Reebok 2007 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

182

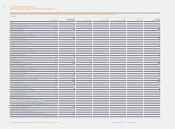

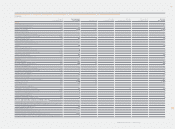

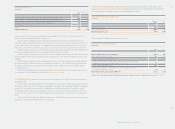

ANNUAL REPORT 2007 --- adidas Group CONSOLIDATED FINANCIAL STATEMENTS - Notes to the Consolidated Balance Sheet

Due to the short-term maturities of cash and cash equivalents, accounts receivable and payable

as well as other current receivables and payables their fair values approximate their carrying

amount.

The fair values of non-current fi nancial assets and liabilities are estimated by discounting

expected future cash fl ows using current interest rates for debt of similar terms and remaining

maturities.

Fair values of short-term fi nancial assets measured at “fair value through profi t or loss” and

long-term fi nancial assets classifi ed as available-for-sale are based on quoted market prices in

an active market or are calculated as present values of expected future cash fl ows.

The fair values of forward contracts and currency options are determined on the basis of the

market conditions at the reporting dates. The fair value of a currency option is determined using

generally accepted models to calculate option prices. The fair market value of an option is infl u-

enced not only by the remaining term of the option but also by further determining factors, such

as the actual foreign exchange rate and the volatility of the underlying foreign currency base.

The fair values of interest rate options at the reporting date are assessed by generally accepted

models, such as the “Markov functional model”.

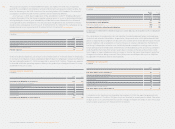

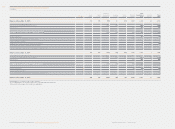

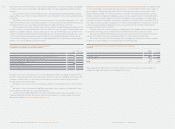

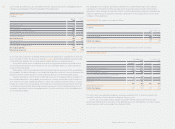

NET GAINS OR (LOSSES) OF FINANCIAL INSTRUMENTS

Reco

g

nized in the Consolidated Income Statement, € in millions

Year ending Dec. 31

200

7 2006

Financial assets or fi nancial liabilities at fair value through profi t or loss

thereof: designated as such upon initial recognition

thereof: classifi ed as held for trading

Loans and receivables

Available-for-sale fi nancial assets

Financial liabilities measured at amortized cost

(

1

)

(8)

—

—

(

1

)

(8)

(

18

)

(8)

—

—

6

12

Net gains or losses on fi nancial assets or fi nancial liabilities held for trading include the effects

from fair value measurements of the derivatives that are not part of a hedging relationship, and

changes in the fair value of other fi nancial instruments as well as interest payments which

mainly relate to investment funds.

Net gains or losses on loans and receivables comprise mainly impairment losses and rever-

sals.

Net gains or losses on fi nancial liabilities measured at amortized cost include effects from

early settlement and reversals of accrued liabilities.

The disclosures required by IFRS 7 Financial Instruments Disclosures paragraphs 31 – 42

(“Nature and Extent of Risks arising from Financial Instruments”) can be found in the Group

Management Report. see Risk and Opportunity Report, p. 104

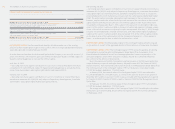

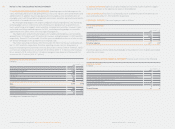

FINANCIAL INSTRUMENTS FOR THE HEDGING OF FOREIGN EXCHANGE RISK The adidas Group

uses natural hedges and arranges forward contracts, currency options and currency swaps to

protect against foreign exchange risk. In 2007, the Group contracted currency options with

premiums paid totaling of € 7 million (2006: € 11 million). The effective part of the currency

hedges is directly recognized in hedging reserves and the acquisition costs of secured invento-

ries, respectively, and posted into the income statement at the same time as the underlying

secured transaction is recorded. An amount of negative € 10 million (2006: € 0 million) for cur-

rency options and an amount of negative € 51 million (2006: negative € 22 million) for forward

contracts were recorded in hedging reserves. A total amount of € 12 million impacted net

income in 2007 (2006: € 27 million).

The time value of the currency options not being part of the hedge in an amount of negative

€ 9 million (2006: negative € 9 million) was recorded in the income statement in 2007.

The total net amount of US dollar purchases versus other currencies was US $ 3.0 billion

and US $ 3.2 billion in the years ending December 31, 2007 and 2006, respectively.

The notional amounts of all outstanding currency hedging instruments, which are mainly

related to cash fl ow hedges, are summarized in the following table:

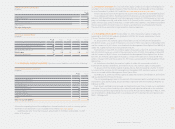

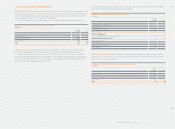

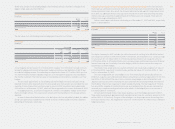

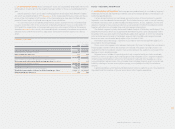

NOTIONAL AMOUNTS OF ALL CURRENCY HEDGING INSTRUMENTS

€

in milli

o

n

s

D

ec.

3

1 Dec. 31

200

7

2006

Forward contracts

Currency options

To

t

al

2,

3

1

7

1,771

5

6

2

566

2,879 2,337

7

The comparatively high amount of forward contracts is primarily due to currency swaps for

liquidity management purposes and hedging transactions.