertible bonds are

issued at a price which is not signifi cantly below the market value of these bonds. The limit for

subscription right exclusions of 10 % of the registered stock capital according to § 186 section 3

sentence 4 in conjunction with § 221 section 4 sentence 2 of the German Stock Corporation Act

has been observed.

The Executive Board of adidas AG did not issue any shares from the Contingent Capital 2006

in the period beyond the balance sheet date up to and including February 15, 2008.

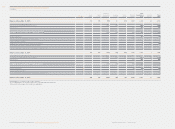

ACQUISITION OF TREASURY SHARES By resolution of the Annual General Meeting held on May

10, 2007, the shareholders of adidas AG cancelled the authorization to repurchase treasury

shares resolved upon on May 11, 2006, which had not been used, and resolved upon a new

authorization of the Executive Board to acquire treasury shares in an aggregate amount of up to

10 % of the nominal capital for any permissible purpose and within the legal framework until

November 9, 2008. The authorization can be used by the Company but also by Group companies

or by third parties, on the account of the Company or Group companies. The Executive Board is

authorized to use the treasury shares repurchased on the basis of this authorization for the

following purposes:

-- Subject to Supervisory Board approval, for the resale of shares via the stock exchange or via a

tender offer to all shareholders for cash at a price not signifi cantly below the stock market price

of the shares with the same features.

-- Subject to Supervisory Board approval, for the purpose of acquiring companies, parts of

companies or participations in companies.

-- Subject to Supervisory Board approval, as consideration for the acquisition, also through

Group companies, of industrial property rights such as patents, brands, names and logos of

athletes, sports clubs and other third parties or for the acquisition of licenses relating to such

rights.

-- To meet subscription or conversion rights or conversion obligations arising from bonds with

warrants and / or convertible bonds issued by the Company or any direct or indirect subsidiary

of the Company.

-- To meet the Company’s obligations arising from the Management Share Option Plan 1999

(MSOP).

-- Subject to Supervisory Board approval, to redeem and cancel the shares without a further

shareholders’ resolution on the redemption or the cancellation.

Furthermore, the Supervisory Board is authorized to assign or promise reacquired treasury

shares to Executive Board members as compensation by way of a stock bonus, subject to the

proviso that resale shall only be permitted following a retention period of at least two years from

the date of assignment.

The Executive Board of adidas AG did not make use of this authorization up to the balance

sheet date. Following the approval by the Supervisory Board, the Executive Board decided on

January 29, 2008, to make use of this authorization. The Company began a share buyback

program on January 30, 2008, and has since acquired a total of 1,180,000 shares corresponding

to 0.58 % of the stock capital (as at February 15, 2008).

05