Reebok 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

099

ANNUAL REPORT 2007 --- adidas Group

03

REEBOK BUSINESS PERFORMANCE In

2007

,

R

eebok made important pro

g

ress in revitaliz-

i

n

g

the brand. Wh

i

le sales were below Mana

g

e-

ment’s ex

p

ectations,

p

ro

fi

tability develo

p

ed in

l

ine with Management’s expectations.

C

urrenc

y-

n

eu

tr

al

sales for the Reebok segment were

s

table. In euro terms, th

i

s development repre-

s

ents a decrease o

f

6

%

to

€

2.

333

b

i

ll

i

on

i

n

2007

f

rom € 2.47

3

b

illion in

2006

.

O

n a like- for

-

l

ike basis, sales declined

5

%

.

The gross margin

of the Reebok se

g

ment

g

rew by

3

.

7

percenta

g

e

p

o

i

nts to

3

8.7

%

in

2

00

7 fr

o

m

35

.0

%

in

2

006

.

T

h

i

s

i

ncrease was dr

i

ven b

y

the non-recurrence

o

f

negative purchase price allocation impacts

and cost syner

g

ies from the combination of the

ad

i

das and Reebok sourc

i

n

g

act

i

v

i

t

i

es, wh

i

ch

possitively impacted the se

g

ment’s cost o

f

s

ales. In euro terms, Reebok’s gross pro

fi

t grew

4

%

t

o

€

902

mil lion in

2007

v

ers

u

s

€

8

65

m

il-

l

i

o

n in

2

006. Reebok’s operatin

g

mar

g

in

i

ncreased by

1.2

percenta

g

e po

i

nts to 4.7

%

in

200

7

f

rom

3

.

5

%

in the

p

rior year, as a result o

f

t

he positive gross margin development, which

was partly offset by higher operating expenses

as a percenta

g

e of sales. As a result, Reebok’s

operatin

g

pro

fi

t increased by 27

%

t

o

€

1

09

mil-

li

on

i

n

200

7 v

ers

u

s

€

86

mi

ll

i

on

i

n the

p

r

i

or year.

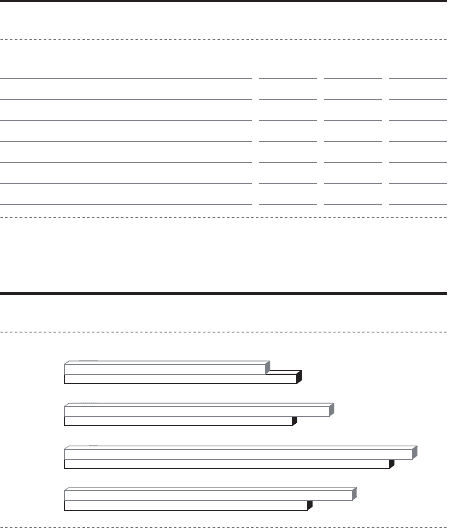

TWELVE MONTHS OF REEBOK RESULTS CONSOLIDATED

IN 2007 Several factors impact the comparison of Reebok’s

fi nancial results to the prior year. In 2006, only eleven months

were consolidated due to the acquisition date (February 1, 2006).

In 2007, twelve months of Reebok’s results were consolidated.

This had a positive impact on the comparison of Reebok segment

sales to the prior year. The segment’s gross and operating

margins, however, were negatively affected, as the month of

January is traditionally characterized by higher-than-average

clearance activities. The fi rst-time inclusion of the Greg Norman

Collection (GNC)-related sales which were generated through

Reebok’s own-retail outlets also positively affected the seg-

ment’s revenue development. These operations were excluded

from the divestiture of the

GNC business and transferred from

the TaylorMade- adidas Golf

to the Reebok segment, effective

January 1, 2007. How ever, the transfer of the NBA and Liverpool

licensed businesses to brand adidas in the fi rst half of 2006

had a negative effect on the segment’s sales development.

Purchase price allo cation charges also negatively impacted

Reebok’s results, how ever to a signifi cantly lesser extent com-

pared to the prior year.

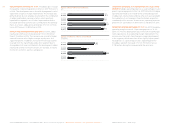

SEGMENT SALES STABLE ON A CURRENCY-NEUTRAL BASIS

In 2007, sales for the Reebok segment were stable on a currency-

neutral basis. This development was below Management’s

initial expectation of a low-single-digit sales increase. It was

a result of the weakening market situation in Reebok’s most

important market, the USA, during 2007. While apparel reve-

nues grew, footwear and hardware sales decreased. The fi rst-

time inclusion of January, which was not consolidated in 2006

due to the timing of the acquisition, had a positive impact on

revenues. Incremental sales increases in several countries for

which Reebok had purchased the distribution rights, in partic-

ular Russia and China, also contributed to this development.

Distribution buybacks were made to better control brand

management and gain market share. see Reebok Strategy, p. 050

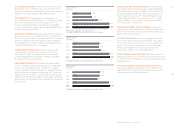

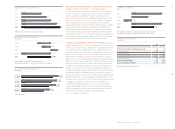

REEBOK AT A GLANCE

€

in milli

o

n

s

2

007 20061) Change

Net sales

Gross profi t

Gross margin

Operating profi t

Operating margin

1)

Only includes eleven months of the twelve-month period

.

2

,333

3

2,473 (6 %)

902

2

865 4 %

3

8.7

%

%

35.0 % 3.7 pp

109

9

86 27 %

4

.7

%

%

3.5 % 1.2 pp

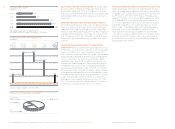

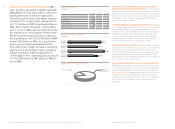

REEBOK NET SALES BY QUARTER

€

in milli

o

n

s

Q1 2006 1)

Q

1 200

7

Q2 2006

Q2

2007

Q3 2006

Q3

200

7

Q4 2006

Q

4 200

7

1)

Only includes two months of the three-month period

.

728

778

5

1

4

595

5

2

4

454

5

6

7

645